Answered step by step

Verified Expert Solution

Question

1 Approved Answer

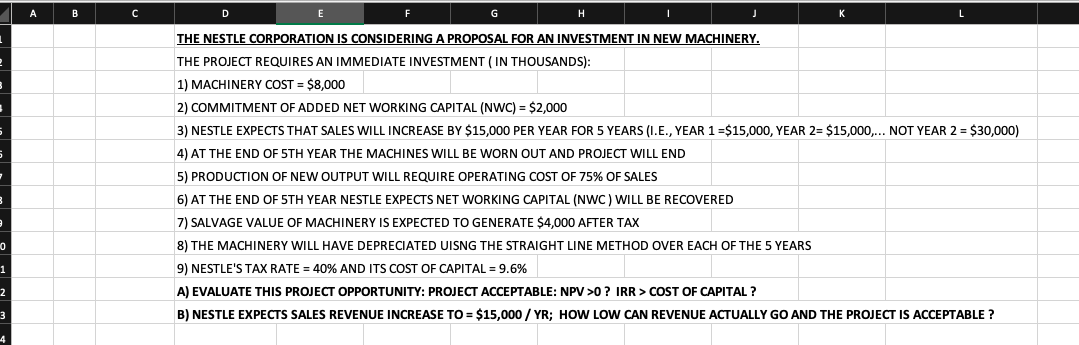

Please show all work - including formulas. A B C H K THE NESTLE CORPORATION IS CONSIDERING A PROPOSAL FOR AN INVESTMENT IN NEW MACHINERY.

Please show all work - including formulas.

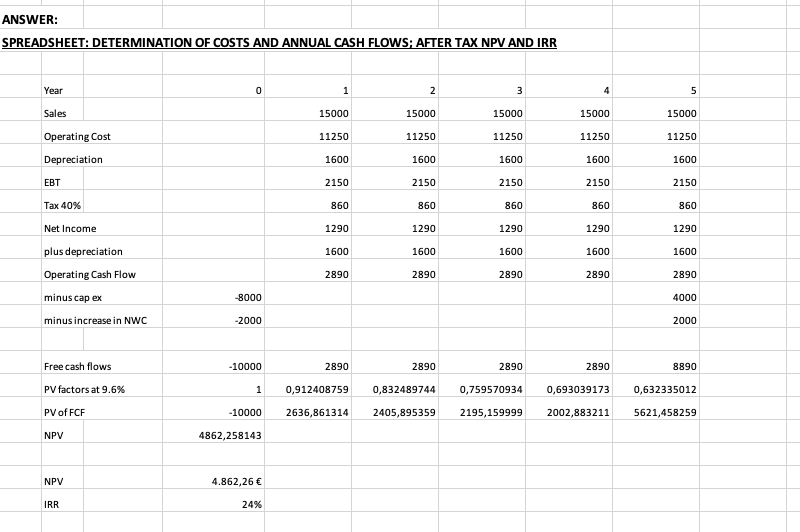

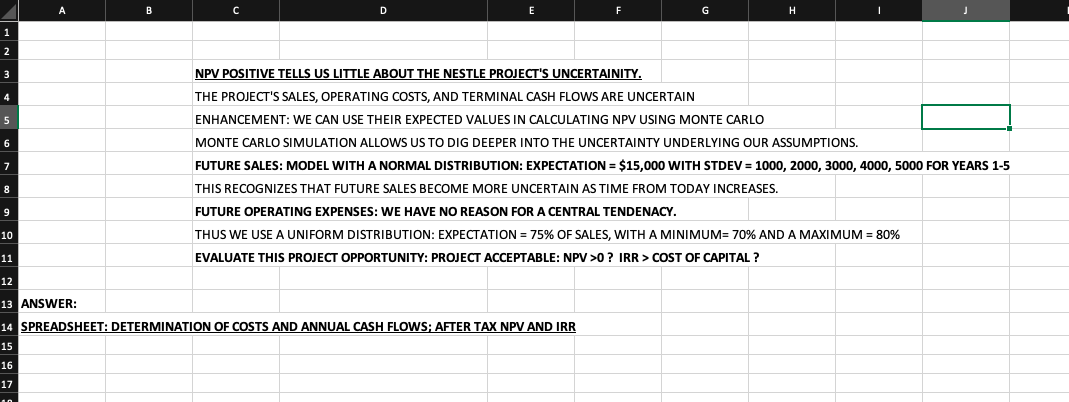

A B C H K THE NESTLE CORPORATION IS CONSIDERING A PROPOSAL FOR AN INVESTMENT IN NEW MACHINERY. THE PROJECT REQUIRES AN IMMEDIATE INVESTMENT (IN THOUSANDS): 1) MACHINERY COST = $8,000 2) COMMITMENT OF ADDED NET WORKING CAPITAL (NWC) = $2,000 3) NESTLE EXPECTS THAT SALES WILL INCREASE BY $15,000 PER YEAR FOR 5 YEARS (I.E., YEAR 1 =$15,000, YEAR 2= $15,000... NOT YEAR 2 = $30,000) 4) AT THE END OF 5TH YEAR THE MACHINES WILL BE WORN OUT AND PROJECT WILL END 5) PRODUCTION OF NEW OUTPUT WILL REQUIRE OPERATING COST OF 75% OF SALES 6) AT THE END OF 5TH YEAR NESTLE EXPECTS NET WORKING CAPITAL (NWC) WILL BE RECOVERED 7) SALVAGE VALUE OF MACHINERY IS EXPECTED TO GENERATE $4,000 AFTER TAX 8) THE MACHINERY WILL HAVE DEPRECIATED UISNG THE STRAIGHT LINE METHOD OVER EACH OF THE 5 YEARS 9) NESTLE'S TAX RATE = 40% AND ITS COST OF CAPITAL = 9.6% A) EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >O? IRR > COST OF CAPITAL ? B) NESTLE EXPECTS SALES REVENUE INCREASE TO = $15,000 / YR; HOW LOW CAN REVENUE ACTUALLY GO AND THE PROJECT IS ACCEPTABLE ? 0 ANSWER: SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS; AFTER TAX NPV AND IRR Year 0 1 2 3 4 5 Sales 15000 15000 15000 15000 15000 Operating Cost 11250 11250 11250 11250 11250 Depreciation 1600 1600 1600 1600 1600 2150 2150 2150 2150 2150 Tax 40% 860 860 860 860 860 Net Income 1290 1290 1290 1290 1290 1600 1600 1600 1600 1600 2890 2890 2890 2890 2890 plus depreciation Operating Cash Flow minus cap ex minus increase in NWC -8000 4000 -2000 2000 -10000 2890 2890 2890 2890 8890 Free cash flows PV factors at 9.6% 1 0,912408759 0,832489744 0,759570934 0,693039173 0,632335012 PV of FCF -10000 2636,861314 2405,895359 2195,159999 2002,883211 5621,458259 NPV 4862,258143 NPV 4.862,26 IRR 24% B C D F G H 1 2 3 5 6 7 NPV POSITIVE TELLS US LITTLE ABOUT THE NESTLE PROJECT'S UNCERTAINITY. THE PROJECT'S SALES, OPERATING COSTS, AND TERMINAL CASH FLOWS ARE UNCERTAIN ENHANCEMENT: WE CAN USE THEIR EXPECTED VALUES IN CALCULATING NPV USING MONTE CARLO MONTE CARLO SIMULATION ALLOWS US TO DIG DEEPER INTO THE UNCERTAINTY UNDERLYING OUR ASSUMPTIONS. FUTURE SALES: MODEL WITH A NORMAL DISTRIBUTION: EXPECTATION = $15,000 WITH STDEV = 1000, 2000, 3000, 4000, 5000 FOR YEARS 1-5 THIS RECOGNIZES THAT FUTURE SALES BECOME MORE UNCERTAIN AS TIME FROM TODAY INCREASES. FUTURE OPERATING EXPENSES: WE HAVE NO REASON FOR A CENTRAL TENDENACY. THUS WE USE A UNIFORM DISTRIBUTION: EXPECTATION = 75% OF SALES, WITH A MINIMUM= 70% AND A MAXIMUM = 80% EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >O? IRR > COST OF CAPITAL ? 8 9 10 11 12 13 ANSWER: 14 SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS; AFTER TAX NPV AND IRR 15 16 17 A B C H K THE NESTLE CORPORATION IS CONSIDERING A PROPOSAL FOR AN INVESTMENT IN NEW MACHINERY. THE PROJECT REQUIRES AN IMMEDIATE INVESTMENT (IN THOUSANDS): 1) MACHINERY COST = $8,000 2) COMMITMENT OF ADDED NET WORKING CAPITAL (NWC) = $2,000 3) NESTLE EXPECTS THAT SALES WILL INCREASE BY $15,000 PER YEAR FOR 5 YEARS (I.E., YEAR 1 =$15,000, YEAR 2= $15,000... NOT YEAR 2 = $30,000) 4) AT THE END OF 5TH YEAR THE MACHINES WILL BE WORN OUT AND PROJECT WILL END 5) PRODUCTION OF NEW OUTPUT WILL REQUIRE OPERATING COST OF 75% OF SALES 6) AT THE END OF 5TH YEAR NESTLE EXPECTS NET WORKING CAPITAL (NWC) WILL BE RECOVERED 7) SALVAGE VALUE OF MACHINERY IS EXPECTED TO GENERATE $4,000 AFTER TAX 8) THE MACHINERY WILL HAVE DEPRECIATED UISNG THE STRAIGHT LINE METHOD OVER EACH OF THE 5 YEARS 9) NESTLE'S TAX RATE = 40% AND ITS COST OF CAPITAL = 9.6% A) EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >O? IRR > COST OF CAPITAL ? B) NESTLE EXPECTS SALES REVENUE INCREASE TO = $15,000 / YR; HOW LOW CAN REVENUE ACTUALLY GO AND THE PROJECT IS ACCEPTABLE ? 0 ANSWER: SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS; AFTER TAX NPV AND IRR Year 0 1 2 3 4 5 Sales 15000 15000 15000 15000 15000 Operating Cost 11250 11250 11250 11250 11250 Depreciation 1600 1600 1600 1600 1600 2150 2150 2150 2150 2150 Tax 40% 860 860 860 860 860 Net Income 1290 1290 1290 1290 1290 1600 1600 1600 1600 1600 2890 2890 2890 2890 2890 plus depreciation Operating Cash Flow minus cap ex minus increase in NWC -8000 4000 -2000 2000 -10000 2890 2890 2890 2890 8890 Free cash flows PV factors at 9.6% 1 0,912408759 0,832489744 0,759570934 0,693039173 0,632335012 PV of FCF -10000 2636,861314 2405,895359 2195,159999 2002,883211 5621,458259 NPV 4862,258143 NPV 4.862,26 IRR 24% B C D F G H 1 2 3 5 6 7 NPV POSITIVE TELLS US LITTLE ABOUT THE NESTLE PROJECT'S UNCERTAINITY. THE PROJECT'S SALES, OPERATING COSTS, AND TERMINAL CASH FLOWS ARE UNCERTAIN ENHANCEMENT: WE CAN USE THEIR EXPECTED VALUES IN CALCULATING NPV USING MONTE CARLO MONTE CARLO SIMULATION ALLOWS US TO DIG DEEPER INTO THE UNCERTAINTY UNDERLYING OUR ASSUMPTIONS. FUTURE SALES: MODEL WITH A NORMAL DISTRIBUTION: EXPECTATION = $15,000 WITH STDEV = 1000, 2000, 3000, 4000, 5000 FOR YEARS 1-5 THIS RECOGNIZES THAT FUTURE SALES BECOME MORE UNCERTAIN AS TIME FROM TODAY INCREASES. FUTURE OPERATING EXPENSES: WE HAVE NO REASON FOR A CENTRAL TENDENACY. THUS WE USE A UNIFORM DISTRIBUTION: EXPECTATION = 75% OF SALES, WITH A MINIMUM= 70% AND A MAXIMUM = 80% EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >O? IRR > COST OF CAPITAL ? 8 9 10 11 12 13 ANSWER: 14 SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS; AFTER TAX NPV AND IRR 15 16 17Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started