Answered step by step

Verified Expert Solution

Question

1 Approved Answer

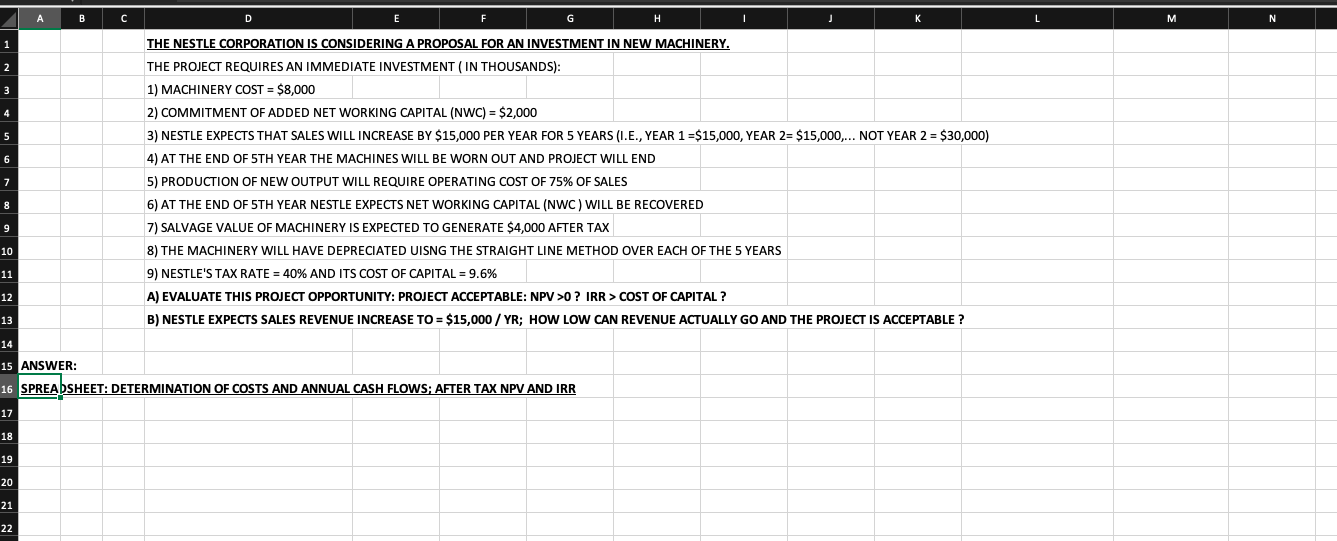

Please show all work including Formulas. Thank you. A B C D H J K L M N 3 1 THE NESTLE CORPORATION IS CONSIDERING

Please show all work including Formulas. Thank you.

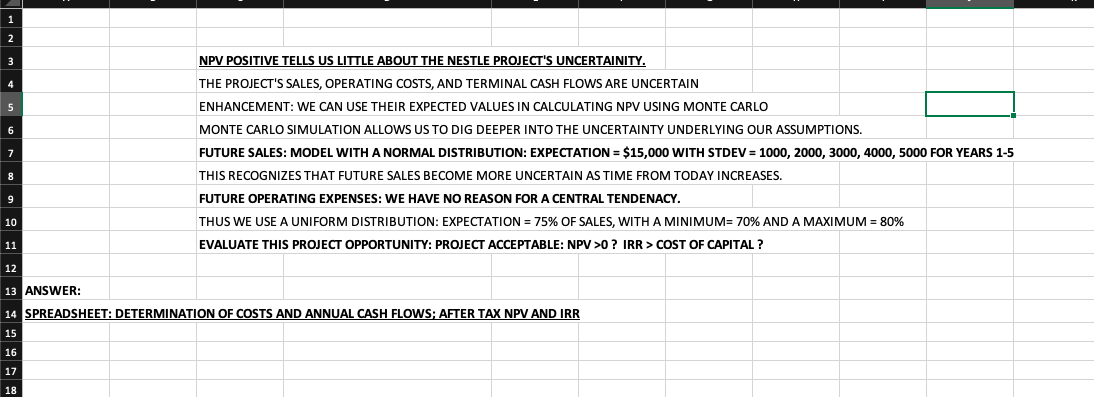

A B C D H J K L M N 3 1 THE NESTLE CORPORATION IS CONSIDERING A PROPOSAL FOR AN INVESTMENT IN NEW MACHINERY. 2 THE PROJECT REQUIRES AN IMMEDIATE INVESTMENT (IN THOUSANDS): 1) MACHINERY COST = $8,000 2) COMMITMENT OF ADDED NET WORKING CAPITAL (NWC) = $2,000 5 3) NESTLE EXPECTS THAT SALES WILL INCREASE BY $15,000 PER YEAR FOR 5 YEARS (1.E., YEAR 1 =$15,000, YEAR 2= $15,000,... NOT YEAR 2 = $30,000) 6 4) AT THE END OF 5TH YEAR THE MACHINES WILL BE WORN OUT AND PROJECT WILL END 7 5) PRODUCTION OF NEW OUTPUT WILL REQUIRE OPERATING COST OF 75% OF SALES 8 6) AT THE END OF 5TH YEAR NESTLE EXPECTS NET WORKING CAPITAL (NWC) WILL BE RECOVERED 9 7) SALVAGE VALUE OF MACHINERY IS EXPECTED TO GENERATE $4,000 AFTER TAX 10 8) THE MACHINERY WILL HAVE DEPRECIATED UISNG THE STRAIGHT LINE METHOD OVER EACH OF THE 5 YEARS 11 9) NESTLE'S TAX RATE = 40% AND ITS COST OF CAPITAL = 9.6% 12 A) EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >O? IRR > COST OF CAPITAL ? 13 B) NESTLE EXPECTS SALES REVENUE INCREASE TO = $15,000/ YR; HOW LOW CAN REVENUE ACTUALLY GO AND THE PROJECT ACCEPTABLE? 14 15 ANSWER: 16 SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS; AFTER TAX NPV AND IRR 17 18 19 20 21 22 1 NPV POSITIVE TELLS US LITTLE ABOUT THE NESTLE PROJECT'S UNCERTAINITY. THE PROJECT'S SALES, OPERATING COSTS, AND TERMINAL CASH FLOWS ARE UNCERTAIN ENHANCEMENT: WE CAN USE THEIR EXPECTED VALUES IN CALCULATING NPV USING MONTE CARLO MONTE CARLO SIMULATION ALLOWS US TO DIG DEEPER INTO THE UNCERTAINTY UNDERLYING OUR ASSUMPTIONS. FUTURE SALES: MODEL WITH A NORMAL DISTRIBUTION: EXPECTATION = $15,000 WITH STDEV = 1000, 2000, 3000, 4000, 5000 FOR YEARS 1-5 THIS RECOGNIZES THAT FUTURE SALES BECOME MORE UNCERTAIN AS TIME FROM TODAY INCREASES. FUTURE OPERATING EXPENSES: WE HAVE NO REASON FOR A CENTRAL TENDENACY. THUS WE USE A UNIFORM DISTRIBUTION: EXPECTATION = 75% OF SALES, WITH A MINIMUM= 70% AND A MAXIMUM = 80% EVALUATE THIS PROJECT OPPORTUNITY: PROJECT ACCEPTABLE: NPV >O? IRR > COST OF CAPITAL ? 9 10 11 12 13 ANSWER: 14 SPREADSHEET: DETERMINATION OF COSTS AND ANNUAL CASH FLOWS: AFTER TAX NPV AND IRR 15 16 17 18Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started