Please show all work.

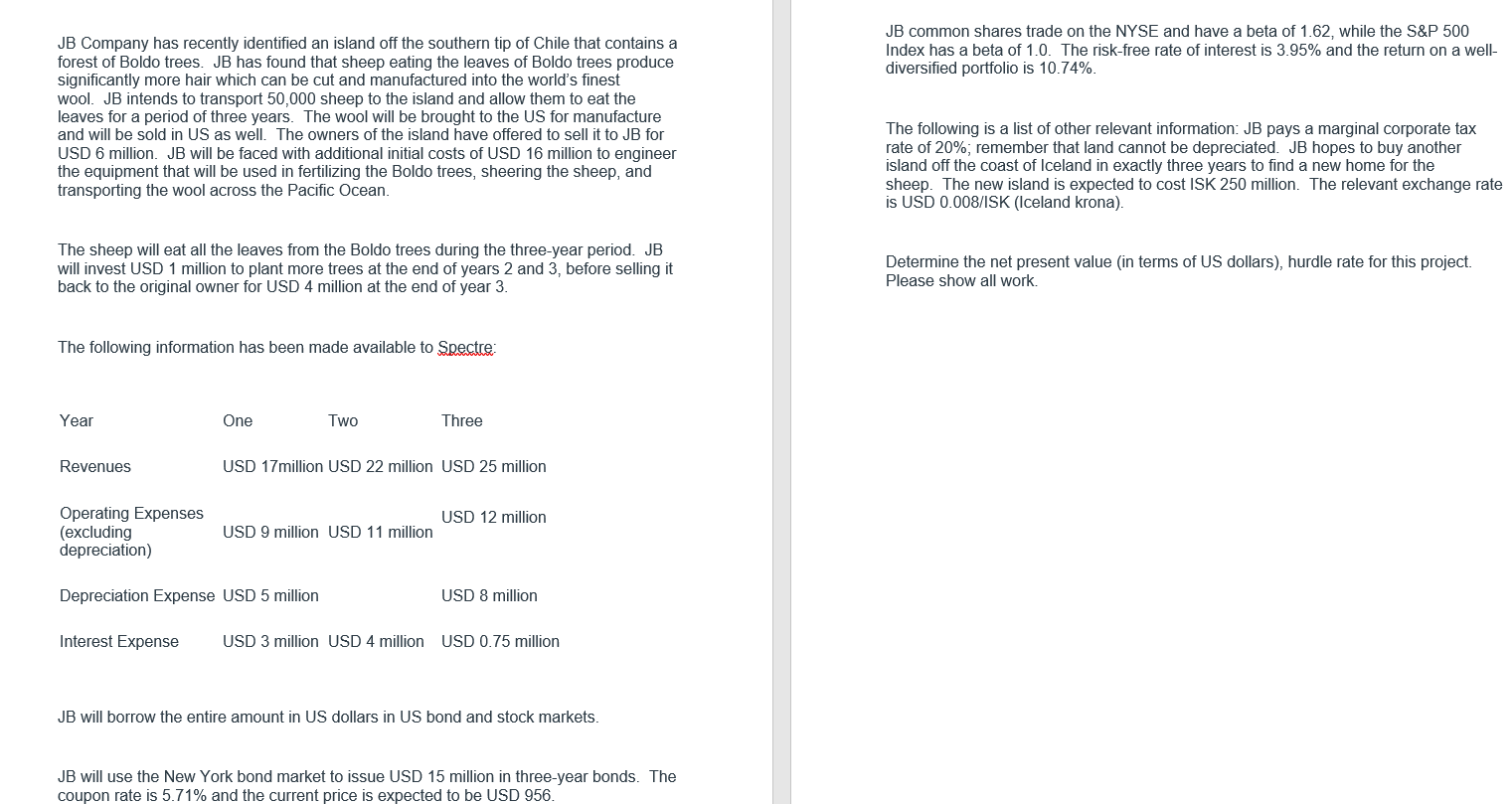

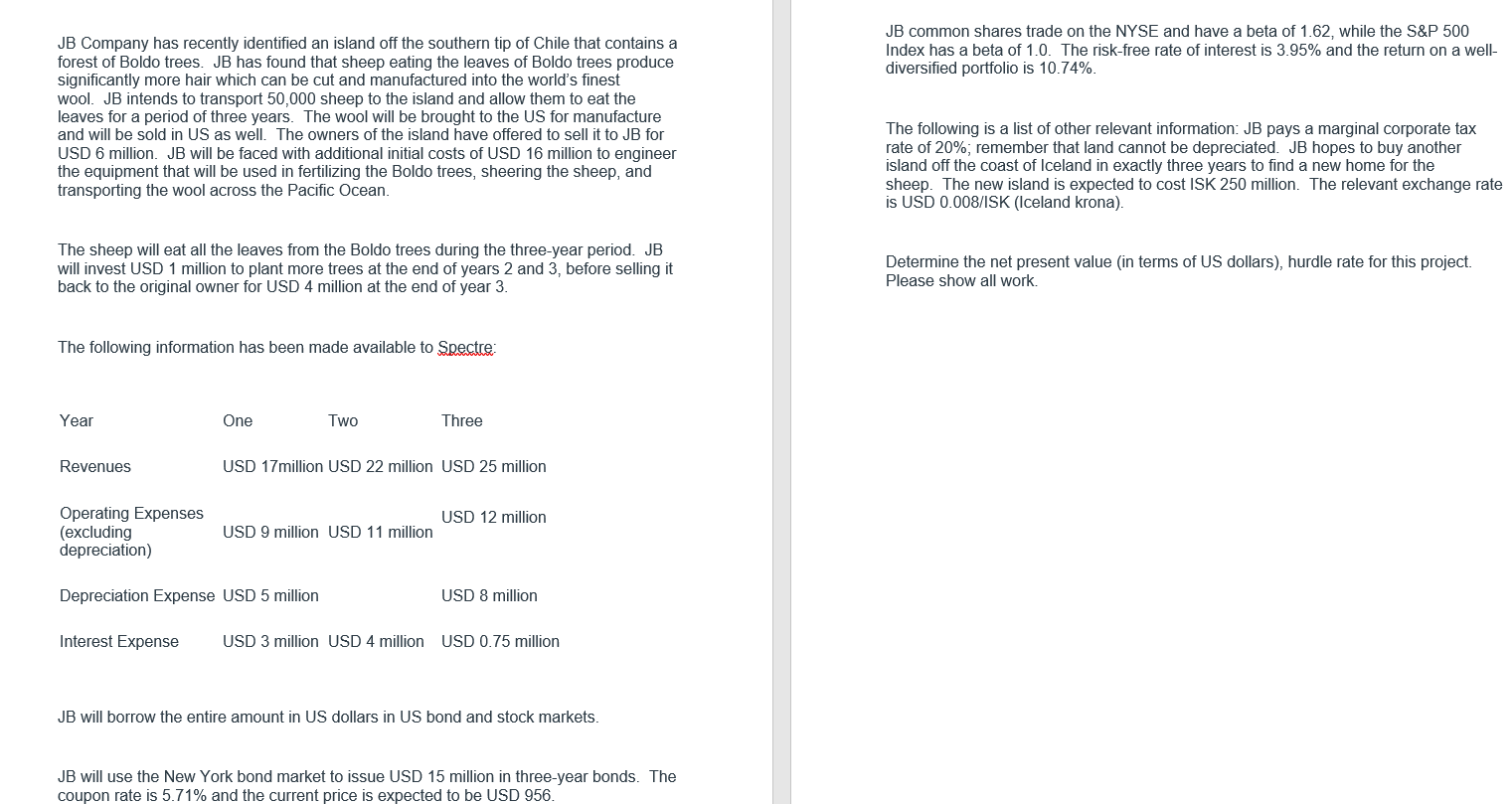

JB common shares trade on the NYSE and have a beta of 1.62, while the S&P 500 Index has a beta of 1.0. The risk-free rate of interest is 3.95% and the return on a well- diversified portfolio is 10.74%. JB Company has recently identified an island off the southern tip of Chile that contains a forest of Boldo trees. JB has found that sheep eating the leaves of Boldo trees produce significantly more hair which can be cut and manufactured into the world's finest wool. JB intends to transport 50,000 sheep to the island and allow them to eat the leaves for a period of three years. The wool will be brought to the US for manufacture and will be sold in US as well. The owners of the island have offered to sell it to JB for USD 6 million. JB will be faced with additional initial costs of USD 16 million to engineer the equipment that will be used in fertilizing the Boldo trees, sheering the sheep, and transporting the wool across the Pacific Ocean. The following is a list of other relevant information: JB pays a marginal corporate tax rate of 20%, remember that land cannot be depreciated. JB hopes to buy another island off the coast of Iceland in exactly three years to find a new home for the sheep. The new island is expected to cost ISK 250 million. The relevant exchange rate is USD 0.008/ISK (Iceland Krona). The sheep will eat all the leaves from the Boldo trees during the three-year period. JB will invest USD 1 million to plant more trees at the end of years 2 and 3, before selling it back to the original owner for USD 4 million at the end of year 3. Determine the net present value in terms of US dollars), hurdle rate for this project. Please show all work. The following information has been made available to Spectre: Year One Two Three Revenues USD 17million USD 22 million USD 25 million USD 12 million Operating Expenses (excluding depreciation) USD 9 million USD 11 million Depreciation Expense USD 5 million USD 8 million Interest Expense USD 3 million USD 4 million USD 0.75 million JB will borrow the entire amount in US dollars in US bond and stock markets. JB will use the New York bond market to issue USD 15 million in three-year bonds. The coupon rate is 5.71% and the current price is expected to be USD 956