Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work on spreadsheet Section 1 : Problem Statement John Smith graduated 5 years ago, with a Business degree and an emphasis in

Please show all work on spreadsheet

Section : Problem Statement

John Smith graduated years ago, with a Business degree and an emphasis in Finance. John is currently employed as a Sr Financial Analyst in the Corporate Finance department of a multinational corporation. He has progressed well in his career, with the ultimate goal of becoming the company's CFO. John's current salary of $ has increased at an average rate of per year, with routine merit raises, and he expects to continue doing so

John's firm, ABC Corporation, has a defined contribution plan k plan in place. Employees are allowed to contribute up to of their gross annual salary up to a maximum of $ per year and the firm will match of the employee's contribution. Unfortunately, John has not yet taken Professor Money Man's advice to "Save, Start Young, and Pay Yourself First." Instead, John has enjoyed his postcollege, nicesalary life by leasing a new car, renting an apartment and going out to Player's every weekend. Now that he has wedding plans on the horizon, John has come to the realization with help from his fiance Jane Doe that it's time to start saving while he's still young!

John expects that the lovebirds' two largest future expenses will be the cost of a wedding shortterm then later the down payment on a house mediumterm The couple plans to spend $ of their own money on the wedding in twelve months. They also hope to purchase a $ house in years. Jane's parents have promised to match their down payment, but only if they manage to save it within years. Talk about motivation to save! Both future spouses agree that John will automate his savings by setting up monthly contributions to his wedding and house accounts.

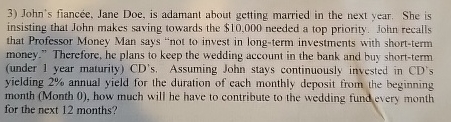

John's fiancee, Jane Doe, is adamant about getting married in the next year. She is insisting that John makes saving towards the $ needed a top priority. John recalls that Professor Money Man says "not to invest in longterm investments with shortterm money." Therefore, he plans to keep the wedding account in the bank and buy shortterm under year maturity CDs Assuming John stays continuously invested in CDs yielding annual yield for the duration of each monthly deposit from the beginning month Month how much will he have to contribute to the wedding fund every month for the next months?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started