Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work. please no excel. One of Burns Industries (BI) most popular products in the North American markets is Duff Beer. Building upon

please show all work. please no excel.

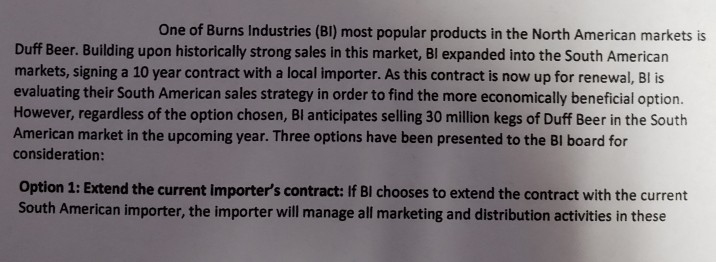

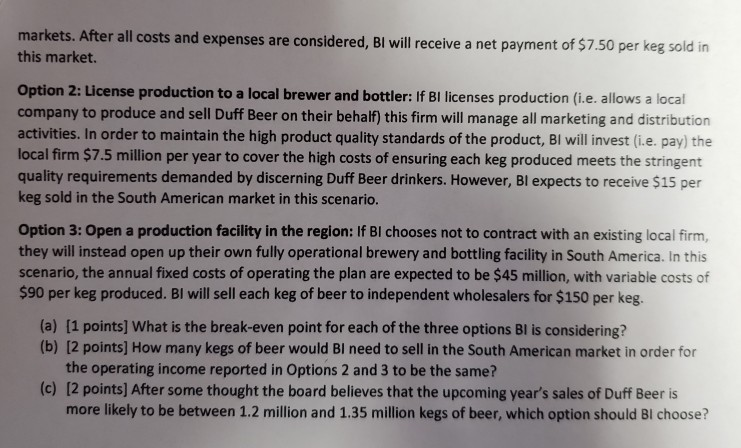

One of Burns Industries (BI) most popular products in the North American markets is Duff Beer. Building upon historically strong sales in this market, BI expanded into the South American markets, signing a 10 year contract with a local importer. As this contract is now up for renewal, Bl is evaluating their South American sales strategy in order to find the more economically beneficial option. However, regardless of the option chosen, Bl anticipates selling 30 million kegs of Duff Beer in the South American market in the upcoming year. Three options have been presented to the Bl board for consideration: Option 1: Extend the current importer's contract: If BI chooses to extend the contract with the current South American importer, the importer will manage all marketing and distribution activities in these markets. After all costs and expenses are considered, Bl will receive a net payment of $7.50 per keg sold in this market. Option 2: License production to a local brewer and bottler: If Bl licenses production (i.e. allows a local company to produce and sell Duff Beer on their behalf) this firm will manage all marketing and distribution activities. In order to maintain the high product quality standards of the product, BI will invest i.e. pay) the local firm $7.5 million per year to cover the high costs of ensuring each keg produced meets the stringent quality requirements demanded by discerning Duff Beer drinkers. However, BI expects to receive $15 per keg sold in the South American market in this scenario. Option 3: Open a production facility in the region: If BI chooses not to contract with an existing local firm, they will instead open up their own fully operational brewery and bottling facility in South America. In this scenario, the annual fixed costs of operating the plan are expected to be $45 million, with variable costs of $90 per keg produced. BI will sell each keg of beer to independent wholesalers for $150 per keg. (a) [1 points) What is the break-even point for each of the three options Bl is considering? (b) (2 points) How many kegs of beer would Bl need to sell in the South American market in order for the operating income reported in Options 2 and 3 to be the same? (C) 12 points) After some thought the board believes that the upcoming year's sales of Duff Beer is more likely to be between 1.2 million and 1.35 million kegs of beer, which option should BI chooseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started