Answered step by step

Verified Expert Solution

Question

1 Approved Answer

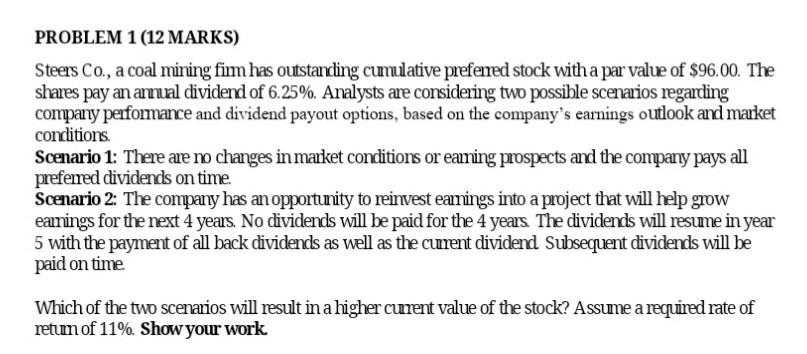

Please show all work PROBLEM 1 (12 MARKS) Steers Co., a coal mining firm has outstanding cumulative preferred stock with a par value of $96.00.

Please show all work

PROBLEM 1 (12 MARKS) Steers Co., a coal mining firm has outstanding cumulative preferred stock with a par value of $96.00. The shares pay an amal dividend of 6.25%. Analysts are considering two possible scenarios regarding company performance and dividend payout options, based on the company's earnings outlook and market conditions Scenario 1: There are no changes in market conditions or earning prospects and the company pays all preferred dividends on time. Scenario 2: The company has an opportunity to reinvest earnings into a project that will help grow eamings for the next 4 years. No dividends will be paid for the 4 years. The dividends will resume in year 5 with the payment of all back dividends as well as the current dividend Subsequent dividends will be paid on time Which of the two scenarios will result in a higher current value of the stock? Assume a required rate of retumn of 11%. Show your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started