Answered step by step

Verified Expert Solution

Question

1 Approved Answer

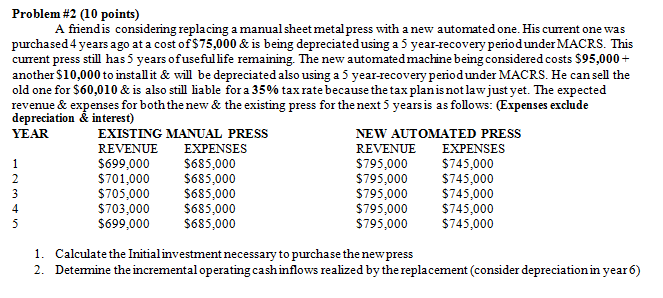

Please show all work Problem #2 (10 points) A friendis considering replacing a manual sheet metalpress with a new automated one. His current one was

Please show all work

Problem #2 (10 points) A friendis considering replacing a manual sheet metalpress with a new automated one. His current one was purchased 4 years ago at a cost of$75,000 & is being depreciated using a 5 year-recovery period underMACRS. This current press still has 5 years ofuseful life remaining. The new automatedmachine being considered costs $95,000+ another $10,000 to install it & will be depreciated also using a 5 year-recovery period under MACRS. He can sell the old one for $60,01 0 & is also still liable for a 35 % tax rate because the tax plan is not law just yet. The expected revenue & expenses for both thenew & the existing press for the next 5 years is as follows: (Expenses exclude depreciation & interest) YEAR EXISTING MANUAL PRESS REVENUE EXPENSES $699,000 $701,000 $705,000 $703,000 $699,000 S685,000 $685,000 $685,000 $685,000 S685,000 NEW AUTOMATED PRESS REVENUE EXPENSES $795,000 $795,000 $795,000 $795,000 $795,000 $745,000 $745,000 $745,000 $745,000 $745,000 1. 2. Calculate the Initialinvestment necessary to purchase the newpress Detemine the incremental operating cashinflows realized by the replacement (consider depreciation in year6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started