Answered step by step

Verified Expert Solution

Question

1 Approved Answer

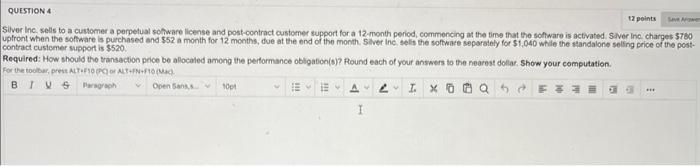

please show all work QUESTION 4 12 points Save Arowen Silver Inc. sells to a customer a perpetual software license and post-contract customer support for

please show all work

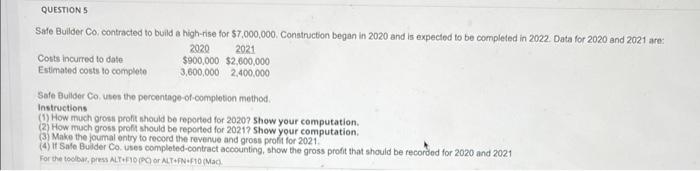

QUESTION 4 12 points Save Arowen Silver Inc. sells to a customer a perpetual software license and post-contract customer support for a 12-month period, commencing at the time that the software is activated. Sver Inc. charges $780 upfront when the software is purchased and $52 a month for 12 months, due at the end of the month. Silver Inc. sells the software separately for $1,040 while the standalone selling price of the post- contract customer support is $520. Required: How should the transaction price be allocated among the performance obligation(s)? Round each of your answers to the nearest dollar. Show your computation. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10(Mac) BIV Paragraph I XOQE Open Sans 10pt EE FF *** QUESTION 5 Safe Builder Co. contracted to build a high-rise for $7,000,000. Construction began in 2020 and is expected to be completed in 2022. Data for 2020 and 2021 are: 2021 2020 $900,000 $2,600,000 3,600,000 2,400,000 Costs incurred to date Estimated costs to complete Safe Builder Co. uses the percentage-of-completion method. Instructions (1) How much gross profit should be reported for 2020? Show your computation. (2) How much gross profit should be reported for 2021? Show your computation. (3) Make the joumal entry to record the revenue and gross profit for 2021. (4) If Safe Builder Co. uses completed-contract accounting, show the gross profit that should be recorded for 2020 and 2021 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started