Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work Sanders Company purchased the following on January 1, 2019: Office equipment at a cost of $60,000 with an estimated useful life

please show all work

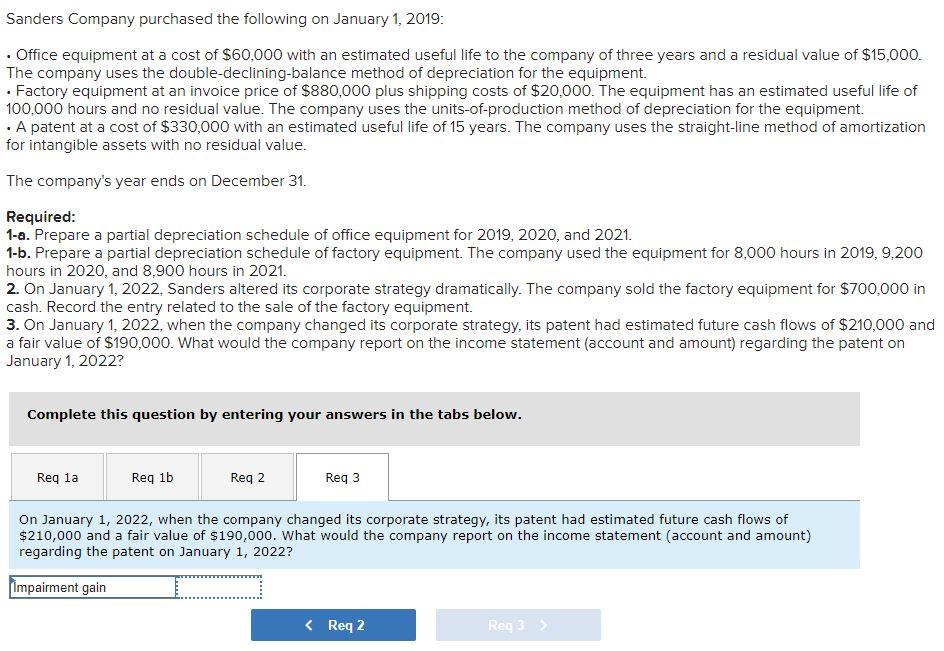

Sanders Company purchased the following on January 1, 2019: Office equipment at a cost of $60,000 with an estimated useful life to the company of three years and a residual value of $15,000. The company uses the double-declining-balance method of depreciation for the equipment. Factory equipment at an invoice price of $880,000 plus shipping costs of $20,000. The equipment has an estimated useful life of 100,000 hours and no residual value. The company uses the units-of-production method of depreciation for the equipment A patent at a cost of $330,000 with an estimated useful life of 15 years. The company uses the straight-line method of amortization for intangible assets with no residual value. The company's year ends on December 31. Required: 1-a. Prepare a partial depreciation schedule of office equipment for 2019, 2020, and 2021. 1-b. Prepare a partial depreciation schedule of factory equipment. The company used the equipment for 8,000 hours in 2019, 9,200 hours in 2020, and 8,900 hours in 2021. 2. On January 1, 2022, Sanders altered its corporate strategy dramatically. The company sold the factory equipment for $700,000 in cash. Record the entry related to the sale of the factory equipment. 3. On January 1, 2022, when the company changed its corporate strategy, its patent had estimated future cash flows of $210,000 and a fair value of $190,000. What would the company report on the income statement (account and amount) regarding the patent on January 1, 2022 Complete this question by entering your answers in the tabs below. Req la Req 1b Reg 2 Req3 On January 1, 2022, when the company changed its corporate strategy, its patent had estimated future cash flows of $210,000 and a fair value of $190,000. What would the company report on the income statement (account and amount) regarding the patent on January 1, 2022? Impairment gainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started