Answered step by step

Verified Expert Solution

Question

1 Approved Answer

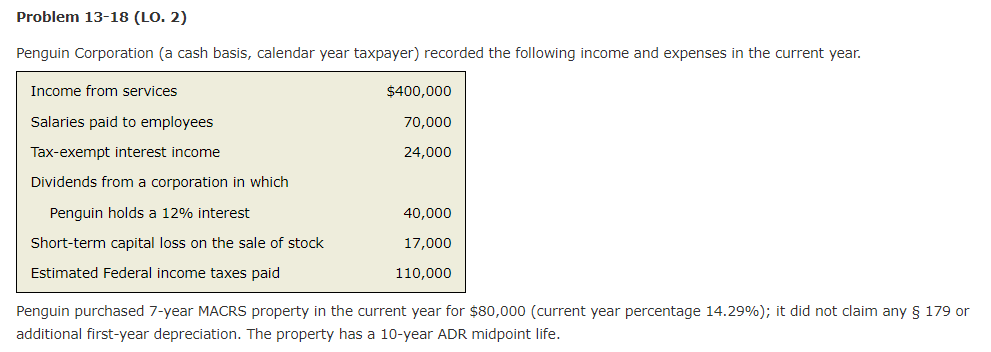

PLEASE SHOW ALL WORK SO I CAN FOLLOW ALONG - THANK YOU SO MUCH!!! Problem 13-18 (LO. 2) Penguin Corporation (a cash basis, calendar year

PLEASE SHOW ALL WORK SO I CAN FOLLOW ALONG - THANK YOU SO MUCH!!!

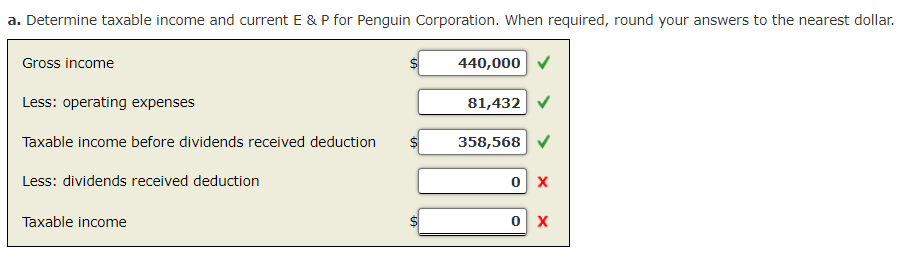

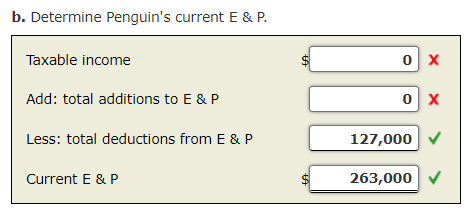

Problem 13-18 (LO. 2) Penguin Corporation (a cash basis, calendar year taxpayer) recorded the following income and expenses in the current year. Penguin purchased 7-year MACRS property in the current year for $80,000 (current year percentage 14.29% ); it did not claim any 179 or additional first-year depreciation. The property has a 10-year ADR midpoint life. a. Determine taxable income and current E \& P for Penguin Corporation. When required, round your answers to the nearest dollar. Gross income Less: operating expenses Taxable income before dividends received deduction Less: dividends received deduction Taxable income b. Determine Penguin's current E \& PStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started