Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work so that I can give a thumbs up. Numbers are the answer options. Thank you! 24. Your company is investigating the

Please show all work so that I can give a thumbs up. Numbers are the answer options. Thank you!

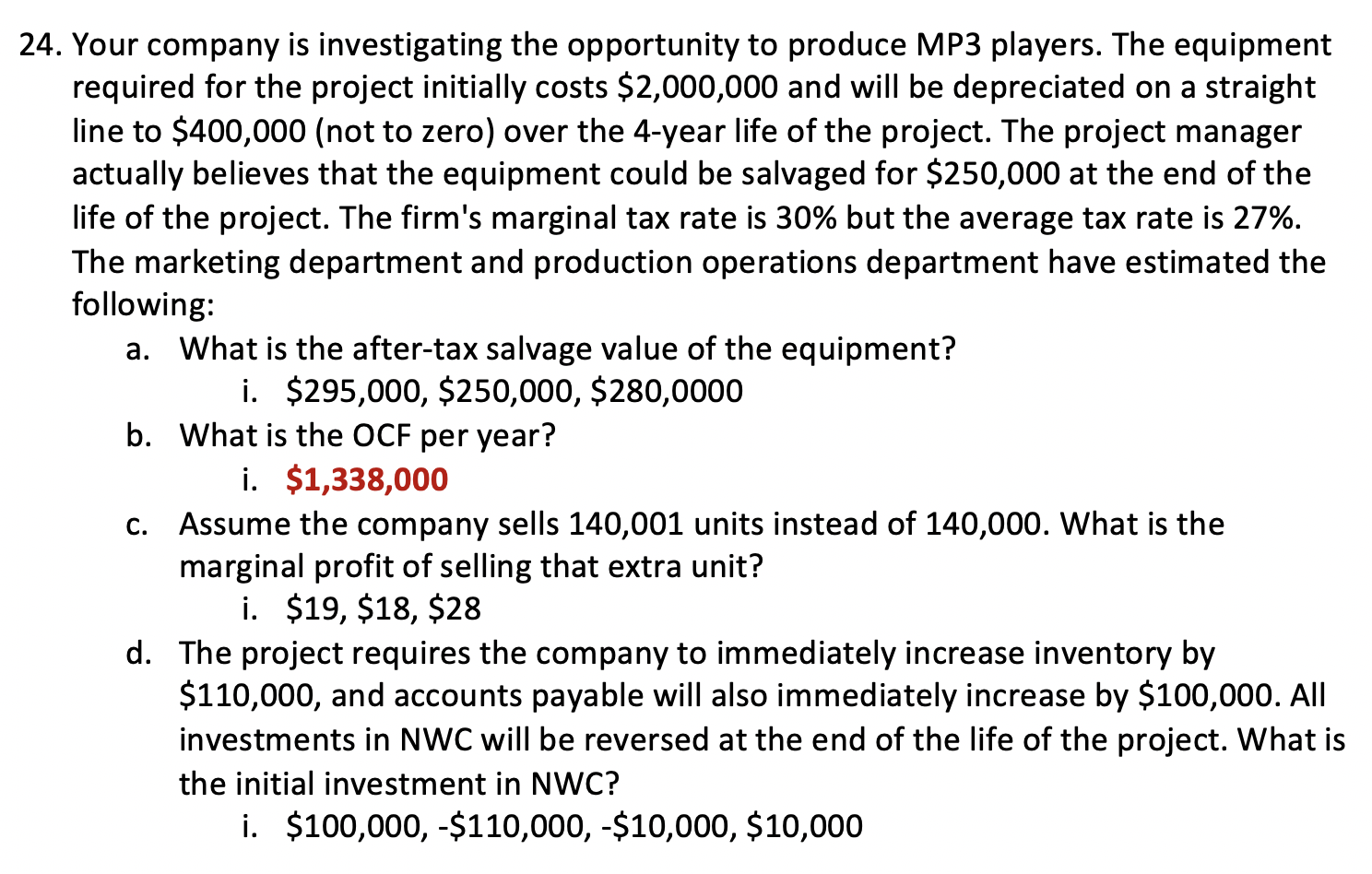

24. Your company is investigating the opportunity to produce MP3 players. The equipment required for the project initially costs $2,000,000 and will be depreciated on a straight line to $400,000 (not to zero) over the 4-year life of the project. The project manager actually believes that the equipment could be salvaged for $250,000 at the end of the life of the project. The firm's marginal tax rate is 30% but the average tax rate is 27%. The marketing department and production operations department have estimated the following: a. What is the after-tax salvage value of the equipment? i. $295,000, $250,000, $280,0000 b. What is the OCF per year? i. $1,338,000 Assume the company sells 140,001 units instead of 140,000. What is the marginal profit of selling that extra unit? i. $19, $18, $28 d. The project requires the company to immediately increase inventory by $110,000, and accounts payable will also immediately increase by $100,000. All investments in NWC will be reversed at the end of the life of the project. What is the initial investment in NWC? i. $100,000,-$110,000,-$10,000, $10,000 C. 24. Your company is investigating the opportunity to produce MP3 players. The equipment required for the project initially costs $2,000,000 and will be depreciated on a straight line to $400,000 (not to zero) over the 4-year life of the project. The project manager actually believes that the equipment could be salvaged for $250,000 at the end of the life of the project. The firm's marginal tax rate is 30% but the average tax rate is 27%. The marketing department and production operations department have estimated the following: a. What is the after-tax salvage value of the equipment? i. $295,000, $250,000, $280,0000 b. What is the OCF per year? i. $1,338,000 Assume the company sells 140,001 units instead of 140,000. What is the marginal profit of selling that extra unit? i. $19, $18, $28 d. The project requires the company to immediately increase inventory by $110,000, and accounts payable will also immediately increase by $100,000. All investments in NWC will be reversed at the end of the life of the project. What is the initial investment in NWC? i. $100,000,-$110,000,-$10,000, $10,000 CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started