Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work such as excel sheets or formulas, thank you! Your firm is considering undertaking a project which requires an initial cash outlay

Please show all work such as excel sheets or formulas, thank you!

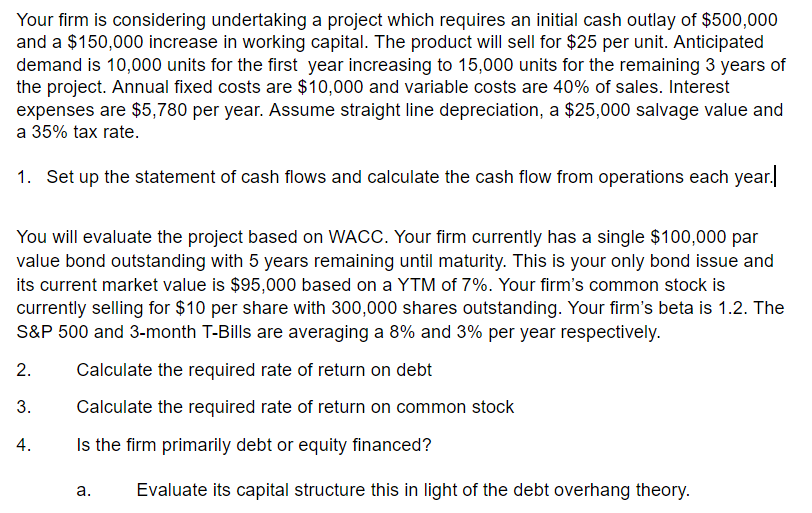

Your firm is considering undertaking a project which requires an initial cash outlay of $500,000 and a $150,000 increase in working capital. The product will sell for $25 per unit. Anticipated demand is 10,000 units for the first year increasing to 15,000 units for the remaining 3 years of the project. Annual fixed costs are $10,000 and variable costs are 40% of sales. Interest expenses are $5,780 per year. Assume straight line depreciation, a $25,000 salvage value and a 35% tax rate. 1. Set up the statement of cash flows and calculate the cash flow from operations each year. You will evaluate the project based on WACC. Your firm currently has a single $100,000 par value bond outstanding with 5 years remaining until maturity. This is your only bond issue and its current market value is $95,000 based on a YTM of 7%. Your firm's common stock is currently selling for $10 per share with 300,000 shares outstanding. Your firm's beta is 1.2. The S&P 500 and 3-month T-Bills are averaging a 8% and 3% per year respectively. Calculate the required rate of return on debt Calculate the required rate of return on common stock Is the firm primarily debt or equity financed? a. Evaluate its capital structure this in light of the debt overhang theoryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started