Answered step by step

Verified Expert Solution

Question

1 Approved Answer

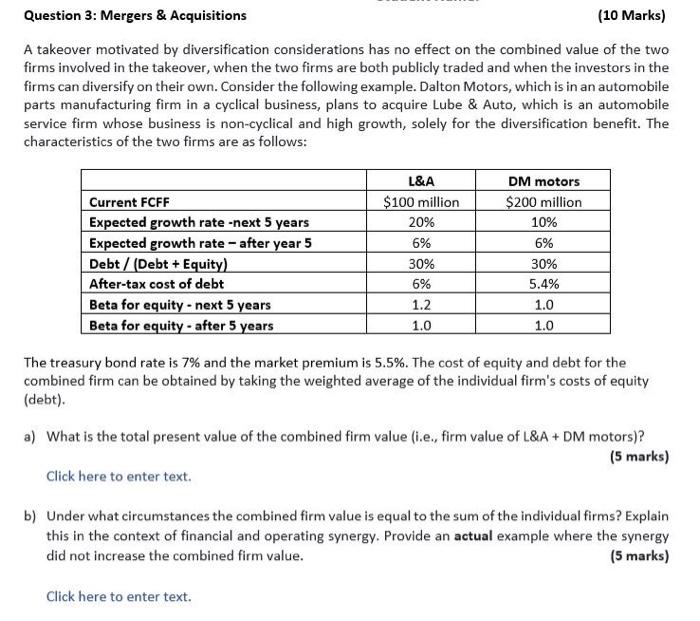

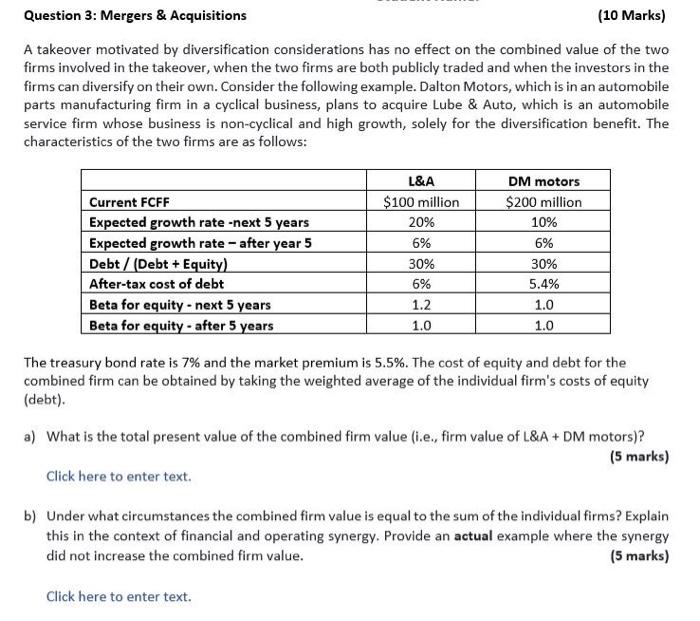

please show all working Question 3: Mergers & Acquisitions (10 Marks) A takeover motivated by diversification considerations has no effect on the combined value of

please show all working

Question 3: Mergers & Acquisitions (10 Marks) A takeover motivated by diversification considerations has no effect on the combined value of the two firms involved in the takeover, when the two firms are both publicly traded and when the investors in the firms can diversify on their own. Consider the following example. Dalton Motors, which is in an automobile parts manufacturing firm in a cyclical business, plans to acquire Lube & Auto, which is an automobile service firm whose business is non-cyclical and high growth, solely for the diversification benefit. The characteristics of the two firms are as follows: Current FCFF Expected growth rate -next 5 years Expected growth rate - after year 5 Debt / (Debt + Equity) After-tax cost of debt Beta for equity - next 5 years Beta for equity - after 5 years L&A $100 million 20% 6% 30% 6% 1.2 1.0 DM motors $200 million 10% 6% 30% 5.4% 1.0 1.0 The treasury bond rate is 7% and the market premium is 5.5%. The cost of equity and debt for the combined firm can be obtained by taking the weighted average of the individual firm's costs of equity (debt). a) What is the total present value of the combined firm value (i.e, firm value of L&A + DM motors)? (5 marks) Click here to enter text. b) Under what circumstances the combined firm value is equal to the sum of the individual firms? Explain this in the context of financial and operating synergy. Provide an actual example where the synergy did not increase the combined firm value. (5 marks) Click here to enter text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started