Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all working where necessary Question 1 a) Assuming a short position in a forward contract, provide a mathematical proof of why the value

please show all working where necessary

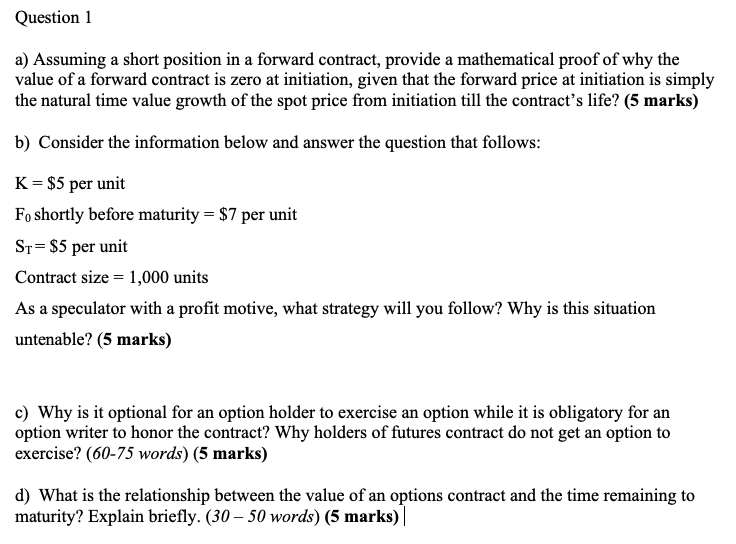

Question 1 a) Assuming a short position in a forward contract, provide a mathematical proof of why the value of a forward contract is zero at initiation, given that the forward price at initiation is simply the natural time value growth of the spot price from initiation till the contract's life? (5 marks) b) Consider the information below and answer the question that follows: K= $5 per unit Fo shortly before maturity = $7 per unit St= $5 per unit Contract size = 1,000 units As a speculator with a profit motive, what strategy will you follow? Why is this situation untenable? (5 marks) c) Why is it optional for an option holder to exercise an option while it is obligatory for an option writer to honor the contract? Why holders of futures contract do not get an option to exercise? (60-75 words) (5 marks) d) What is the relationship between the value of an options contract and the time remaining to maturity? Explain briefly. (30-50 words) (5 marks) Question 1 a) Assuming a short position in a forward contract, provide a mathematical proof of why the value of a forward contract is zero at initiation, given that the forward price at initiation is simply the natural time value growth of the spot price from initiation till the contract's life? (5 marks) b) Consider the information below and answer the question that follows: K= $5 per unit Fo shortly before maturity = $7 per unit St= $5 per unit Contract size = 1,000 units As a speculator with a profit motive, what strategy will you follow? Why is this situation untenable? (5 marks) c) Why is it optional for an option holder to exercise an option while it is obligatory for an option writer to honor the contract? Why holders of futures contract do not get an option to exercise? (60-75 words) (5 marks) d) What is the relationship between the value of an options contract and the time remaining to maturity? Explain briefly. (30-50 words)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started