Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all working where necessary Question 1(a) You have a share of stock worth $65, and all market indicators point towards an impending fall

please show all working where necessary

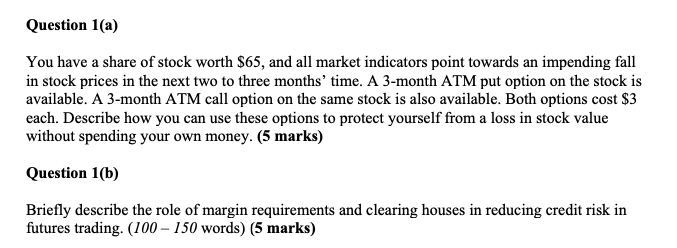

Question 1(a) You have a share of stock worth $65, and all market indicators point towards an impending fall in stock prices in the next two to three months' time. A 3-month ATM put option on the stock is available. A 3-month ATM call option on the same stock is also available. Both options cost $3 each. Describe how you can use these options to protect yourself from a loss in stock value without spending your own money. (5 marks) Question 1(b) Briefly describe the role of margin requirements and clearing houses in reducing credit risk in futures trading. (100 - 150 words)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started