please show all workings clearly. thank

you!

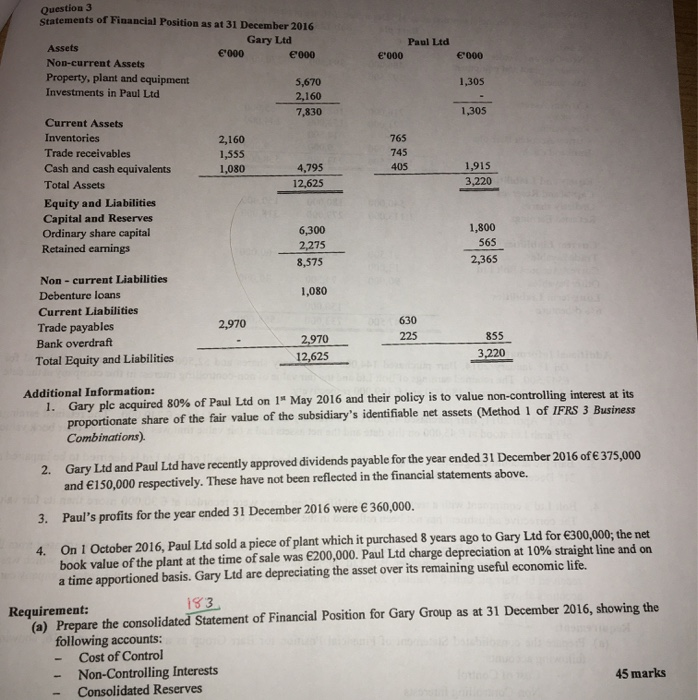

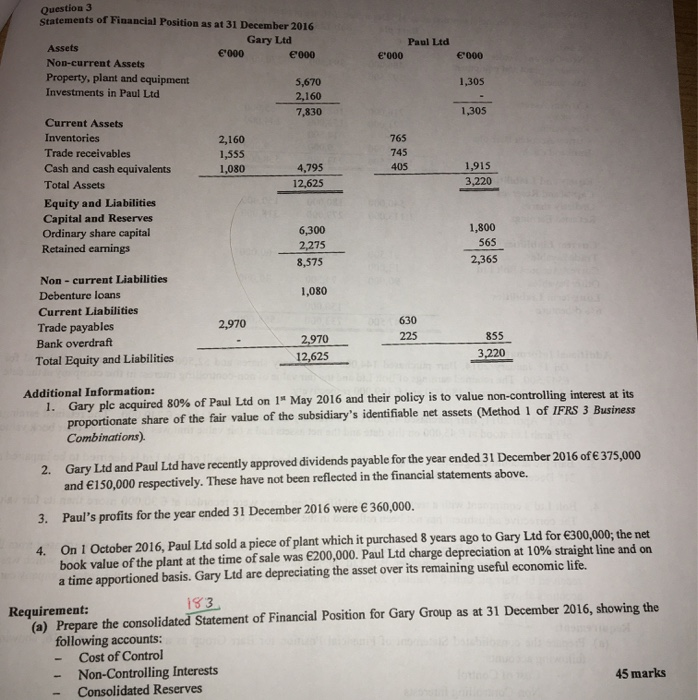

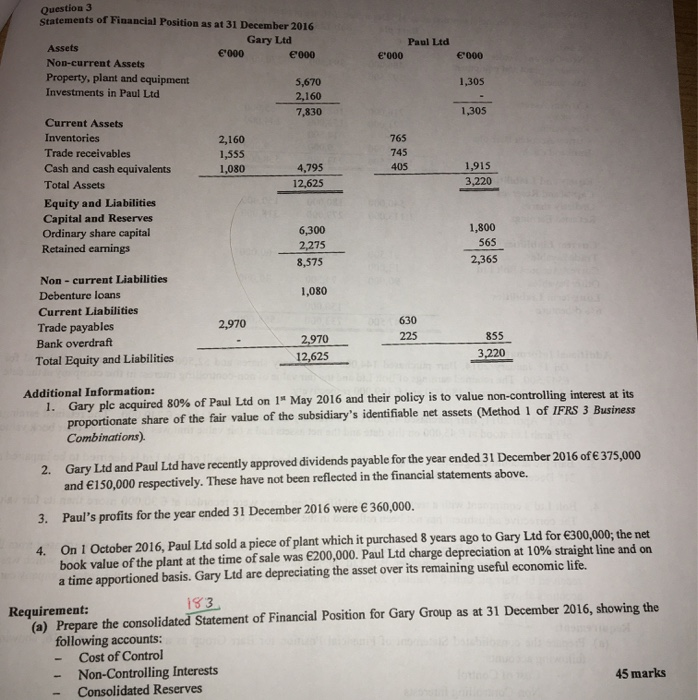

Question 3 Paul Ltd "000 000 1,305 1,305 765 745 405 1,915 3,220 Statements of Financial Position as at 31 December 2016 Assets Gary Ltd 000 000 Non-current Assets Property, plant and equipment 5,670 Investments in Paul Ltd 2,160 7,830 Current Assets Inventories 2,160 Trade receivables 1,555 Cash and cash equivalents 1,080 4,795 Total Assets 12,625 Equity and Liabilities Capital and Reserves Ordinary share capital 6,300 Retained earnings 2,275 8,575 Non-current Liabilities Debenture loans 1,080 Current Liabilities Trade payables 2,970 Bank overdraft 2,970 Total Equity and Liabilities 12,625 1,800 565 2,365 630 225 855 3,220 Additional Information: 1. Gary plc acquired 80% of Paul Ltd on 1" May 2016 and their policy is to value non-controlling interest at its proportionate share of the fair value of the subsidiary's identifiable net assets (Method 1 of IFRS 3 Business Combinations) 4. 2. Gary Ltd and Paul Ltd have recently approved dividends payable for the year ended 31 December 2016 of 375,000 and 150,000 respectively. These have not been reflected in the financial statements above. 3. Paul's profits for the year ended 31 December 2016 were 360,000. On 1 October 2016, Paul Ltd sold a piece of plant which it purchased 8 years ago to Gary Ltd for 300,000, the net book value of the plant at the time of sale was 200,000. Paul Ltd charge depreciation at 10% straight line and on a time apportioned basis. Gary Ltd are depreciating the asset over its remaining useful economic life. Requirement: 183 (a) Prepare the consolidated Statement of Financial Position for Gary Group as at 31 December 2016, showing the following accounts: Cost of Control Non-Controlling Interests Consolidated Reserves 45 marks Question 3 Paul Ltd "000 000 1,305 1,305 765 745 405 1,915 3,220 Statements of Financial Position as at 31 December 2016 Assets Gary Ltd 000 000 Non-current Assets Property, plant and equipment 5,670 Investments in Paul Ltd 2,160 7,830 Current Assets Inventories 2,160 Trade receivables 1,555 Cash and cash equivalents 1,080 4,795 Total Assets 12,625 Equity and Liabilities Capital and Reserves Ordinary share capital 6,300 Retained earnings 2,275 8,575 Non-current Liabilities Debenture loans 1,080 Current Liabilities Trade payables 2,970 Bank overdraft 2,970 Total Equity and Liabilities 12,625 1,800 565 2,365 630 225 855 3,220 Additional Information: 1. Gary plc acquired 80% of Paul Ltd on 1" May 2016 and their policy is to value non-controlling interest at its proportionate share of the fair value of the subsidiary's identifiable net assets (Method 1 of IFRS 3 Business Combinations) 4. 2. Gary Ltd and Paul Ltd have recently approved dividends payable for the year ended 31 December 2016 of 375,000 and 150,000 respectively. These have not been reflected in the financial statements above. 3. Paul's profits for the year ended 31 December 2016 were 360,000. On 1 October 2016, Paul Ltd sold a piece of plant which it purchased 8 years ago to Gary Ltd for 300,000, the net book value of the plant at the time of sale was 200,000. Paul Ltd charge depreciation at 10% straight line and on a time apportioned basis. Gary Ltd are depreciating the asset over its remaining useful economic life. Requirement: 183 (a) Prepare the consolidated Statement of Financial Position for Gary Group as at 31 December 2016, showing the following accounts: Cost of Control Non-Controlling Interests Consolidated Reserves 45 marks