Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all workings Friendly Computers, located in Richmond Hill, is a decentralized company that rewards each of its divisional managers based on the annual

Please show all workings

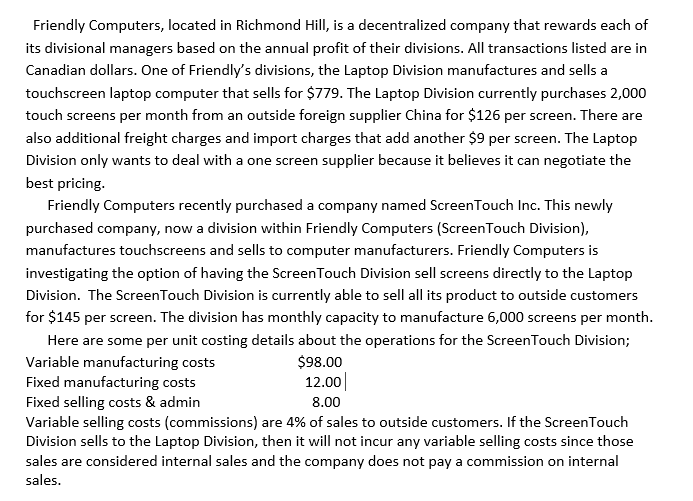

Friendly Computers, located in Richmond Hill, is a decentralized company that rewards each of its divisional managers based on the annual profit of their divisions. All transactions listed are in Canadian dollars. One of Friendly's divisions, the Laptop Division manufactures and sells a touchscreen laptop computer that sells for $779. The Laptop Division currently purchases 2,000 touch screens per month from an outside foreign supplier China for $126 per screen. There are also additional freight charges and import charges that add another $9 per screen. The Laptop Division only wants to deal with a one screen supplier because it believes it can negotiate the best pricing. Friendly Computers recently purchased a company named ScreenTouch Inc. This newly purchased company, now a division within Friendly Computers (Screen Touch Division), manufactures touchscreens and sells to computer manufacturers. Friendly Computers is investigating the option of having the Screen Touch Division sell screens directly to the Laptop Division. The Screen Touch Division is currently able to sell all its product to outside customers for $145 per screen. The division has monthly capacity to manufacture 6,000 screens per month. Here are some per unit costing details about the operations for the Screen Touch Division; Variable manufacturing costs $98.00 Fixed manufacturing costs 12.00 Fixed selling costs & admin 8.00 Variable selling costs (commissions) are 4% of sales to outside customers. If the Screen Touch Division sells to the Laptop Division, then it will not incur any variable selling costs since those sales are considered internal sales and the company does not pay a commission on internal sales. Required: a) Calculate the maximum unit transfer price that the Laptop Division would be willing to pay to purchase the touchscreens from the Screen Touch division. b) Assume that Screen Touch is currently selling 3,500 units per month to outside customers. Calculate the minimum $Cdn unit price that Screen Touch division would be willing to accept to sell the touchscreens to the Laptop Division. c) Assume instead that Screen Touch is currently selling 4,500 units per month. Calculate the minimum $Cdn unit price that Screen Touch division would be willing to accept to sell the touchscreens to the Laptop Division. Is there still an opportunity for a negotiated price? d) Another option being considered is having the Touch Screen Division transfer product to the Laptop Division using the market price for screens since it would be easier to implement. Would you consider this method to be a good option? Explain why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started