Please show all your working

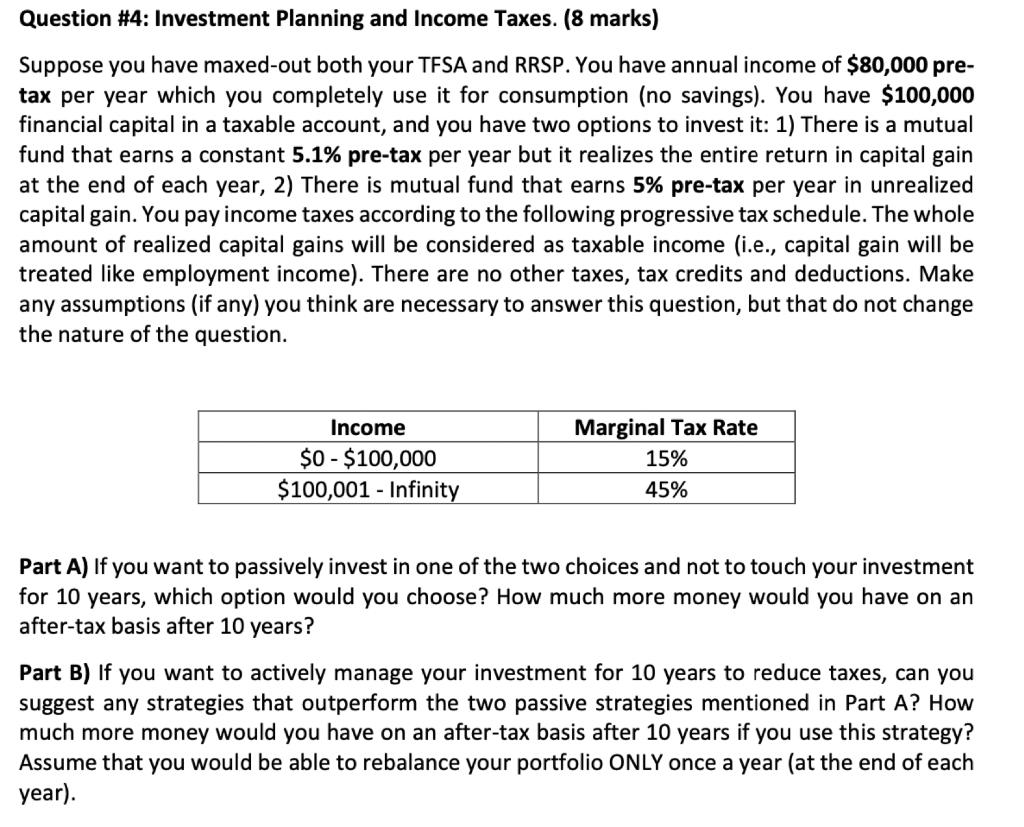

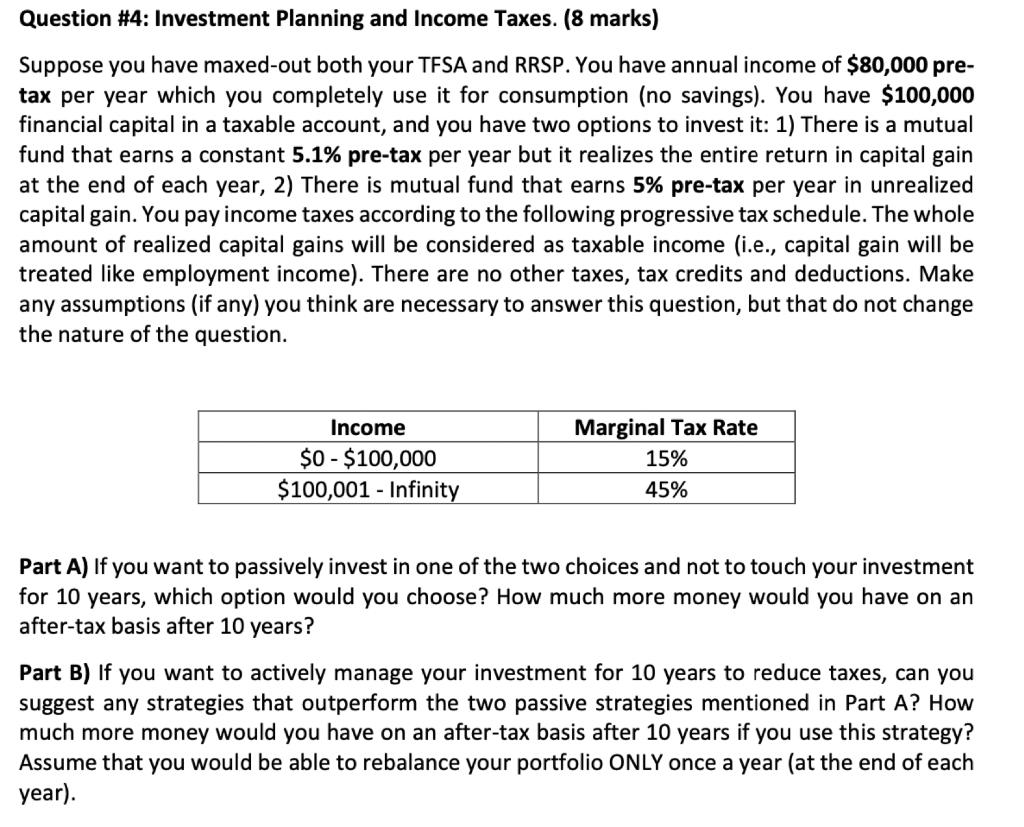

Question #4: Investment Planning and Income Taxes. (8 marks) Suppose you have maxed-out both your TFSA and RRSP. You have annual income of $80,000 pre- tax per year which you completely use it for consumption (no savings). You have $100,000 financial capital in a taxable account, and you have two options to invest it: 1) There is a mutual fund that earns a constant 5.1% pre-tax per year but it realizes the entire return in capital gain at the end of each year, 2) There is mutual fund that earns 5% pre-tax per year in unrealized capital gain. You pay income taxes according to the following progressive tax schedule. The whole amount of realized capital gains will be considered as taxable income (i.e., capital gain will be treated like employment income). There are no other taxes, tax credits and deductions. Make any assumptions (if any) you think are necessary to answer this question, but that do not change the nature of the question. Income $0 - $100,000 $100,001 - Infinity Marginal Tax Rate 15% 45% Part A) If you want to passively invest in one of the two choices and not to touch your investment for 10 years, which option would you choose? How much more money would you have on an after-tax basis after 10 years? Part B) If you want to actively manage your investment for 10 years to reduce taxes, can you suggest any strategies that outperform the two passive strategies mentioned in Part A? How much more money would you have on an after-tax basis after 10 years if you use this strategy? Assume that you would be able to rebalance your portfolio ONLY once a year (at the end of each year). Question #4: Investment Planning and Income Taxes. (8 marks) Suppose you have maxed-out both your TFSA and RRSP. You have annual income of $80,000 pre- tax per year which you completely use it for consumption (no savings). You have $100,000 financial capital in a taxable account, and you have two options to invest it: 1) There is a mutual fund that earns a constant 5.1% pre-tax per year but it realizes the entire return in capital gain at the end of each year, 2) There is mutual fund that earns 5% pre-tax per year in unrealized capital gain. You pay income taxes according to the following progressive tax schedule. The whole amount of realized capital gains will be considered as taxable income (i.e., capital gain will be treated like employment income). There are no other taxes, tax credits and deductions. Make any assumptions (if any) you think are necessary to answer this question, but that do not change the nature of the question. Income $0 - $100,000 $100,001 - Infinity Marginal Tax Rate 15% 45% Part A) If you want to passively invest in one of the two choices and not to touch your investment for 10 years, which option would you choose? How much more money would you have on an after-tax basis after 10 years? Part B) If you want to actively manage your investment for 10 years to reduce taxes, can you suggest any strategies that outperform the two passive strategies mentioned in Part A? How much more money would you have on an after-tax basis after 10 years if you use this strategy? Assume that you would be able to rebalance your portfolio ONLY once a year (at the end of each year)