Answered step by step

Verified Expert Solution

Question

1 Approved Answer

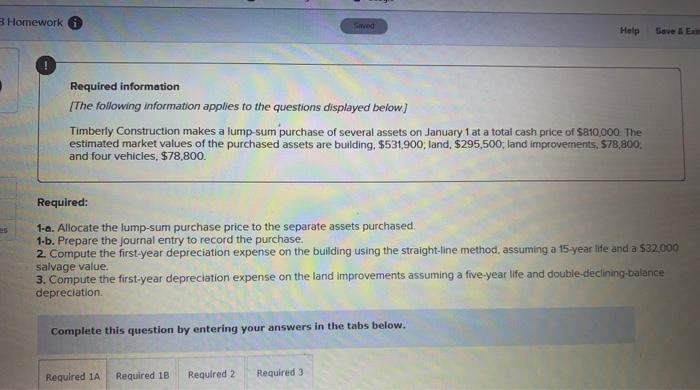

Please show and explain your work ! Homework God Help Save & Ear Required information The following information applies to the questions displayed below) Timberly

Please show and explain your work !

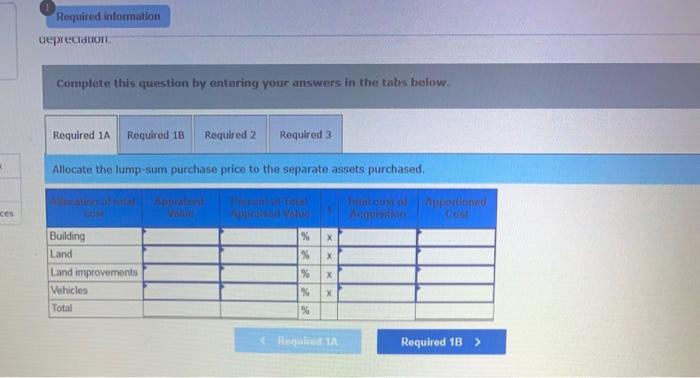

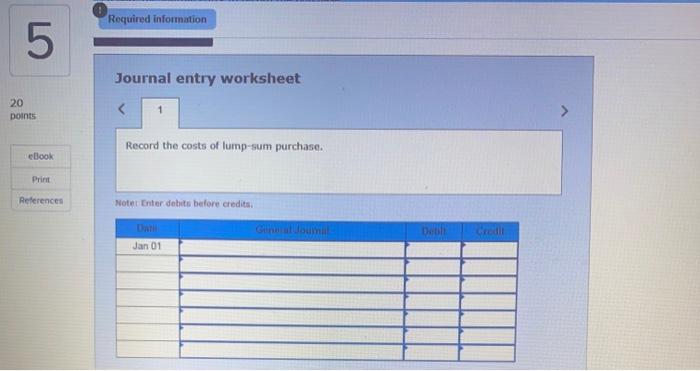

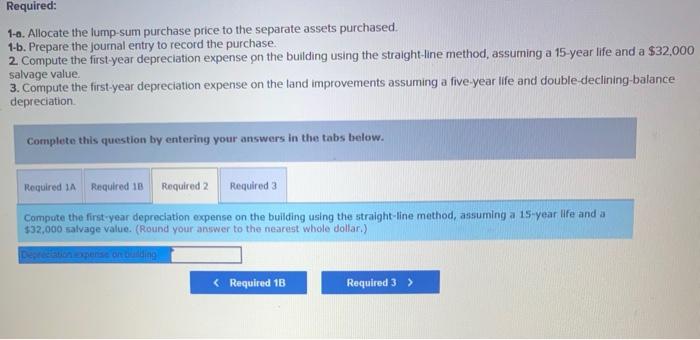

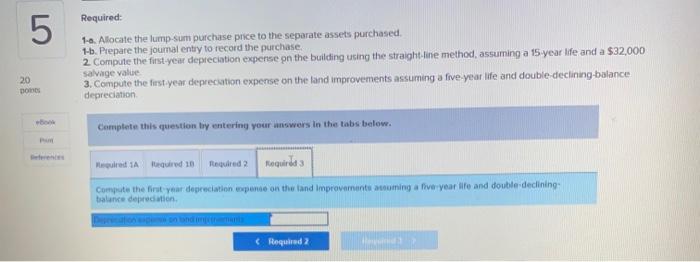

Homework God Help Save & Ear Required information The following information applies to the questions displayed below) Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810.000 The estimated market values of the purchased assets are building, $531,900; land, $295,500; land improvements. 578,800 and four vehicles, $78,800. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $32.000 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Required information depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Allocate the lump sum purchase price to the separate assets purchased. Tot.costa portioned sition DO ces X X Building Land Land improvements Vehicles Total RRRR x Required information 5 Journal entry worksheet 20 points Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started