Answered step by step

Verified Expert Solution

Question

1 Approved Answer

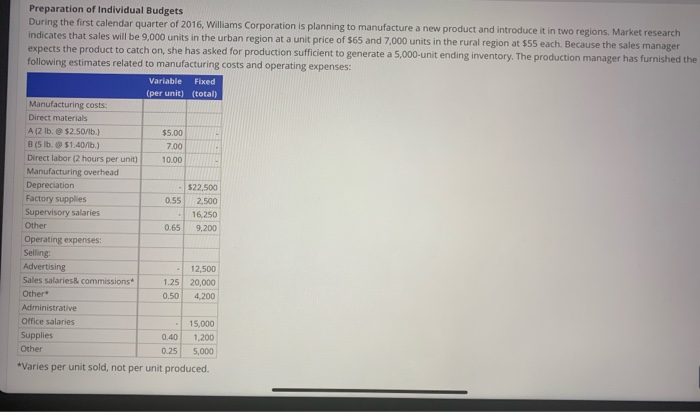

please show answer exactly how the question is written, highly apperciated. - Preparation of Individual Budgets During the first calendar quarter of 2016, Williams Corporation

please show answer exactly how the question is written, highly apperciated.

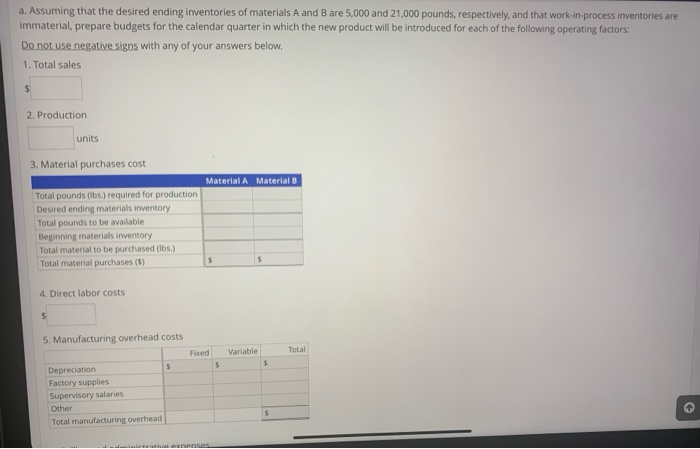

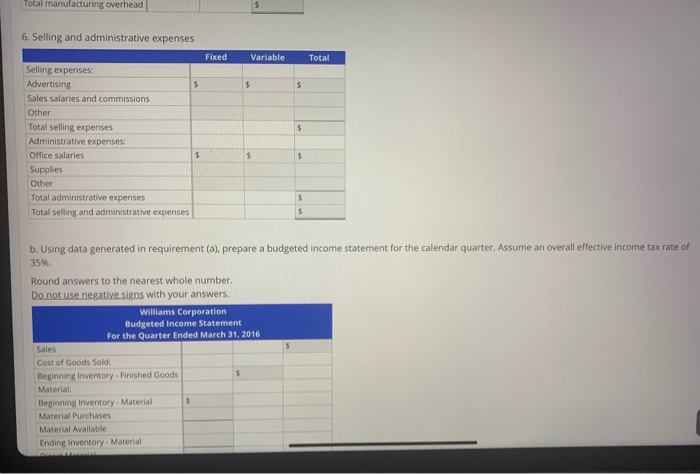

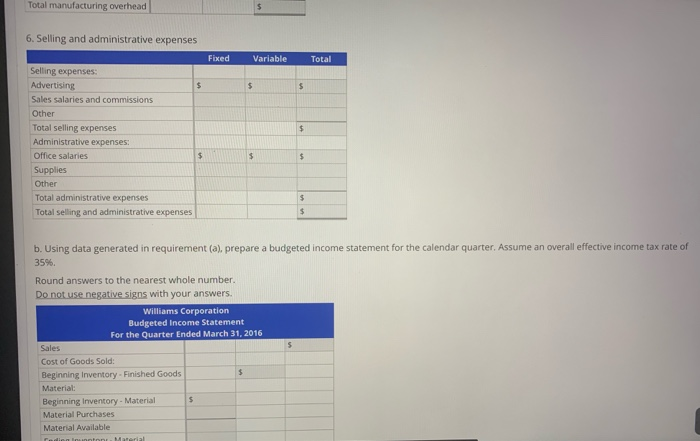

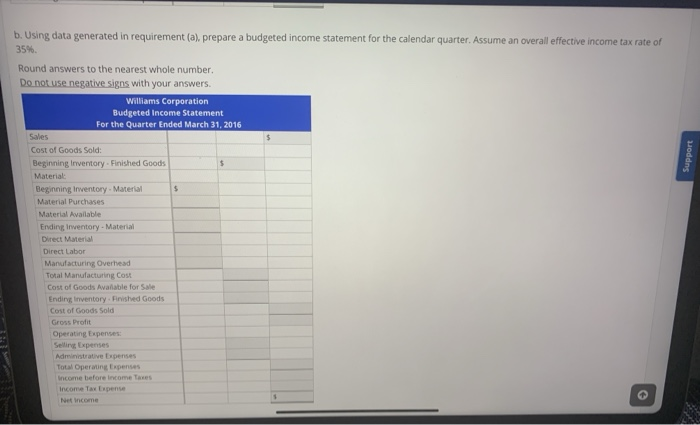

- Preparation of Individual Budgets During the first calendar quarter of 2016, Williams Corporation is planning to manufacture a new product and introduce it in two regions. Market research indicates that sales will be 9.000 units in the urban region at a unit price of $65 and 7,000 units the rural region at $55 each. Because the sales manager expects the product to catch on, she has asked for production sufficient to generate a 5,000-unit ending inventory. The production manager has furnished the following estimates related to manufacturing costs and operating expenses: Variable Fixed (per unit) (total) Manufacturing costs Direct materials A (2 lb. $2.50/1b.) $5.00 B (5 lb. 51.40/1b.) 7.00 Direct labor (2 hours per unit) 10.00 Manufacturing overhead Depreciation $22,500 Factory supplies 0.55 2.500 Supervisory salaries 16,250 Other 0.65 9,200 Operating expenses: Selling Advertising 12,500 Sales salaries & commissions 1.25 20,000 Other 0.50 4,200 Administrative Office salaries 15,000 Supplies 0.40 1,200 Other 0.25 5,000 *Varies per unit sold, not per unit produced. a. Assuming that the desired ending inventories of materials A and B are 5,000 and 21,000 pounds, respectively, and that work-in-process inventories are immaterial, prepare budgets for the calendar quarter in which the new product will be introduced for each of the following operating factors: Do not use negative signs with any of your answers below. 1. Total sales 2. Production units 3. Material purchases cost Material A Material B Total pounds (lbs.) required for production Desired ending materials inventory Total pounds to be available Beginning materials inventory Total material to be purchased (lbs) Total material purchases (5) $ 4. Direct labor costs $ 5. Manufacturing overhead costs Foced Variable Total $ 5 $ Depreciation Factory supplies Supervisory salaries Other Total manufacturing overhead Total manufacturing overhead 6. Selling and administrative expenses Fixed Variable Total $ $ $ $ Selling expenses Advertising Sales salaries and commissions Other Total selling expenses Administrative expenses: Office salaries Supplies Other Total administrative expenses Total selling and administrative expenses 5 $ $ $ $ b. Using data generated in requirement (a), prepare a budgeted income statement for the calendar quarter. Assume an overall effective income tax rate of 35% Round answers to the nearest whole number Do not use negative signs with your answers, Williams Corporation Budgeted Income Statement For the Quarter Ended March 31, 2016 Sales Cost of Goods Sold: Beginning Inventory. Finished Goods $ Material Beginning Inventory - Material $ Material Purchases Material Available Ending Inventory. Material $ Total manufacturing overhead 6. Selling and administrative expenses Fixed Variable Total $ $ $ $ Selling expenses: Advertising Sales salaries and commissions Other Total selling expenses Administrative expenses: Office salaries Supplies Other Total administrative expenses Total selling and administrative expenses $ $ $ $ $ b. Using data generated in requirement (a), prepare a budgeted income statement for the calendar quarter. Assume an overall effective income tax rate of 35%. Round answers to the nearest whole number Do not use negative signs with your answers. Williams Corporation Budgeted Income Statement For the Quarter Ended March 31, 2016 Sales Cost of Goods Sold: Beginning Inventory - Finished Goods $ Material: Beginning Inventory - Material $ Material Purchases Material Available din nunti Material Support b. Using data generated in requirement (a), prepare a budgeted income statement for the calendar quarter. Assume an overall effective income tax rate of 35%. Round answers to the nearest whole number. Do not use negative signs with your answers. Williams Corporation Budgeted Income Statement For the Quarter Ended March 31, 2016 Sales $ Cost of Goods Sold: Beginning inventory. Finished Goods $ Material: $ Beginning Inventory. Material Material Purchases Material Available Ending inventory. Material Direct Material Direct Labor Manufacturing Overhead Total Manufacturing Cost Cost of Goods Avaliable for Sale Ending inventory. Finished Goods Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses Administrative Expenses Total Operating Expenses Income before Income Taxes Income Tax Expense Net Income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started