Answered step by step

Verified Expert Solution

Question

1 Approved Answer

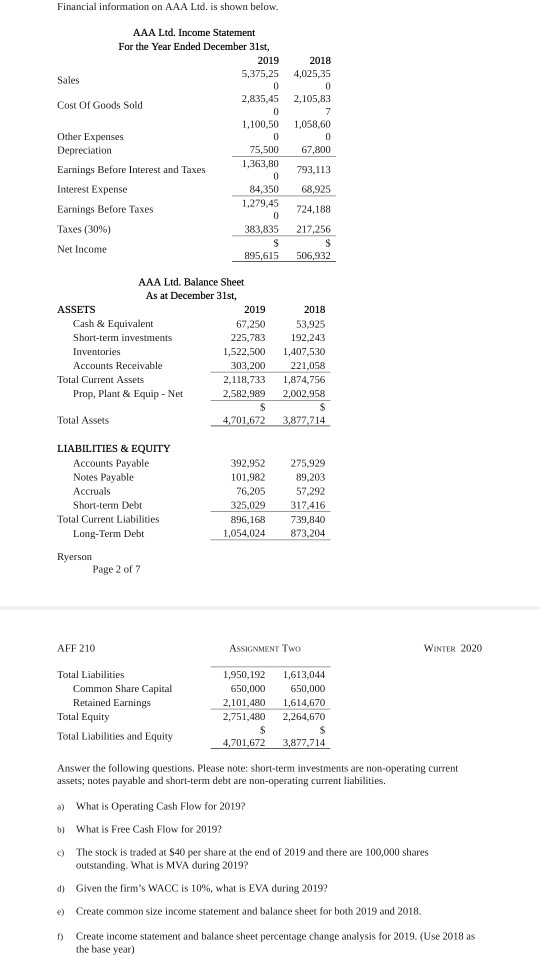

*Please show answers using excel formulas* Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year Ended December 31st, 2019

*Please show answers using excel formulas*

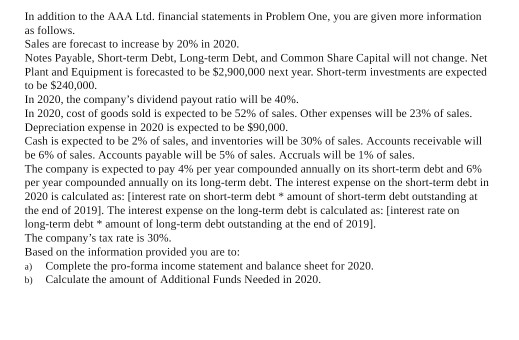

Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year Ended December 31st, 2019 5,375,25 2018 4,025,35 Sales 2,835,45 2,105.83 Cost Of Goods Sold 1,100,50 1,058,60 Other Expenses Depreciation 75,500 1,363,80 Earnings Before Interest and Taxes 67,800 793,113 68,925 84,350 1,279,45 0 724,188 Interest Expense Earnings Before Taxes Taxes (30%) Net Income 383,835 217,256 SS 895,615 506,932 AAA Ltd. Balance Sheet As at December 31st, ASSETS 2019 2018 Cash & Equivalent 67,250 53,925 Short-term investments 225,783 192,243 Inventories 1,522,500 1,407,530 Accounts Receivable 303,200 221,058 Total Current Assets 2,118,733 1,874,756 Prop, Plant & Equip-Net 2,582,989 2,002,958 $ Total Assets 4,701,6723,877,714 LIABILITIES & EQUITY Accounts Payable Notes Payable Accruals Short-term Debt Total Current Liabilities Long-Term Debt 392,952 275,929 101,982 89.203 76,205 57,292 325,029317,416 896,168 739,840 1,054,024 873,204 Ryerson Page 2 of 7 AFF 210 ASSIGNMENT TWO WINTER 2020 Total Liabilities Common Share Capital Retained Earnings Total Equity Total Liabilities and Equity 1,950, 1921,613,044 650,000 650,000 2,101,480 1,614,670 2,751,480 2,264,670 $ $ 4,701,672 3,877,714 Answer the following questions. Please note: short-term investments are non-operating current assets, notes payable and short-term debt are non-operating current liabilities. a) What is Operating Cash Flow for 2019? b) What is Free Cash Flow for 2019? c) The stock is traded at S40 per share at the end of 2019 and there are 100,000 shares outstanding. What is MVA during 2019? d) Given the firm's WACC is 10%, what is EVA during 2019? e) Create common size income statement and balance sheet for both 2019 and 2018. D) Create income statement and balance sheet percentage change analysis for 2019. (Use 2018 as the base year) In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast to increase by 20% in 2020. Notes Payable, Short-term Debt, Long-term Debt, and Common Share Capital will not change. Net Plant and Equipment is forecasted to be $2,900,000 next year. Short-term investments are expected to be $240,000. In 2020, the company's dividend payout ratio will be 40%. In 2020, cost of goods sold is expected to be 52% of sales. Other expenses will be 23% of sales. Depreciation expense in 2020 is expected to be $90,000. Cash is expected to be 2% of sales, and inventories will be 30% of sales. Accounts receivable will be 6% of sales. Accounts payable will be 5% of sales. Accruals will be 1% of sales. The company is expected to pay 4% per year compounded annually on its short-term debt and 6% per year compounded annually on its long-term debt. The interest expense on the short-term debt in 2020 is calculated as: [interest rate on short-term debt amount of short-term debt outstanding at the end of 2019). The interest expense on the long-term debt is calculated as: [interest rate on long-term debt amount of long-term debt outstanding at the end of 2019]. The company's tax rate is 30%. Based on the information provided you are to: a) Complete the pro-forma income statement and balance sheet for 2020. b) Calculate the amount of Additional Funds Needed in 2020. Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year Ended December 31st, 2019 5,375,25 2018 4,025,35 Sales 2,835,45 2,105.83 Cost Of Goods Sold 1,100,50 1,058,60 Other Expenses Depreciation 75,500 1,363,80 Earnings Before Interest and Taxes 67,800 793,113 68,925 84,350 1,279,45 0 724,188 Interest Expense Earnings Before Taxes Taxes (30%) Net Income 383,835 217,256 SS 895,615 506,932 AAA Ltd. Balance Sheet As at December 31st, ASSETS 2019 2018 Cash & Equivalent 67,250 53,925 Short-term investments 225,783 192,243 Inventories 1,522,500 1,407,530 Accounts Receivable 303,200 221,058 Total Current Assets 2,118,733 1,874,756 Prop, Plant & Equip-Net 2,582,989 2,002,958 $ Total Assets 4,701,6723,877,714 LIABILITIES & EQUITY Accounts Payable Notes Payable Accruals Short-term Debt Total Current Liabilities Long-Term Debt 392,952 275,929 101,982 89.203 76,205 57,292 325,029317,416 896,168 739,840 1,054,024 873,204 Ryerson Page 2 of 7 AFF 210 ASSIGNMENT TWO WINTER 2020 Total Liabilities Common Share Capital Retained Earnings Total Equity Total Liabilities and Equity 1,950, 1921,613,044 650,000 650,000 2,101,480 1,614,670 2,751,480 2,264,670 $ $ 4,701,672 3,877,714 Answer the following questions. Please note: short-term investments are non-operating current assets, notes payable and short-term debt are non-operating current liabilities. a) What is Operating Cash Flow for 2019? b) What is Free Cash Flow for 2019? c) The stock is traded at S40 per share at the end of 2019 and there are 100,000 shares outstanding. What is MVA during 2019? d) Given the firm's WACC is 10%, what is EVA during 2019? e) Create common size income statement and balance sheet for both 2019 and 2018. D) Create income statement and balance sheet percentage change analysis for 2019. (Use 2018 as the base year) In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast to increase by 20% in 2020. Notes Payable, Short-term Debt, Long-term Debt, and Common Share Capital will not change. Net Plant and Equipment is forecasted to be $2,900,000 next year. Short-term investments are expected to be $240,000. In 2020, the company's dividend payout ratio will be 40%. In 2020, cost of goods sold is expected to be 52% of sales. Other expenses will be 23% of sales. Depreciation expense in 2020 is expected to be $90,000. Cash is expected to be 2% of sales, and inventories will be 30% of sales. Accounts receivable will be 6% of sales. Accounts payable will be 5% of sales. Accruals will be 1% of sales. The company is expected to pay 4% per year compounded annually on its short-term debt and 6% per year compounded annually on its long-term debt. The interest expense on the short-term debt in 2020 is calculated as: [interest rate on short-term debt amount of short-term debt outstanding at the end of 2019). The interest expense on the long-term debt is calculated as: [interest rate on long-term debt amount of long-term debt outstanding at the end of 2019]. The company's tax rate is 30%. Based on the information provided you are to: a) Complete the pro-forma income statement and balance sheet for 2020. b) Calculate the amount of Additional Funds Needed in 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started