Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show any Financial calculator inputs. Edit: Question is asking for the total sum of cash flows paid to Tranche A investors . Rounded to

Please show any Financial calculator inputs.

Please show any Financial calculator inputs.

Edit:

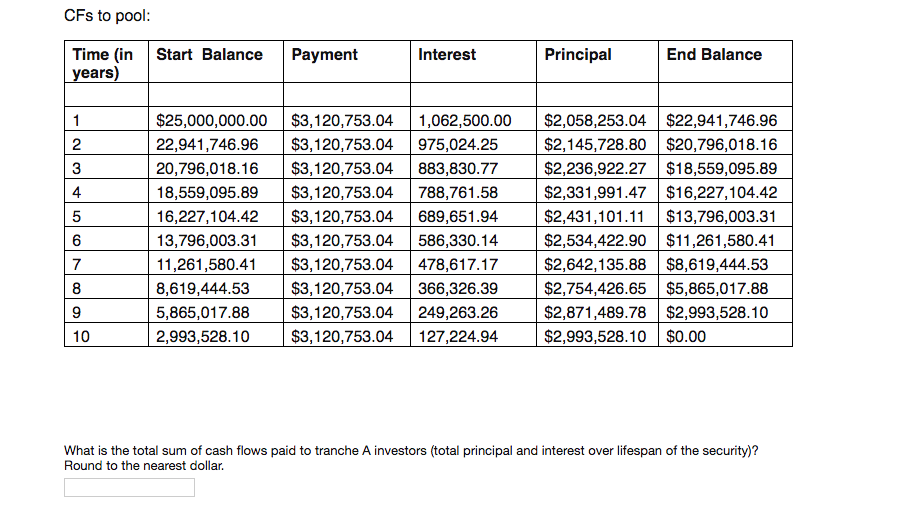

Question is asking for the total sum of cash flows paid to Tranche A investors. Rounded to the nearest dollar.

This was all the information i was given.

2nd Edit:

I see what what you're saying. But again, this was all the information i was given for this problem.

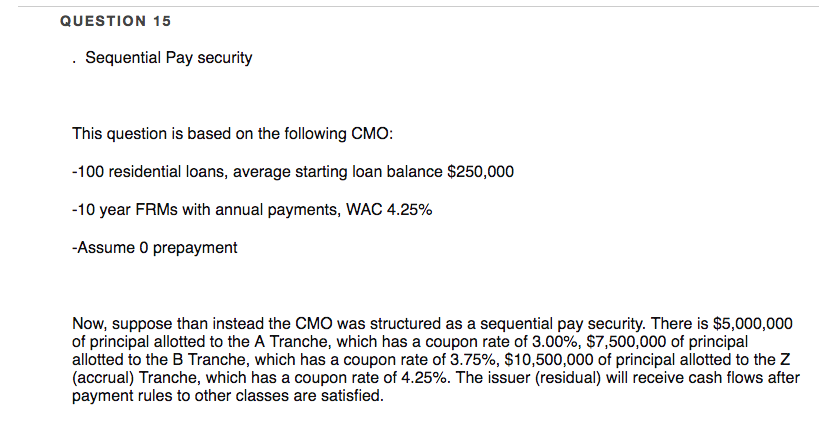

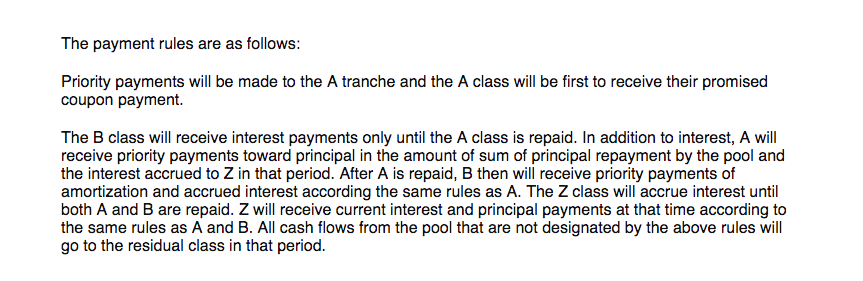

QUESTION 15 . Sequential Pay security This question is based on the following CMO -100 residential loans, average starting loan balance $250,000 -10 year FRMs with annual payments. WAC 4.25% Assume 0 prepayment Now, suppose than instead the CMO was structured as a sequential pay security. There is $5,000,000 of principal allotted to the A Tranche, which has a coupon rate of 3.00%, $7,500,000 of principal allotted to the B Tranche, which has a coupon rate of 3.75%, $10,500,000 of principal allotted to the Z (accrual) Tranche, which has a coupon rate of 4.25%. The issuer (residual) will receive cash flows after payment rules to other classes are satisfiedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started