Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show any work. Thanks! Question 1 Assume that you are an investment analyst preparing an analysis of an investment opportunity for a client. Your

Please show any work. Thanks!

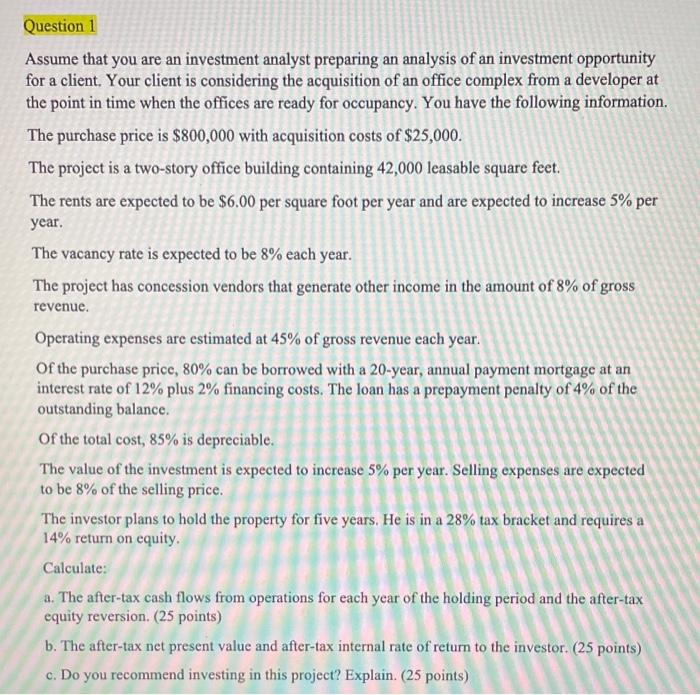

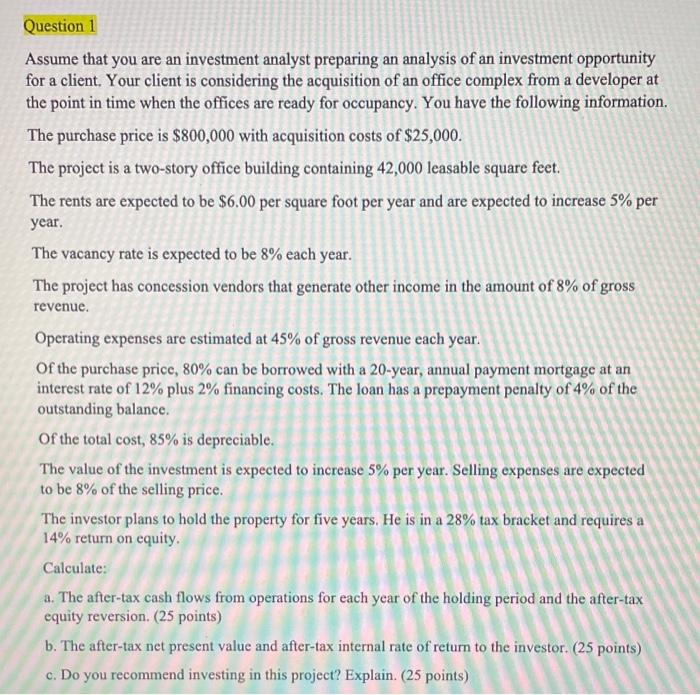

Question 1 Assume that you are an investment analyst preparing an analysis of an investment opportunity for a client. Your client is considering the acquisition of an office complex from a developer at the point in time when the offices are ready for occupancy. You have the following information. The purchase price is $800,000 with acquisition costs of $25,000. The project is a two-story office building containing 42,000 leasable square feet. The rents are expected to be $6.00 per square foot per year and are expected to increase 5% per year. The vacancy rate is expected to be 8% each year. The project has concession vendors that generate other income in the amount of 8% of gross revenue. Operating expenses are estimated at 45% of gross revenue each year. Of the purchase price, 80% can be borrowed with a 20-year, annual payment mortgage at an interest rate of 12% plus 2% financing costs. The loan has a prepayment penalty of 4% of the outstanding balance Of the total cost, 85% is depreciable. The value of the investment is expected to increase 5% per year. Selling expenses are expected to be 8% of the selling price. The investor plans to hold the property for five years. He is in a 28% tax bracket and requires a 14% return on equity. Calculate: a. The after-tax cash flows from operations for each year of the holding period and the after-tax equity reversion. (25 points) b. The after-tax net present value and after-tax internal rate of return to the investor. (25 points) c. Do you recommend investing in this project? Explain. (25 points) Question 1 Assume that you are an investment analyst preparing an analysis of an investment opportunity for a client. Your client is considering the acquisition of an office complex from a developer at the point in time when the offices are ready for occupancy. You have the following information. The purchase price is $800,000 with acquisition costs of $25,000. The project is a two-story office building containing 42,000 leasable square feet. The rents are expected to be $6.00 per square foot per year and are expected to increase 5% per year. The vacancy rate is expected to be 8% each year. The project has concession vendors that generate other income in the amount of 8% of gross revenue. Operating expenses are estimated at 45% of gross revenue each year. Of the purchase price, 80% can be borrowed with a 20-year, annual payment mortgage at an interest rate of 12% plus 2% financing costs. The loan has a prepayment penalty of 4% of the outstanding balance Of the total cost, 85% is depreciable. The value of the investment is expected to increase 5% per year. Selling expenses are expected to be 8% of the selling price. The investor plans to hold the property for five years. He is in a 28% tax bracket and requires a 14% return on equity. Calculate: a. The after-tax cash flows from operations for each year of the holding period and the after-tax equity reversion. (25 points) b. The after-tax net present value and after-tax internal rate of return to the investor. (25 points) c. Do you recommend investing in this project? Explain. (25 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started