please show calcualtions and explantions and lables

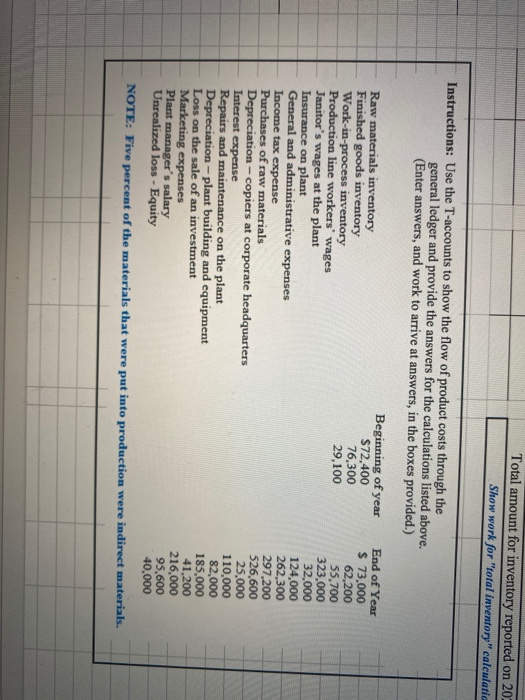

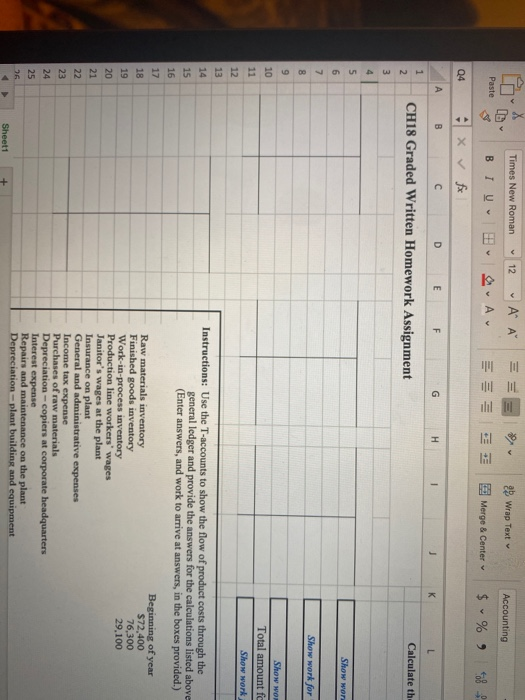

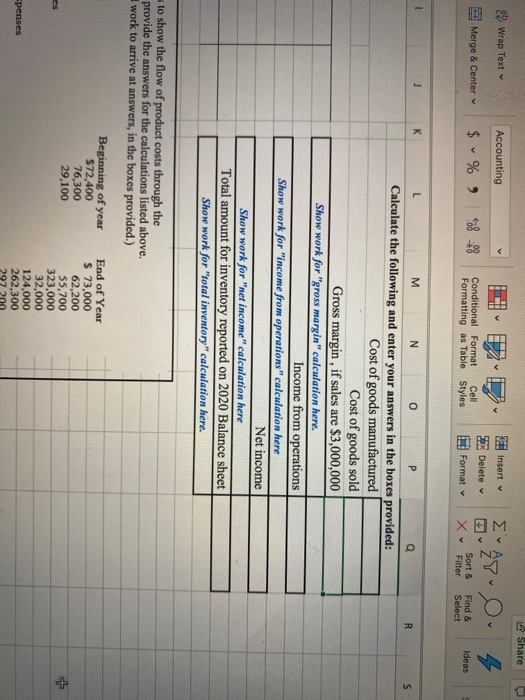

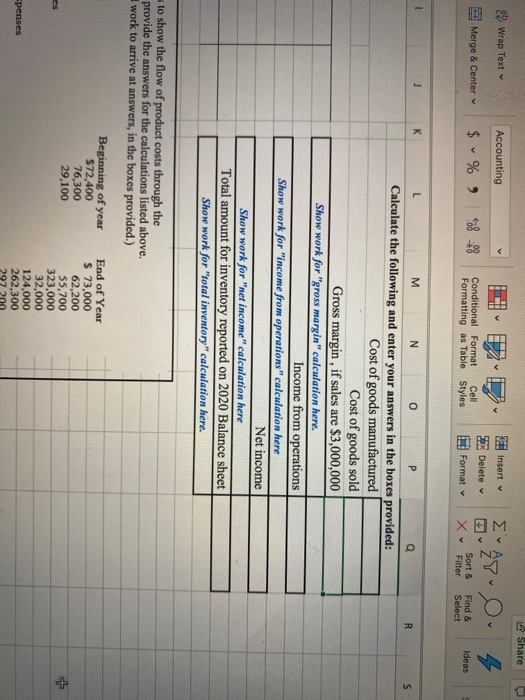

Share a Wrap Text Accounting Insert 22. O. 8 Merge & Center $ % 38- Conditional Format Formatting as Table Cell Styles Format X Sort & Filter Find & Select Ideas L M N O P a Rs. Calculate the following and enter your answers in the boxes provided: Cost of goods manufactured Cost of goods sold Gross margin , if sales are $3,000,000 Show work for "gross margin" calculation here. Income from operations Show work for "income from operations calculation here Net income Show work for "net income" calculation here Total amount for inventory reported on 2020 Balance sheet Show work for total inventory" calculation here to show the flow of product costs through the provide the answers for the calculations listed above. I work to arrive at answers, in the boxes provided.) Beginning of year $72,400 76,300 29,100 End of Year $ 73,000 62,200 55,700 323,000 32,000 124.000 262,300 297 200 penses Total amount for inventory reported on 20 Show work for "total inventory" calculatia Instructions: Use the T-accounts to show the flow of product costs through the general ledger and provide the answers for the calculations listed above. (Enter answers, and work to arrive at answers, in the boxes provided.) Beginning of year $72,400 76,300 29,100 Raw materials inventory Finished goods inventory Work-in-process inventory Production line workers' wages Janitor's wages at the plant Insurance on plant General and administrative expenses Income tax expense Purchases of raw materials Depreciation - copiers at corporate headquarters Interest expense Repairs and maintenance on the plant Depreciation - plant building and equipment Loss on the sale of an investment Marketing expenses Plant manager's salary Unrealized loss - Equity End of Year $ 73,000 62,200 55,700 323,000 32,000 124,000 262,300 297,200 526,600 25,000 110,000 82,000 185.000 41,200 216,000 95,600 40,000 NOTE: Five percent of the materials that were put into production were indirect materials. Accounting 2 E Wrap Text Merge & Center E $ %, Q4 Times New Roman 12 A A == 3 BIU A S x V x DE F CH18 Graded Written Homework Assignment G H Calculate th HNMA Show won Show work for Show wor Total amount fc Show work Instructions: Use the T-accounts to show the flow of product costs through the general ledger and provide the answers for the calculations listed above (Enter answers, and work to arrive at answers, in the boxes provided.) Beginning of year $72,400 76,300 29.100 NNS Raw materials inventory Finished goods inventory Work-in-process inventory Production line workers' wages Janitor's wages at the plant Insurance on plant General and administrative expenses Income tax expense Purchases of raw materials Depreciation - copiers at corporate headquarters Interest expense Repairs and maintenance on the plant Depreciation - plant building and equipment Sheet1 +

please show calcualtions and explantions and lables

please show calcualtions and explantions and lables