please show calculation formulas

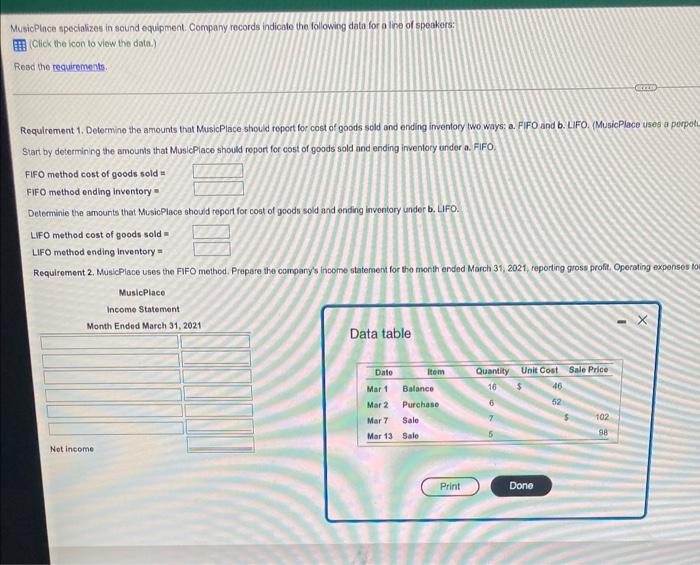

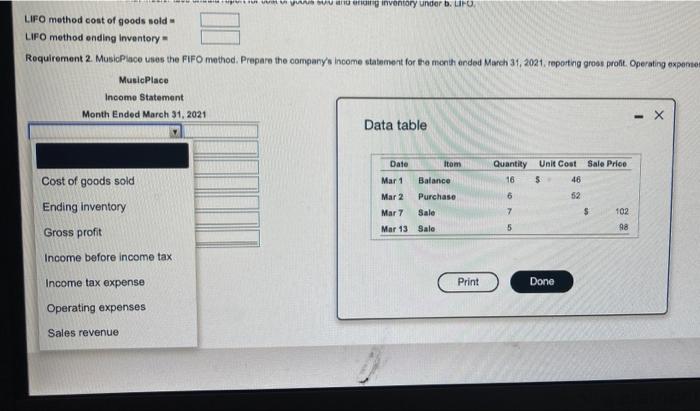

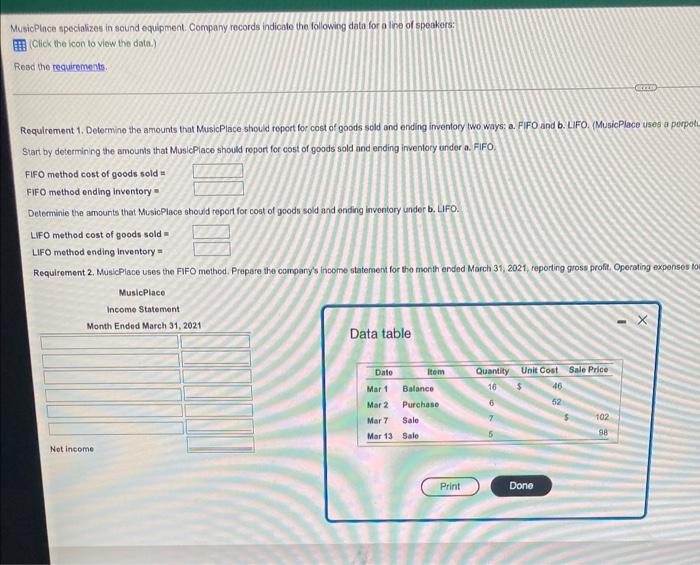

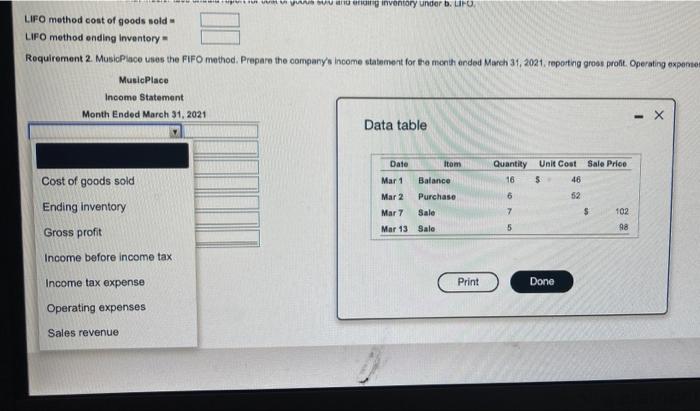

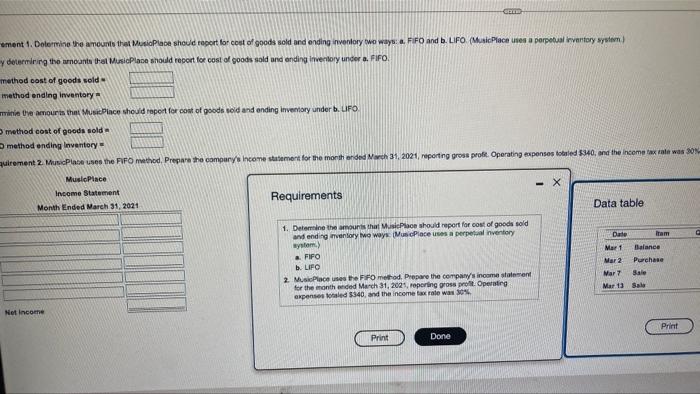

MusicPlace specializes in sound equipment. Company records indicate the following data for a line of speakers: (Click the icon to view the data.) Read the requirements. Stan Requirement 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two ways: a. FIFO and b. LIFO. (MusicPlace uses a perpetu Start by determining the amounts that MusicPlace should report for cost of goods sold and ending inventory under a. FIFO. FIFO method cost of goods sold FIFO method ending inventory = Determinie the amounts that MusicPlace should report for cost of goods sold and ending inventory under b. LIFO. LIFO method cost of goods sold LIFO method ending Inventory = Requirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses tow MusicPlace Income Statement Month Ended March 31, 2021 X Data table Quantity Unit Cost Sale Price Dato Mar 1 16 46 Mar 2 6 52 102 Mar 7 98 Mar 13 Not income Item Balance Purchase Sale Sale Print Done Fotwinys su and ending inventory under b. LIFO LIFO method cost of goods sold LIFO method ending Inventory Requirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses MusicPlace Income Statement Month Ended March 31, 2021 - X Data table Date Quantity Unit Cost Sale Price 16 5 46 6 52 7 102 5 98 Cost of goods sold Ending inventory Gross profit Income before income tax Income tax expense Operating expenses Sales revenue Mar 1 Mar 2 Mar 7 Mar 13 Itom Balance Purchase Sale Sale Print Done $ GOND ement 1. Determine the amounts that MusioPlace should report for cost of goods sold and ending inventory two ways: a. FIFO and b. LIFO (MusicPlace uses a perpetual inventory system) y determining the amounts thet MusicPlace should report for cost of goods sold and ending Inventory undera. FIFO. method cost of goods sold method ending inventory minie the amounts thet MusicPlace should report for cost of goods sold and ending inventory under b. LIFO O method cost of goods sold Omethod ending Inventory quirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses tobsled $340, and the income tax rate was 30% MusicPlace X Income Statement Requirements Month Ended March 31, 2021 Data table 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two ways: (MusoPlace uses a perpetual inventory system) Date O a FIFO b. LIFO 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses totaled $340, and the income tax rate was 30% Print Done Net Income Mar 1 Mar 2 Mar 7 Mar 13 fram Balance Purchase Sale Sala Print MusicPlace specializes in sound equipment. Company records indicate the following data for a line of speakers: (Click the icon to view the data.) Read the requirements. Stan Requirement 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two ways: a. FIFO and b. LIFO. (MusicPlace uses a perpetu Start by determining the amounts that MusicPlace should report for cost of goods sold and ending inventory under a. FIFO. FIFO method cost of goods sold FIFO method ending inventory = Determinie the amounts that MusicPlace should report for cost of goods sold and ending inventory under b. LIFO. LIFO method cost of goods sold LIFO method ending Inventory = Requirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses tow MusicPlace Income Statement Month Ended March 31, 2021 X Data table Quantity Unit Cost Sale Price Dato Mar 1 16 46 Mar 2 6 52 102 Mar 7 98 Mar 13 Not income Item Balance Purchase Sale Sale Print Done Fotwinys su and ending inventory under b. LIFO LIFO method cost of goods sold LIFO method ending Inventory Requirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses MusicPlace Income Statement Month Ended March 31, 2021 - X Data table Date Quantity Unit Cost Sale Price 16 5 46 6 52 7 102 5 98 Cost of goods sold Ending inventory Gross profit Income before income tax Income tax expense Operating expenses Sales revenue Mar 1 Mar 2 Mar 7 Mar 13 Itom Balance Purchase Sale Sale Print Done $ GOND ement 1. Determine the amounts that MusioPlace should report for cost of goods sold and ending inventory two ways: a. FIFO and b. LIFO (MusicPlace uses a perpetual inventory system) y determining the amounts thet MusicPlace should report for cost of goods sold and ending Inventory undera. FIFO. method cost of goods sold method ending inventory minie the amounts thet MusicPlace should report for cost of goods sold and ending inventory under b. LIFO O method cost of goods sold Omethod ending Inventory quirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses tobsled $340, and the income tax rate was 30% MusicPlace X Income Statement Requirements Month Ended March 31, 2021 Data table 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two ways: (MusoPlace uses a perpetual inventory system) Date O a FIFO b. LIFO 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses totaled $340, and the income tax rate was 30% Print Done Net Income Mar 1 Mar 2 Mar 7 Mar 13 fram Balance Purchase Sale Sala Print