Question

Please show calculations. 1) Compute sales growth %, COGS growth % and SGA growth % from the three companies below. 2) Prepare three scenarios: best,

Please show calculations.

1) Compute sales growth %, COGS growth % and SGA growth % from the three companies below. 2) Prepare three scenarios: best, worse and normal. For example, given that you have three sales growth numbers for each company, use the the lowest as the worse case, highest as the best case, and the average of all three as the normal case. Do the same for COGS growth and SGA growth. 3) Build the pro forma income statement, and balance sheet for next year. Assume the following: *Straight-Line depreciation is used *10% of the earnings are paid as dividend, the rest are retained *there is no need to buy any new equipment Use 1-3 to answer: How much of additional funds are required next year in the form of equity, to support business growth under best, worse and normal scenarios?

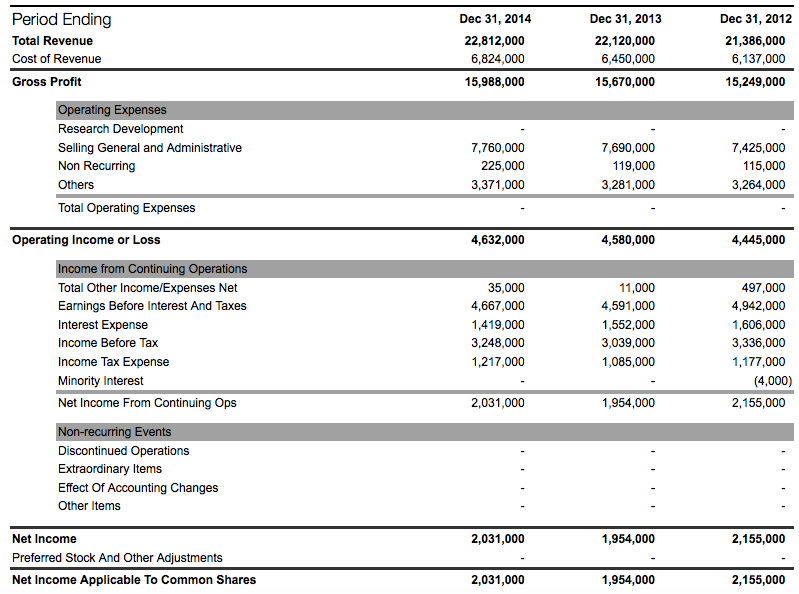

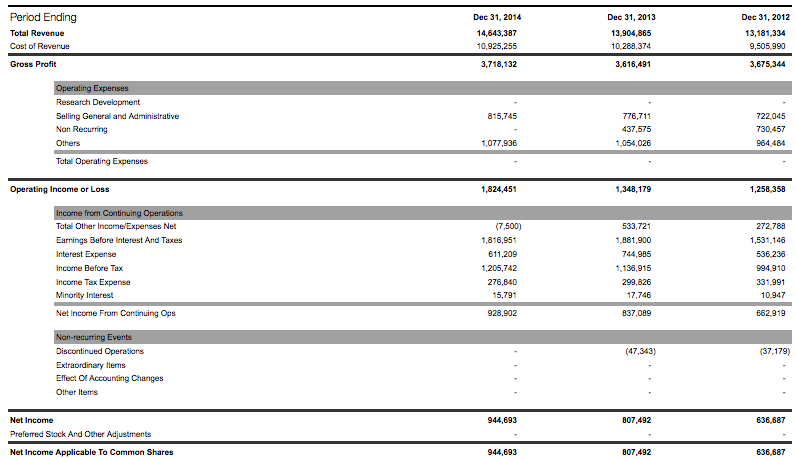

Company 1 Income Statement

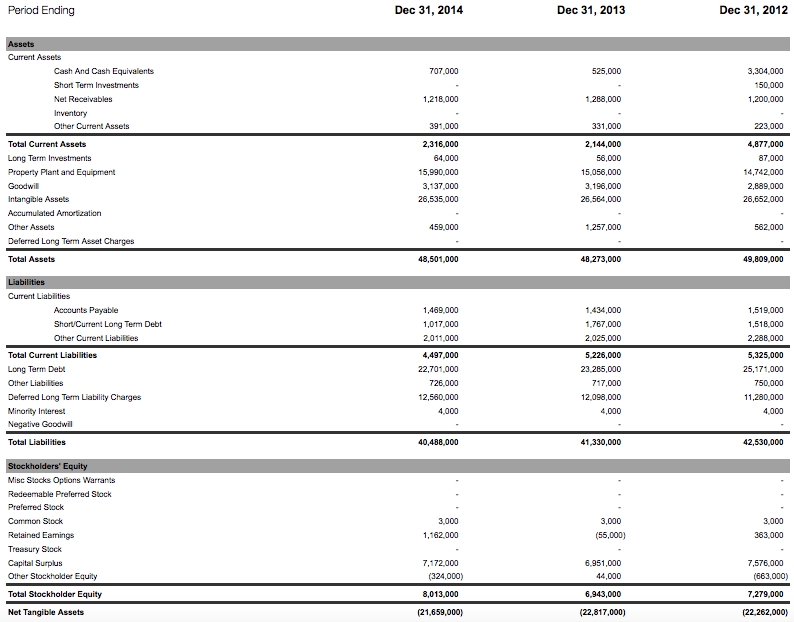

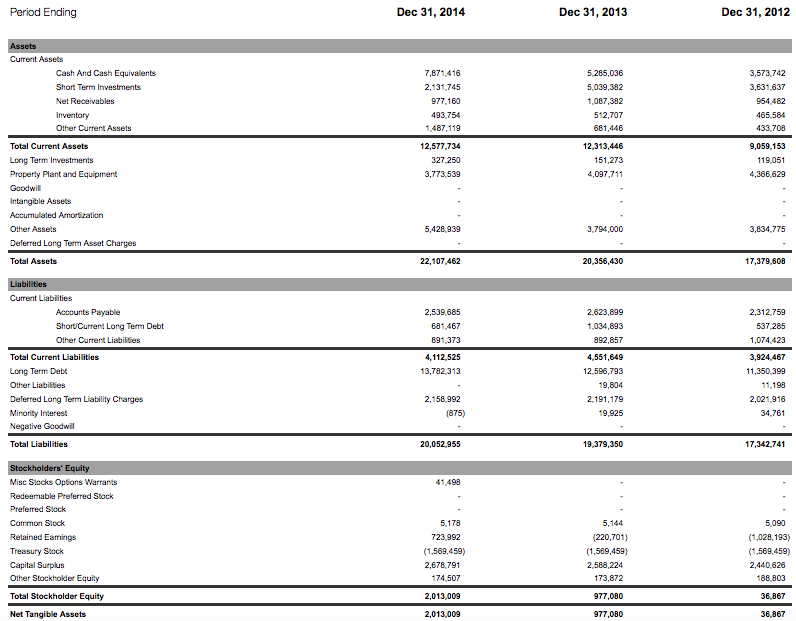

Company 1 Balance Sheet

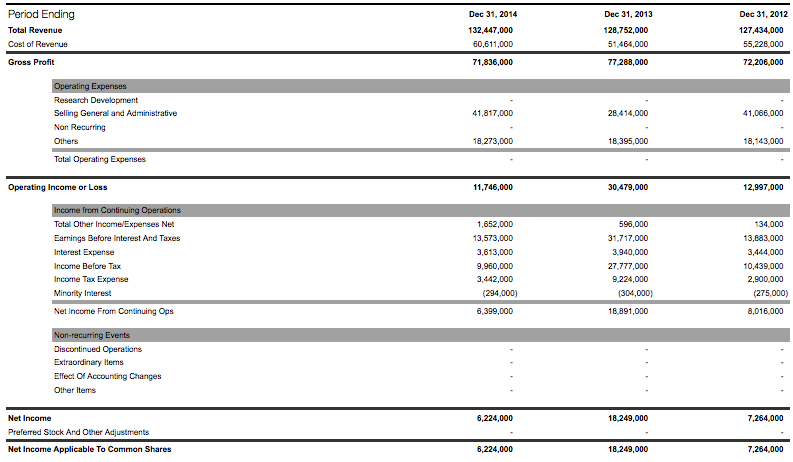

Company 2 Income Statement

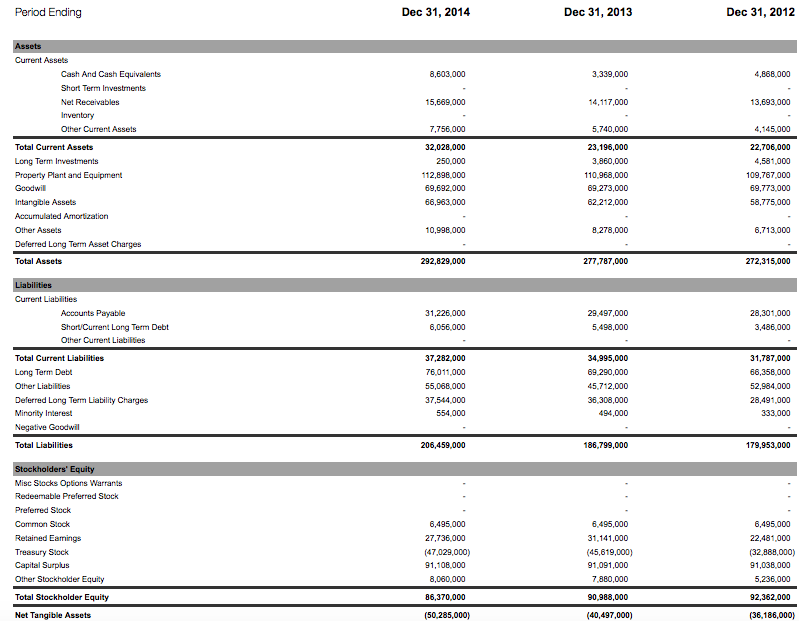

Company 2 Balance Sheet

Company 3 Income Statement

Company 3 Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started