Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show calculations 1. On January 1,2023 , the carwash partnership of Hugh and Jacobs was formed when the partners contributed $80,000 and $50,000 respectively.

Please show calculations

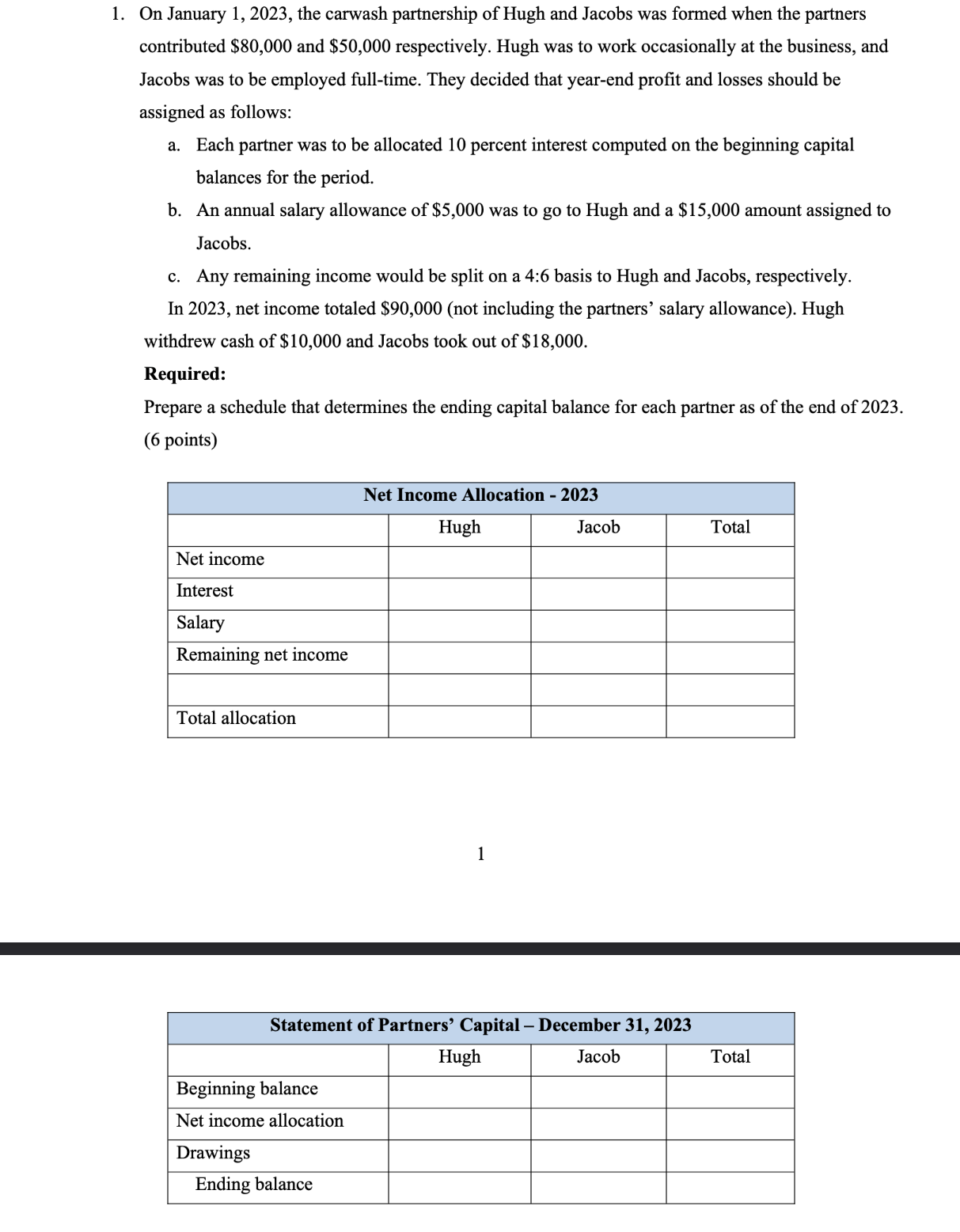

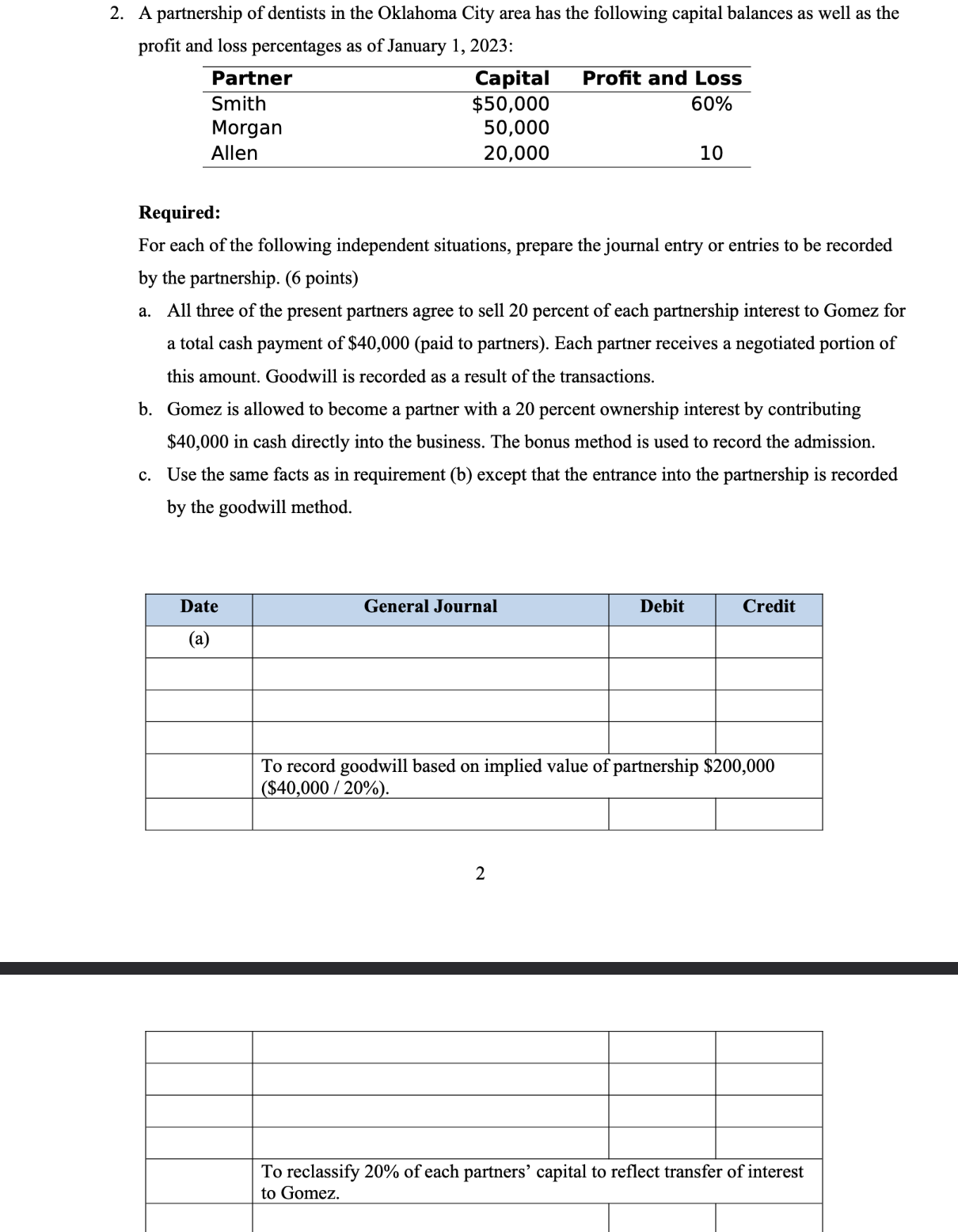

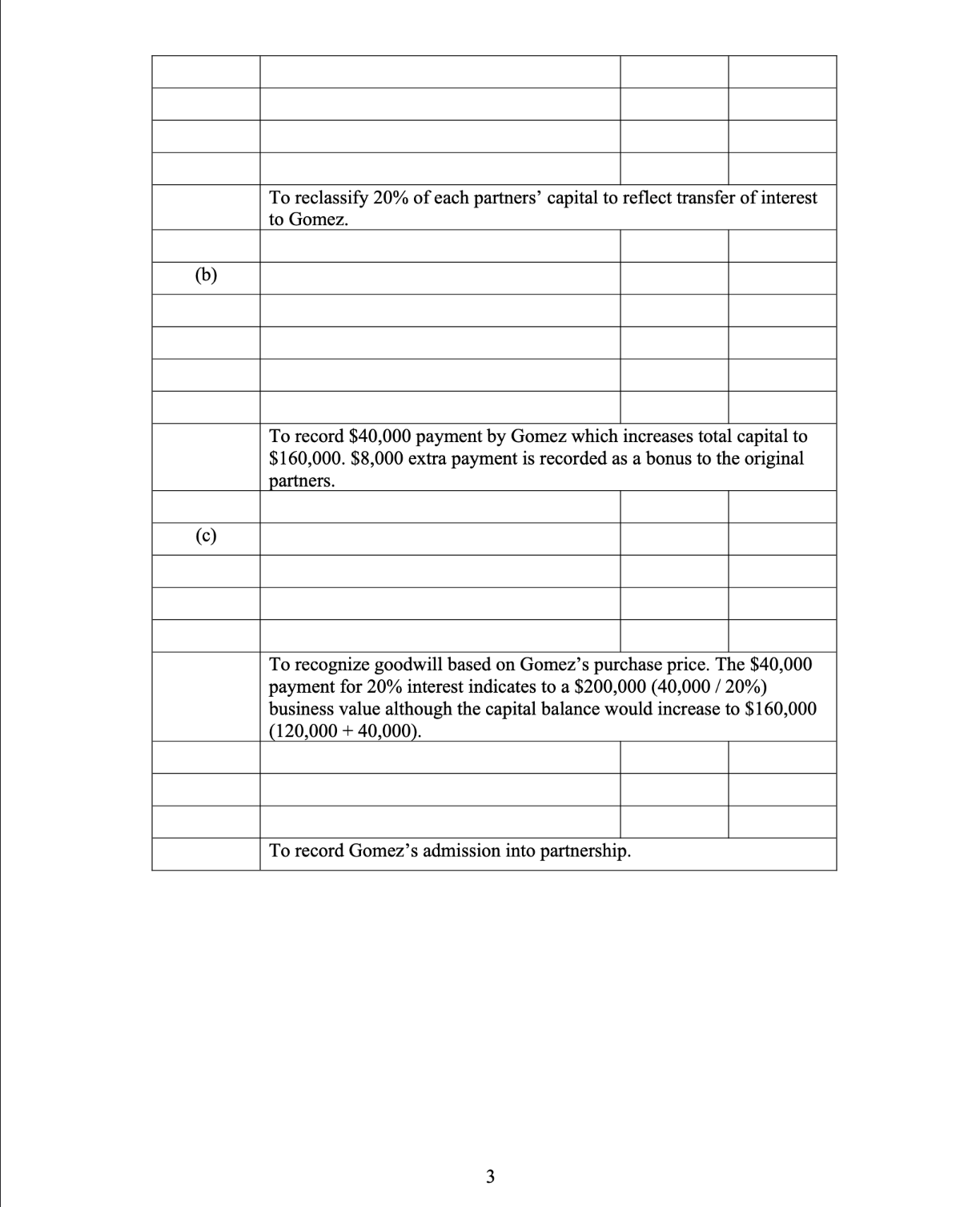

1. On January 1,2023 , the carwash partnership of Hugh and Jacobs was formed when the partners contributed $80,000 and $50,000 respectively. Hugh was to work occasionally at the business, and Jacobs was to be employed full-time. They decided that year-end profit and losses should be assigned as follows: a. Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period. b. An annual salary allowance of $5,000 was to go to Hugh and a $15,000 amount assigned to Jacobs. c. Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively. In 2023 , net income totaled $90,000 (not including the partners' salary allowance). Hugh withdrew cash of $10,000 and Jacobs took out of $18,000. Required: Prepare a schedule that determines the ending capital balance for each partner as of the end of 2023. (6 points) 2. A partnership of dentists in the Oklahoma City area has the following capital balances as well as the profit and loss percentages as of January 1, 2023: Required: For each of the following independent situations, prepare the journal entry or entries to be recorded by the partnership. (6 points) a. All three of the present partners agree to sell 20 percent of each partnership interest to Gomez for a total cash payment of $40,000 (paid to partners). Each partner receives a negotiated portion of this amount. Goodwill is recorded as a result of the transactions. b. Gomez is allowed to become a partner with a 20 percent ownership interest by contributing $40,000 in cash directly into the business. The bonus method is used to record the admission. c. Use the same facts as in requirement (b) except that the entrance into the partnership is recorded by the goodwill method. 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started