Answered step by step

Verified Expert Solution

Question

1 Approved Answer

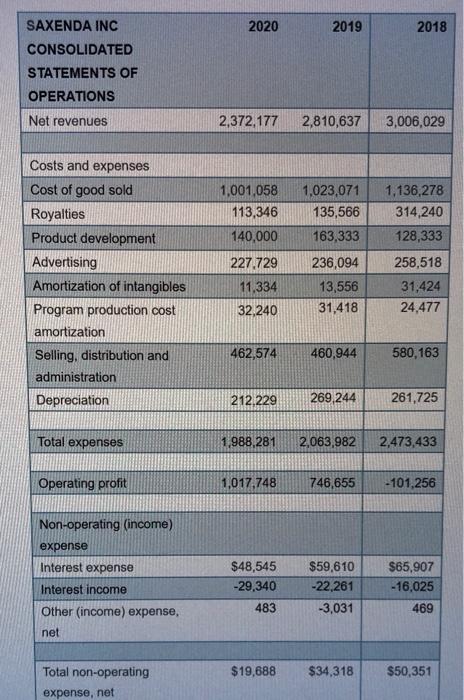

please show calculations and which formula you used to get the answers 2020 2019 2018 SAXENDA INC CONSOLIDATED STATEMENTS OF OPERATIONS Net revenues 2,372,177 2,810,637

please show calculations and which formula you used to get the answers

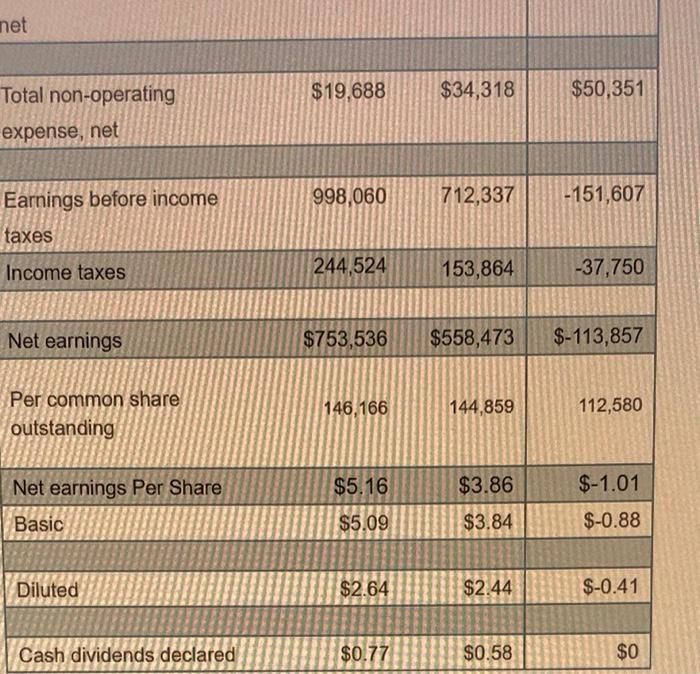

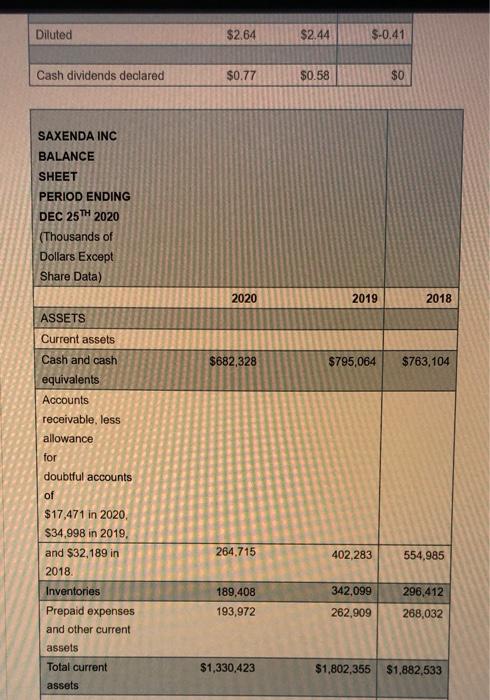

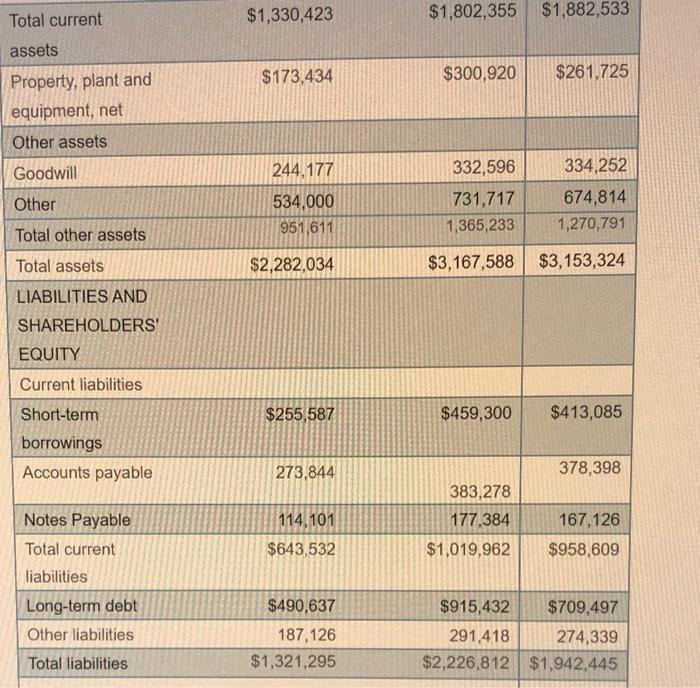

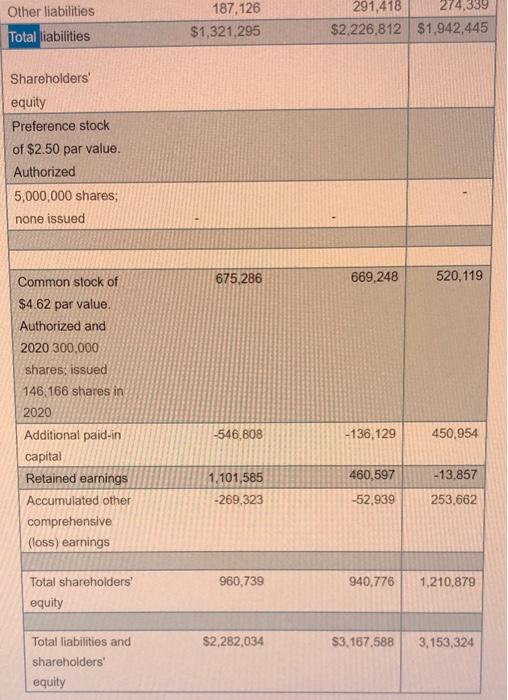

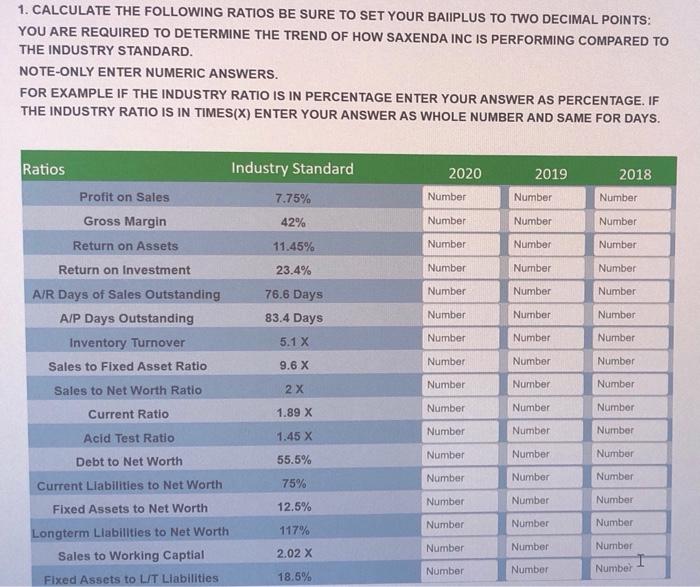

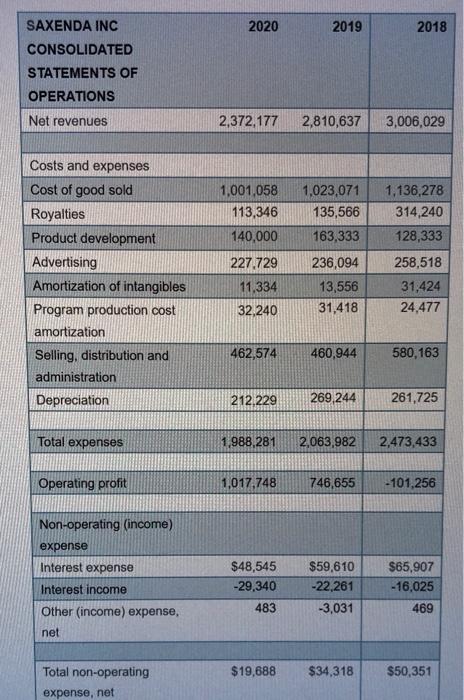

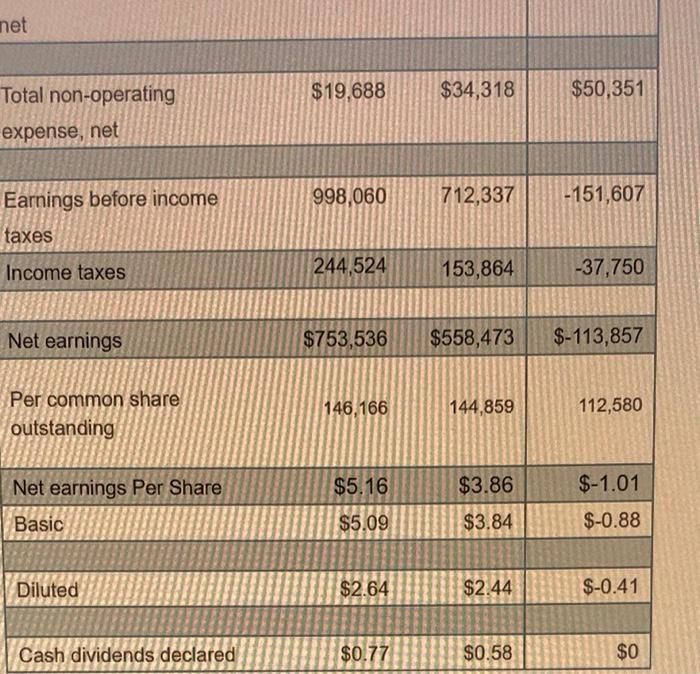

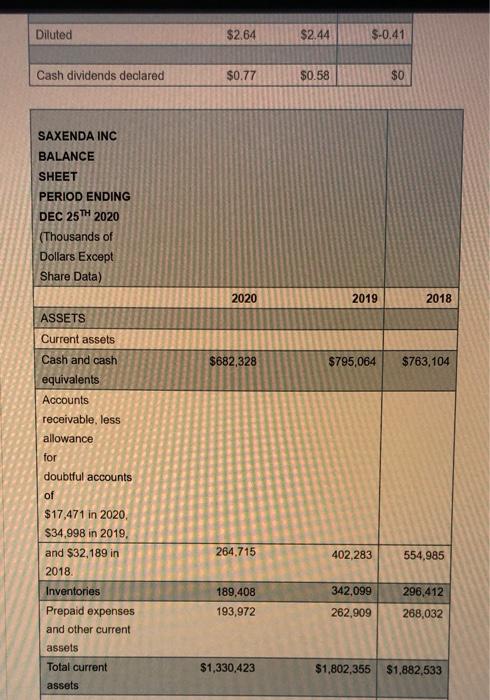

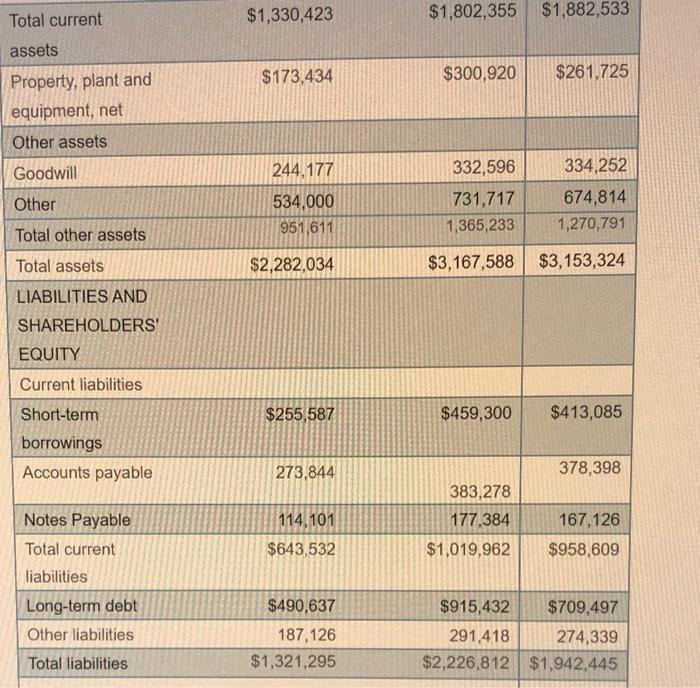

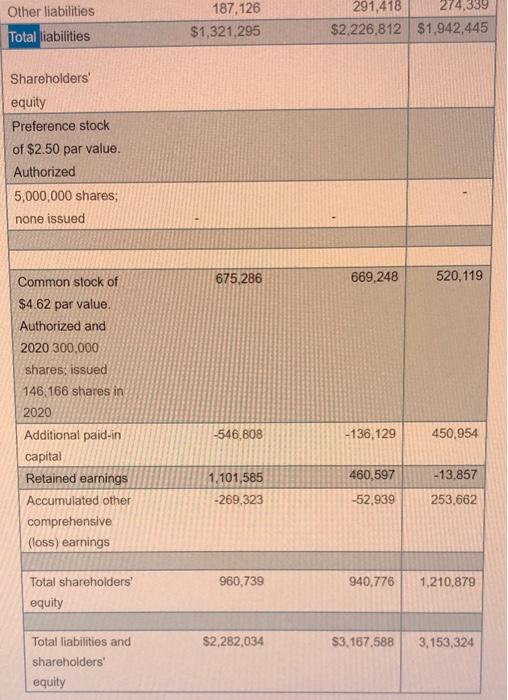

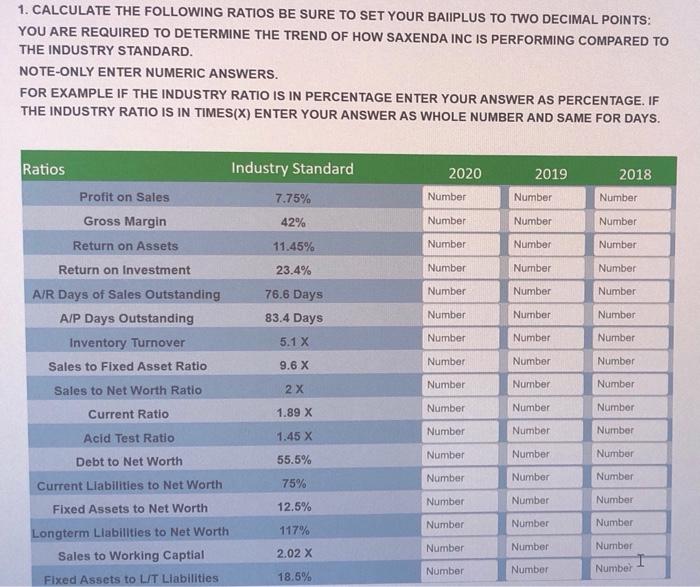

2020 2019 2018 SAXENDA INC CONSOLIDATED STATEMENTS OF OPERATIONS Net revenues 2,372,177 2,810,637 3,006,029 1,001,058 113,346 140,000 1,023,071 135,566 163,333 Costs and expenses Cost of good sold Royalties Product development Advertising Amortization of intangibles Program production cost amortization Selling, distribution and administration Depreciation 1,136,278 314,240 128,333 258,518 31,424 24,477 227.729 11,334 32,240 236,094 13,556 31,418 462,574 460,944 580,163 212,229 269,244 261,725 Total expenses 1,988,281 2,063,982 2,473,433 Operating profit 1,017,748 746,655 -101,256 Non-operating (income) expense Interest expense Interest income $48,545 -29,340 483 $59.610 -22,261 -3,031 $65.907 -16,025 469 Other (income) expense, net $19,688 $34,318 $50,351 Total non-operating expense, net net Total non-operating $19.688 $34,318 $50,351 expense, net Earnings before income 998,060 712,337 -151,607 taxes Income taxes 244,524 153,864 -37,750 Net earnings $753,536 $558,473 $-113,857 Per common share outstanding 146,166 144,859 112,580 $5.16 $3.86 $-1.01 Net earnings Per Share Basic $5.09 $3.84 $-0.88 Diluted $2.64 $2.44 $-0.41 Cash dividends declared $0.77 $0.58 $0 Diluted $2.64 $2.44 $-0.41 Cash dividends declared $0.77 $0.58 $0 SAXENDA INC BALANCE SHEET PERIOD ENDING DEC 25TH 2020 (Thousands of Dollars Except Share Data) 2020 2019 2018 $682,328 $795,064 $763,104 ASSETS Current assets Cash and cash equivalents Accounts receivable, less allowance for doubtful accounts of $17,471 in 2020, $34.998 in 2019, and $32,189 in 2018 264.715 402,283 554,985 189,408 193,972 342,099 262,909 296,412 268,032 Inventories Prepaid expenses and other current assets Total current assets $1,330,423 $1,802,355 $1,882,533 Other liabilities Total liabilities 187,126 $1,321,295 291,418 274,339 $2,226,812 $1.942,445 Shareholders' equity Preference stock of $2.50 par value. Authorized 5,000,000 shares; none issued 675,286 669,248 520,119 Common stock of $4.62 par value. Authorized and 2020 300.000 shares; issued 146,166 shares in 2020 -546,808 -136,129 450,954 460,597 -13.857 Additional paid-in capital Retained earnings Accumulated other comprehensive (loss) earnings 1.101,585 -269,323 -52,939 253,662 960,739 940,776 1,210,879 Total shareholders equity $2,282,034 $3,167,588 3,153,324 Total liabilities and shareholders' equity 1. CALCULATE THE FOLLOWING RATIOS BE SURE TO SET YOUR BAUPLUS TO TWO DECIMAL POINTS: YOU ARE REQUIRED TO DETERMINE THE TREND OF HOW SAXENDA INC IS PERFORMING COMPARED TO THE INDUSTRY STANDARD. NOTE-ONLY ENTER NUMERIC ANSWERS. FOR EXAMPLE IF THE INDUSTRY RATIO IS IN PERCENTAGE ENTER YOUR ANSWER AS PERCENTAGE. IF THE INDUSTRY RATIO IS IN TIMES(X) ENTER YOUR ANSWER AS WHOLE NUMBER AND SAME FOR DAYS. Ratios Industry Standard 2019 2018 Profit on Sales 7.75% 2020 Number Number Number Number Gross Margin 42% Number Number Return on Assets 11.45% Number Number Number 23.4% Number Number Number Number Number Number 76.6 Days 83.4 Days Number Number Number Return on Investment AIR Days of Sales Outstanding A/P Days Outstanding Inventory Turnover Sales to Fixed Asset Ratio Sales to Net Worth Ratio Current Ratio 5.1 X Number Number Number Number Number 9.6 X Number 2 x Number Number Number 1.89 X Number Number Number Number Number 1.45 X Number Acid Test Ratio Number Number Number Debt to Net Worth 55.5% Number Number Number 75% Current Liabilities to Net Worth Fixed Assets to Net Worth Number Number Number 12.5% Number Number Number 117% Number Number Number Longterm Liabilities to Net Worth Sales to Working Captial Fixed Assets to LT Liabilities 2.02 X Number Number Number 18.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started