Question

Please show calculations in Excel, how did you get these answers? Nikki started by talking with her parents about some of the estimated sales and

Please show calculations in Excel, how did you get these answers?

| Nikki started by talking with her parents about some of the estimated sales and costs that they thought would incur for the month of September. Here are some of those estimates: Total | Apple Pies | Caramel Apples | |

| Sales price (per unit) | $25.00 | $8.50 | |

| Expected sales units (for September) | 17,000 | 7,500 | 9,500 |

| Expected Manufacturing costs: | Total | Apple Pies | Caramel Apples |

| Fixed OH (per month) | $21,900.00 | $17,625.00 | $4,275.00 |

| Direct labor (per unit) | $3.75 | $2.10 | |

| Direct materials (per unit) | $3.00 | $2.00 | |

| Variable OH (per unit) | $2.25 | $0.90 | |

| Expected Marketing and admin costs: | |||

| Fixed costs (per month) | $6,675.00 | $5,250.00 | $1,425.00 |

| Variable costs (per unit) | $1.45 | $0.35 |

Additionally, Sally informed her that the farm received a special order to sell their apple pies and caramel apples at the local county fair in September. Sally wanted to sell 3,500 pies and 4,500 caramel apples for a discounted price of $20.00 and $7.50, respectively. With, the number of staff and the size of the bakery, Nikki determined that the maximum capacity for the bakery is 3,800 labor hours a month. At the current projected sale amounts she expects that theyll need 3,205 hours to meet their regular sales volume. After review of the salaries of all the staff, Nikki determined that the average hourly wage was $15.00.

Ned was also concerned about how much it cost to keep apple pie inventory on hand at the end of the month, caramel apples should be sold within a couple days, so no inventory is left at the end of the month. Since there is a limited shelf life for the apple pies, Ned and Sally try and keep the ending inventories in line with next months expectations. They estimated that theyd have to start 8,000 apple pies in order to have 1,000 apple pies in-process at the end of the month and 500 finished pies. At the end of August there were 500 pies that were in-process and no finished pies.

| The variable costs associated with these inventories were as follows: DM | Conversion | |

| Beginning WIP inventory | $1,675 | $3,500 |

| September costs | $20,000 | $38,500 |

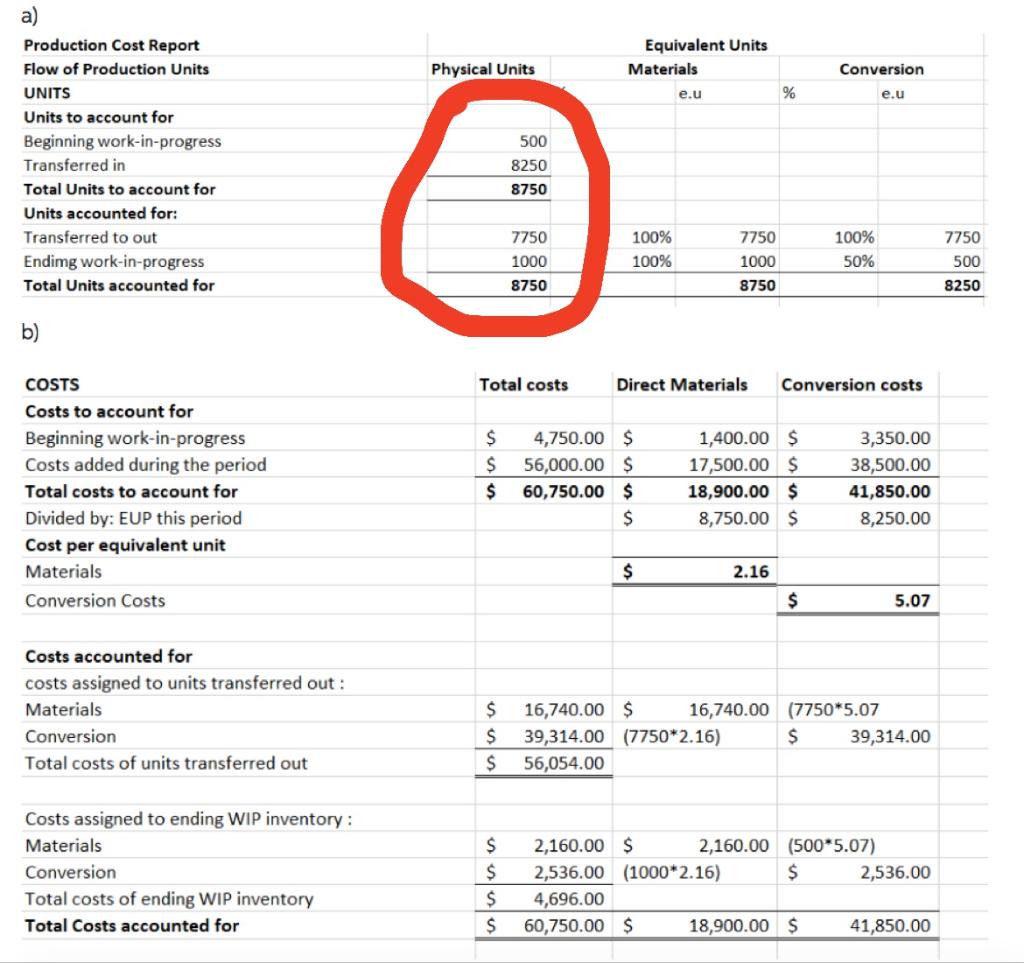

a) Production Cost Report Flow of Production Units UNITS Units to account for Beginning work-in-progress Transferred in Total Units to account for Units accounted for: Transferred to out Endimg work-in-progress Total Units accounted for b) COSTS Costs to account for Beginning work-in-progress Costs added during the period Total costs to account for Divided by: EUP this period Cost per equivalent unit Materials Conversion Costs Costs accounted for costs assigned to units transferred out : Materials Conversion Total costs of units transferred out Costs assigned to ending WIP inventory: Materials Conversion Total costs of ending WIP inventory Total Costs accounted for Physical Units 500 8250 8750 7750 1000 8750 Total costs $ $ $ $ $ $ $ $ $ $ Equivalent Units Materials e.u 100% 100% Direct Materials 7750 1000 8750 4,750.00 $ 56,000.00 $ 60,750.00 $ $ $ 16,740.00 $ 39,314.00 (7750*2.16) 56,054.00 2,160.00 $ 2,536.00 (1000*2.16) 4,696.00 60,750.00 $ % Conversion e.u 100% 50% Conversion costs 3,350.00 38,500.00 41,850.00 8,250.00 5.07 1,400.00 $ 17,500.00 $ 18,900.00 $ 8,750.00 $ 2.16 $ 16,740.00 (7750*5.07 $ 2,160.00 (500*5.07) $ 18,900.00 $ 39,314.00 2,536.00 41,850.00 7750 500 8250 a) Production Cost Report Flow of Production Units UNITS Units to account for Beginning work-in-progress Transferred in Total Units to account for Units accounted for: Transferred to out Endimg work-in-progress Total Units accounted for b) COSTS Costs to account for Beginning work-in-progress Costs added during the period Total costs to account for Divided by: EUP this period Cost per equivalent unit Materials Conversion Costs Costs accounted for costs assigned to units transferred out : Materials Conversion Total costs of units transferred out Costs assigned to ending WIP inventory: Materials Conversion Total costs of ending WIP inventory Total Costs accounted for Physical Units 500 8250 8750 7750 1000 8750 Total costs $ $ $ $ $ $ $ $ $ $ Equivalent Units Materials e.u 100% 100% Direct Materials 7750 1000 8750 4,750.00 $ 56,000.00 $ 60,750.00 $ $ $ 16,740.00 $ 39,314.00 (7750*2.16) 56,054.00 2,160.00 $ 2,536.00 (1000*2.16) 4,696.00 60,750.00 $ % Conversion e.u 100% 50% Conversion costs 3,350.00 38,500.00 41,850.00 8,250.00 5.07 1,400.00 $ 17,500.00 $ 18,900.00 $ 8,750.00 $ 2.16 $ 16,740.00 (7750*5.07 $ 2,160.00 (500*5.07) $ 18,900.00 $ 39,314.00 2,536.00 41,850.00 7750 500 8250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started