Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show calculations in excel You may answer these problems using Excel. Please upload your finished Excel file on Canvas. Problem 1 You have decided

Please show calculations in excel

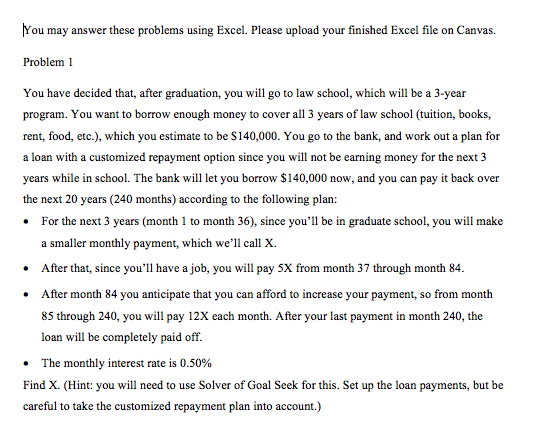

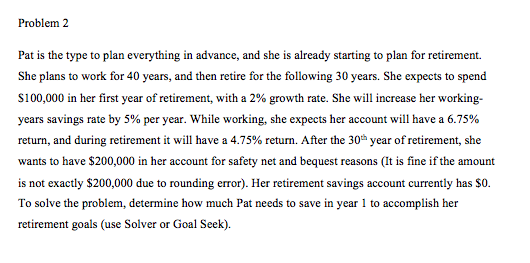

You may answer these problems using Excel. Please upload your finished Excel file on Canvas. Problem 1 You have decided that, after graduation, you will go to law school, which will be a 3-year program. You want to borrow enough money to cover all 3 years of law school (tuition, books, rent, food, etc.), which you estimate to be $140,000. You go to the bank, and work out a plan for a loan with a customized repayment option since you will not be earning money for the next 3 years while in school. The bank will let you borrow $140,000 now, and you can pay it back over the next 20 years (240 months) according to the following plan: For the next 3 years (month 1 to month 36), since you'll be in graduate school, you will make a smaller monthly payment, which we'll call X. After that, since you'll have a job, you will pay 5X from month 37 through month 84. After month 84 you anticipate that you can afford to increase your payment, so from month 85 through 240, you will pay 12X each month. After your last payment in month 240, the loan will be completely paid off. The monthly interest rate is 0.50% Find X. (Hint: you will need to use Solver of Goal Seek for this. Set up the loan payments, but be careful to take the customized repayment plan into account.) Problem 2 Pat is the type to plan everything in advance, and she is already starting to plan for retirement. She plans to work for 40 years, and then retire for the following 30 years. She expects to spend $100,000 in her first year of retirement, with a 2% growth rate. She will increase her working years savings rate by 5% per year. While working, she expects her account will have a 6.75% return, and during retirement it will have a 4.75% return. After the 30 year of retirement, she wants to have $200,000 in her account for safety net and bequest reasons (It is fine if the amount is not exactly $200,000 due to rounding error). Her retirement savings account currently has $0. To solve the problem, determine how much Pat needs to save in year 1 to accomplish her retirement goals (use Solver or Goal Seek)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started