Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show calculations Income tax expense indented when amount is entered. Do not indent manually. If no entry is required, select No Entry for the

please show calculations Income tax expense

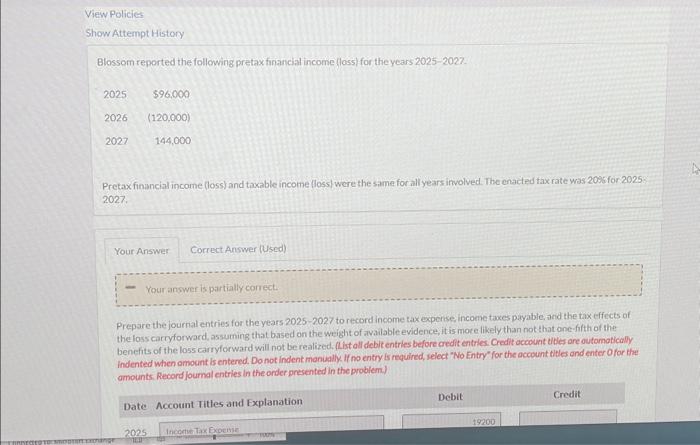

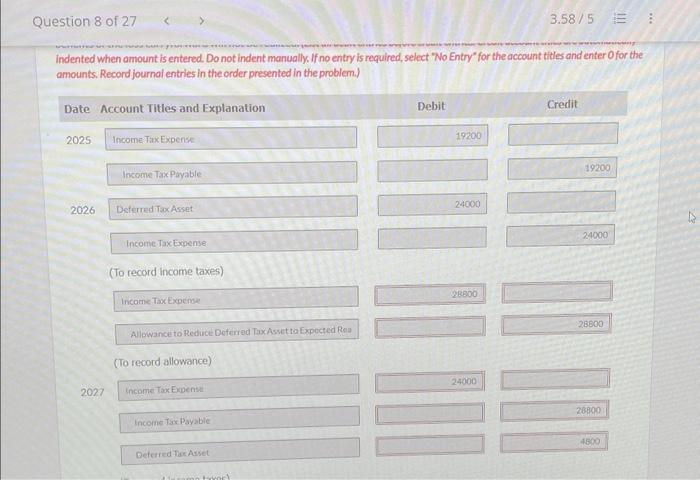

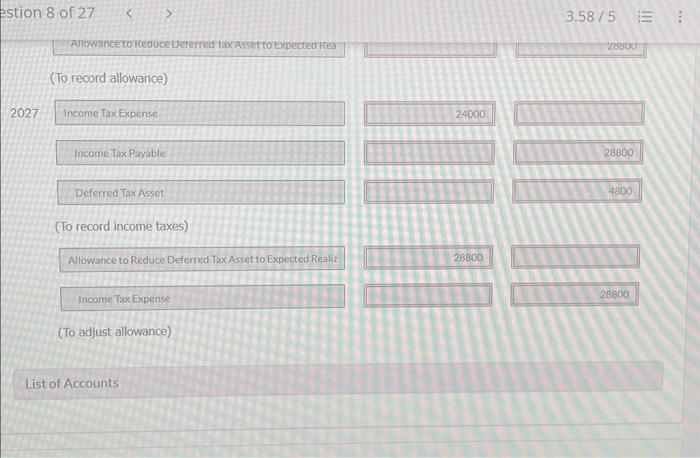

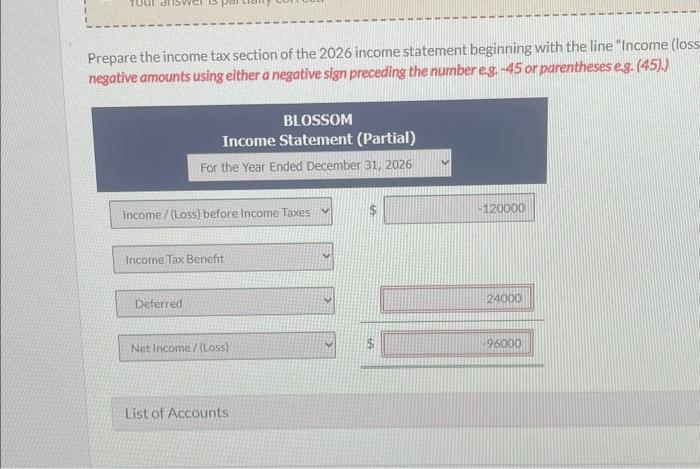

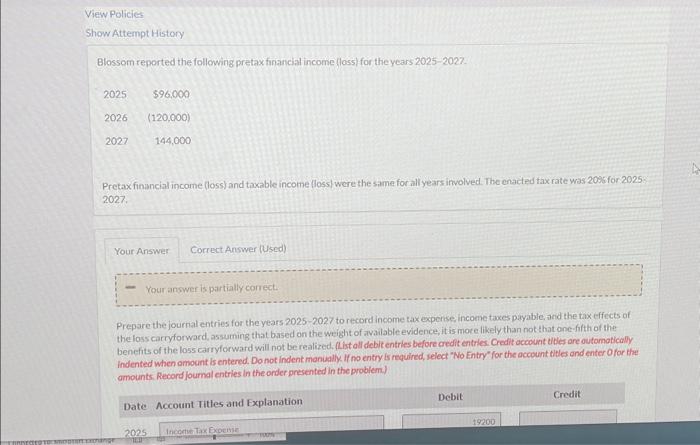

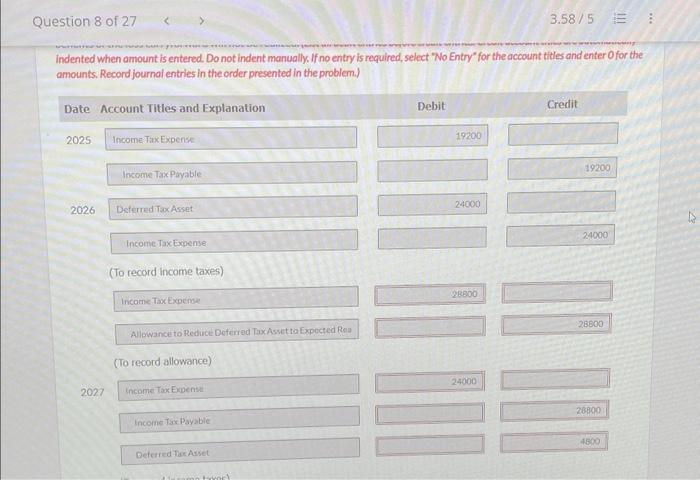

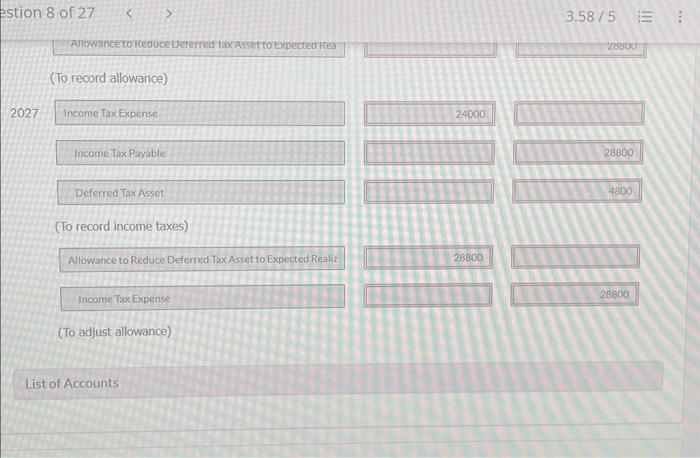

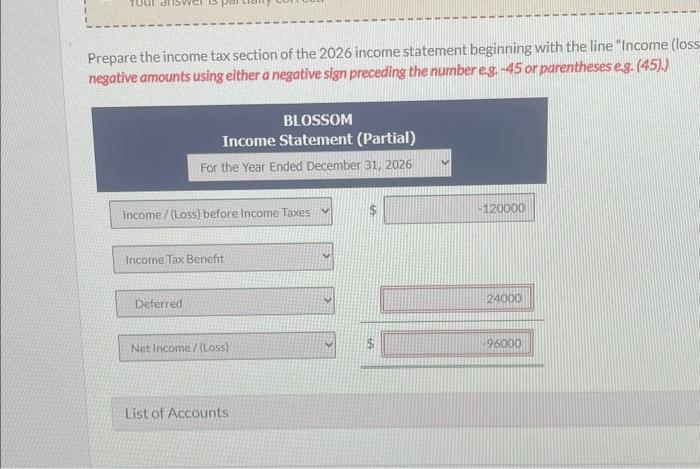

indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter Ofor the amounts. Record journal entries in the order presented in the problem.) Blossom reported the following pretax financial income (loss) for the years 2025-2027. Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The enacted tax rate was 2095 for 2025 : 2027. Your anower is partially correct. Prepare the journal entries for the years \\( 2025-2027 \\) to record income tax experise, income taxes payable, and the tax effects of the loss carryforward, assuming that based on the weight of avalable evidence, it is more likely than not that one-filth of the benefits of the loss carryforward will not be realized, (List all debit entries before credit entries Credit account ubles are outamotically indented when omount is entered. Do not indent manually. If mo entry is required, select \"No Entry\" for the account tilles and enter Ofor the gmounts. Record joumal entries in the onder presented in the problem) estion 8 of 27 Allowanceto keduce Deferred tax Asset to Expected kea \\( 3.58 / 5 ; \\equiv \\quad \\vdots \\) (To record allowance) 2027 Income Tax Expense Income Tax Payable Deferred Tax Asset. (To record income taxes) Allowance to Reduce Deferred Tax Asset to Expected Realiz Income Tax Expense (To adjust allowance) List of Accounts Prepare the income tax section of the 2026 income statement beginning with the line \"Income (loss negative amounts using either a negative sign preceding the number eg, -45 or parentheses eg. (45).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started