Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW CALCULATIONS PLEASE ! SHOW WORK ! THERE ARE 2 REQUIREMENTS PLEASE ANSWER BOTH! Pritchet Computer Company is considering purchasing two different types of

PLEASE SHOW CALCULATIONS PLEASE !

SHOW WORK ! THERE ARE 2 REQUIREMENTS PLEASE ANSWER BOTH!

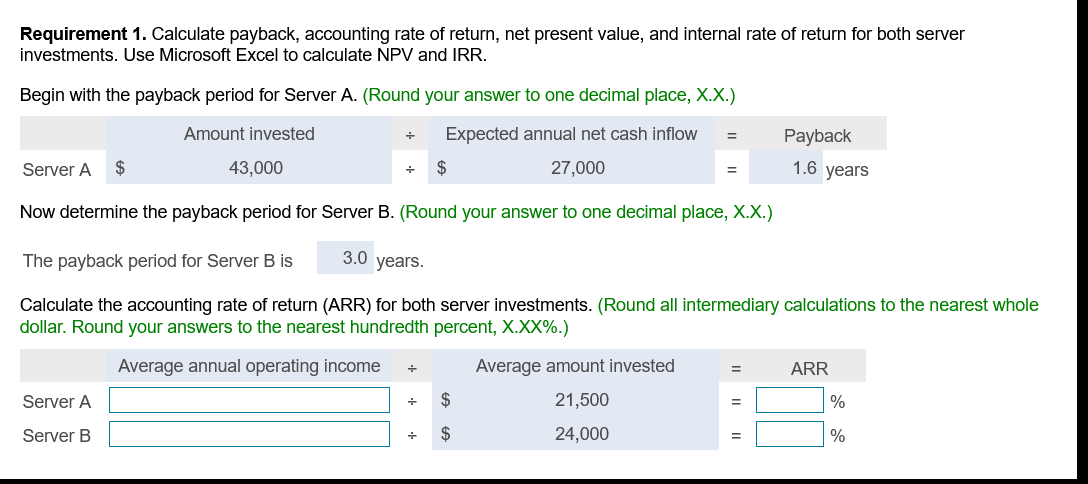

Pritchet Computer Company is considering purchasing two different types of servers. Server A will generate net cash inflows of $27,000 per year and have a zero residual value. Server A's estimated useful life is three years, and it costs $43,000. Server B will generate net cash inflows of $29,000 in year 1,$10,000 in year 2 , and $4,000 in year 3 . Server B has a $5,000 residua value and an estimated useful life of three years. Server B also costs $43,000. Pritchet Computer Company's required rate of return is 16%. Read the requirements. \begin{tabular}{l|l|l|l|l} \hline \begin{tabular}{l} Req \\ inves \end{tabular} & Requirements & or both server \\ Begi & \begin{tabular}{l} 1. Calculate payback, accounting rate of return, net present value, and internal \\ rate of return for both server investments. Use Microsoft Excel to calculate \\ NPV and IRR. \end{tabular} & 2. Assuming capital rationing applies, which server should Pritchet Computer \\ Company invest in? \end{tabular} Requirement 1. Calculate payback, accounting rate of return, net present value, and internal rate of return for both server investments. Use Microsoft Excel to calculate NPV and IRR. Begin with the payback period for Server A. (Round your answer to one decimal place, X.X.) Now determine the payback period for Server B. (Round your answer to one decimal place, X.X.) The payback period for Server B is years. Calculate the accounting rate of return (ARR) for both server investments. (Round all intermediary calculations to the nearest whole dollar. Round your answers to the nearest hundredth percent, X.XX\%.)

Pritchet Computer Company is considering purchasing two different types of servers. Server A will generate net cash inflows of $27,000 per year and have a zero residual value. Server A's estimated useful life is three years, and it costs $43,000. Server B will generate net cash inflows of $29,000 in year 1,$10,000 in year 2 , and $4,000 in year 3 . Server B has a $5,000 residua value and an estimated useful life of three years. Server B also costs $43,000. Pritchet Computer Company's required rate of return is 16%. Read the requirements. \begin{tabular}{l|l|l|l|l} \hline \begin{tabular}{l} Req \\ inves \end{tabular} & Requirements & or both server \\ Begi & \begin{tabular}{l} 1. Calculate payback, accounting rate of return, net present value, and internal \\ rate of return for both server investments. Use Microsoft Excel to calculate \\ NPV and IRR. \end{tabular} & 2. Assuming capital rationing applies, which server should Pritchet Computer \\ Company invest in? \end{tabular} Requirement 1. Calculate payback, accounting rate of return, net present value, and internal rate of return for both server investments. Use Microsoft Excel to calculate NPV and IRR. Begin with the payback period for Server A. (Round your answer to one decimal place, X.X.) Now determine the payback period for Server B. (Round your answer to one decimal place, X.X.) The payback period for Server B is years. Calculate the accounting rate of return (ARR) for both server investments. (Round all intermediary calculations to the nearest whole dollar. Round your answers to the nearest hundredth percent, X.XX\%.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started