Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show calculations TAW Partnership is owned 40% by Selena, 20% by Sawyer, and 40% by Tucker Beckman, Inc. is owned 50% by TAW Partnership,

Please show calculations

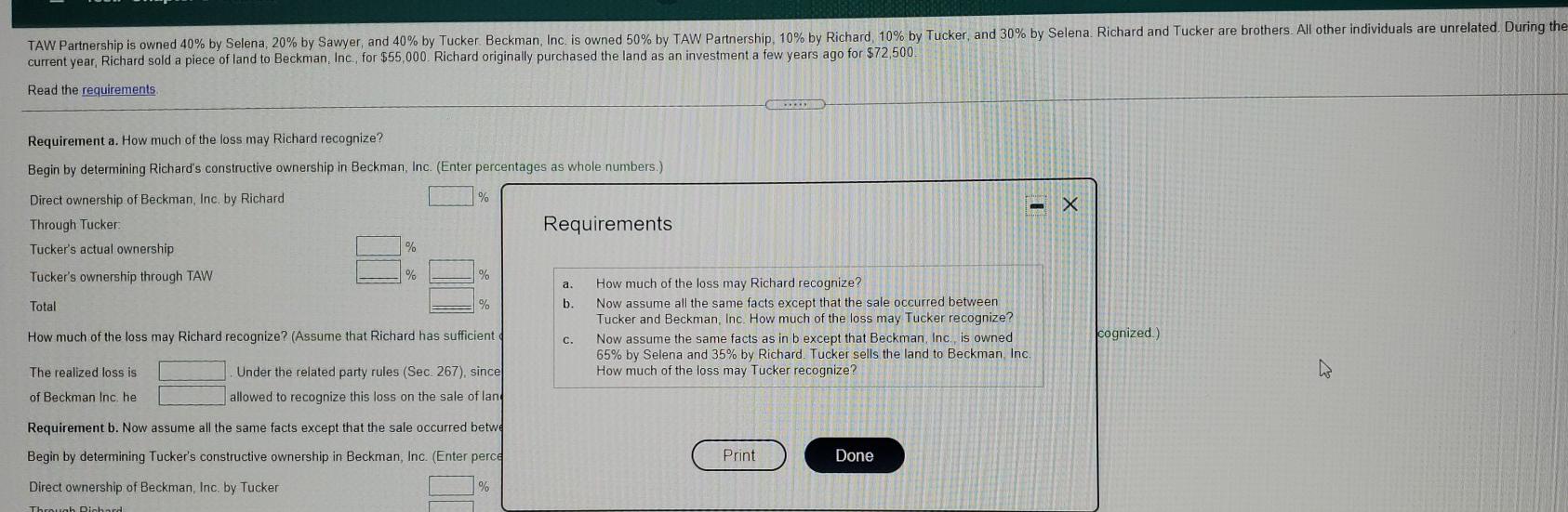

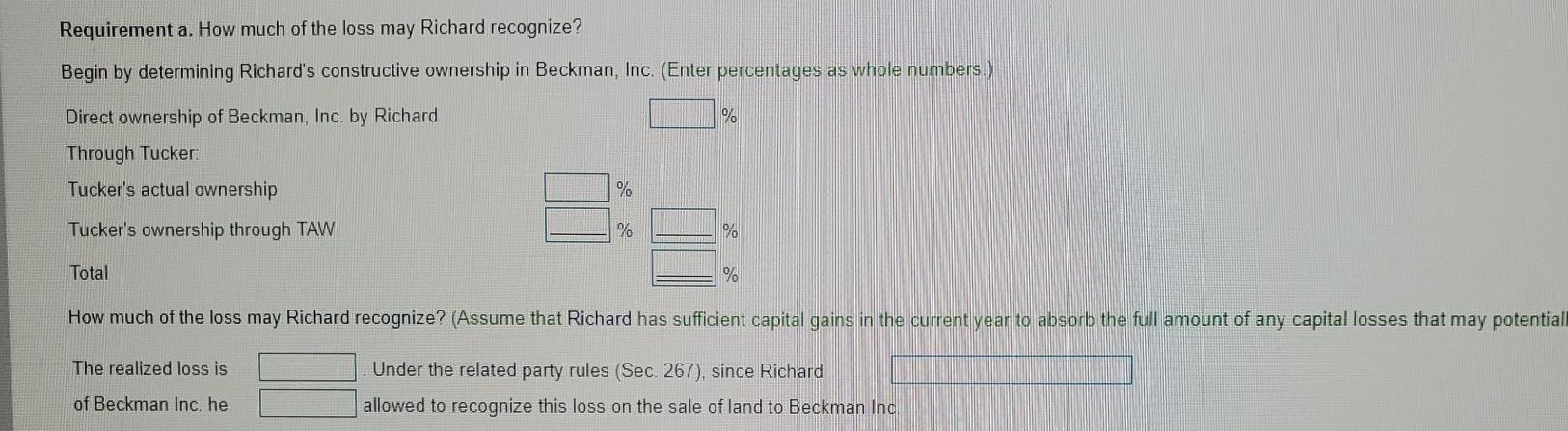

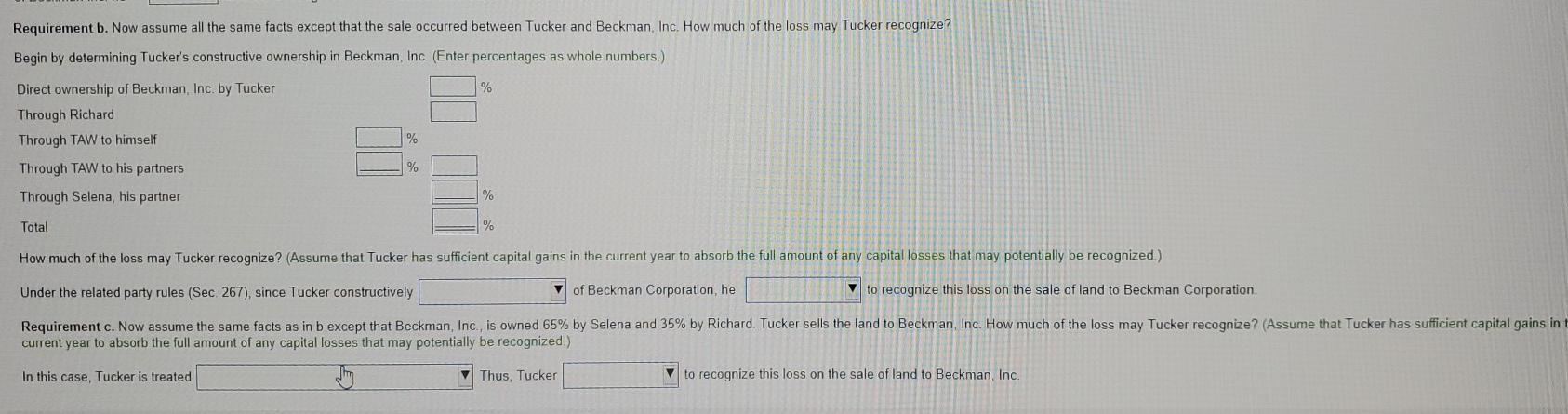

TAW Partnership is owned 40% by Selena, 20% by Sawyer, and 40% by Tucker Beckman, Inc. is owned 50% by TAW Partnership, 10% by Richard, 10% by Tucker, and 30% by Selena Richard and Tucker are brothers. All other individuals are unrelated During the current year, Richard sold a piece of land to Beckman, Inc., for $55,000 Richard originally purchased the land as an investment a few years ago for $72,500 Read the requirements Requirement a. How much of the loss may Richard recognize? Begin by determining Richard's constructive ownership in Beckman, Inc. (Enter percentages as whole numbers.) Direct ownership of Beckman, Inc. by Richard % - X Through Tucker Requirements Tucker's actual ownership % Tucker's ownership through TAW % % How much of the loss may Richard recognize? Total % b. Now assume all the same facts except that the sale occurred between Tucker and Beckman, Inc. How much of the loss may Tucker recognize? How much of the loss may Richard recognize? (Assume that Richard has sufficient C. Now assume the same facts as in b except that Beckman, Inc. is owned 65% by Selena and 35% by Richard. Tucker sells the land to Beckman, Inc. The realized loss is Under the related party rules (Sec. 267), since How much of the loss may Tucker recognize? of Beckman Inc, he allowed to recognize this loss on the sale of lan a. cognized.) Requirement b. Now assume all the same facts except that the sale occurred betwe Begin by determining Tucker's constructive ownership in Beckman, Inc. (Enter perce Print Done Direct ownership of Beckman, Inc. by Tucker % Through Richard Requirement a. How much of the loss may Richard recognize? Begin by determining Richard's constructive ownership in Beckman, Inc. (Enter percentages as whole numbers.) % Direct ownership of Beckman, Inc. by Richard Through Tucker Tucker's actual ownership % Tucker's ownership through TAW % % Total % How much of the loss may Richard recognize? (Assume that Richard has sufficient capital gains in the current year to absorb the full amount of any capital losses that may potential The realized loss is Under the related party rules (Sec. 267), since Richard allowed to recognize this loss on the sale of land to Beckman Inc of Beckman Inc. he % Requirement b. Now assume all the same facts except that the sale occurred between Tucker and Beckman, Inc. How much of the loss may Tucker recognize? Begin by determining Tucker's constructive ownership in Beckman, Inc. (Enter percentages as whole numbers.) Direct ownership of Beckman, Inc. by Tucker Through Richard Through TAW to himself % Through TAW to his partners Through Selena, his partner % Total How much of the loss may Tucker recognize? (Assume that Tucker has sufficient capital gains in the current year to absorb the full amount of any capital losses that may potentially be recognized) Under the related party rules (Sec 267), since Tucker constructively of Beckman Corporation, he to recognize this loss on the sale of land to Beckman Corporation Requirement c. Now assume the same facts as in b except that Beckman, Inc., is owned 65% by Selena and 35% by Richard Tucker sells the land to Beckman, Inc. How much of the loss may Tucker recognize? (Assume that Tucker has sufficient capital gains in current year to absorb the full amount of any capital losses that may potentially be recognized.) In this case, Tucker is treated Thus, Tucker V to recognize this loss on the sale of land to Beckman, Inc. TAW Partnership is owned 40% by Selena, 20% by Sawyer, and 40% by Tucker Beckman, Inc. is owned 50% by TAW Partnership, 10% by Richard, 10% by Tucker, and 30% by Selena Richard and Tucker are brothers. All other individuals are unrelated During the current year, Richard sold a piece of land to Beckman, Inc., for $55,000 Richard originally purchased the land as an investment a few years ago for $72,500 Read the requirements Requirement a. How much of the loss may Richard recognize? Begin by determining Richard's constructive ownership in Beckman, Inc. (Enter percentages as whole numbers.) Direct ownership of Beckman, Inc. by Richard % - X Through Tucker Requirements Tucker's actual ownership % Tucker's ownership through TAW % % How much of the loss may Richard recognize? Total % b. Now assume all the same facts except that the sale occurred between Tucker and Beckman, Inc. How much of the loss may Tucker recognize? How much of the loss may Richard recognize? (Assume that Richard has sufficient C. Now assume the same facts as in b except that Beckman, Inc. is owned 65% by Selena and 35% by Richard. Tucker sells the land to Beckman, Inc. The realized loss is Under the related party rules (Sec. 267), since How much of the loss may Tucker recognize? of Beckman Inc, he allowed to recognize this loss on the sale of lan a. cognized.) Requirement b. Now assume all the same facts except that the sale occurred betwe Begin by determining Tucker's constructive ownership in Beckman, Inc. (Enter perce Print Done Direct ownership of Beckman, Inc. by Tucker % Through Richard Requirement a. How much of the loss may Richard recognize? Begin by determining Richard's constructive ownership in Beckman, Inc. (Enter percentages as whole numbers.) % Direct ownership of Beckman, Inc. by Richard Through Tucker Tucker's actual ownership % Tucker's ownership through TAW % % Total % How much of the loss may Richard recognize? (Assume that Richard has sufficient capital gains in the current year to absorb the full amount of any capital losses that may potential The realized loss is Under the related party rules (Sec. 267), since Richard allowed to recognize this loss on the sale of land to Beckman Inc of Beckman Inc. he % Requirement b. Now assume all the same facts except that the sale occurred between Tucker and Beckman, Inc. How much of the loss may Tucker recognize? Begin by determining Tucker's constructive ownership in Beckman, Inc. (Enter percentages as whole numbers.) Direct ownership of Beckman, Inc. by Tucker Through Richard Through TAW to himself % Through TAW to his partners Through Selena, his partner % Total How much of the loss may Tucker recognize? (Assume that Tucker has sufficient capital gains in the current year to absorb the full amount of any capital losses that may potentially be recognized) Under the related party rules (Sec 267), since Tucker constructively of Beckman Corporation, he to recognize this loss on the sale of land to Beckman Corporation Requirement c. Now assume the same facts as in b except that Beckman, Inc., is owned 65% by Selena and 35% by Richard Tucker sells the land to Beckman, Inc. How much of the loss may Tucker recognize? (Assume that Tucker has sufficient capital gains in current year to absorb the full amount of any capital losses that may potentially be recognized.) In this case, Tucker is treated Thus, Tucker V to recognize this loss on the sale of land to Beckman, Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started