Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show calculations. thank you (g) Indicate the amount) reported in the income statement relaned to the futures contract and the inventory transactions on December

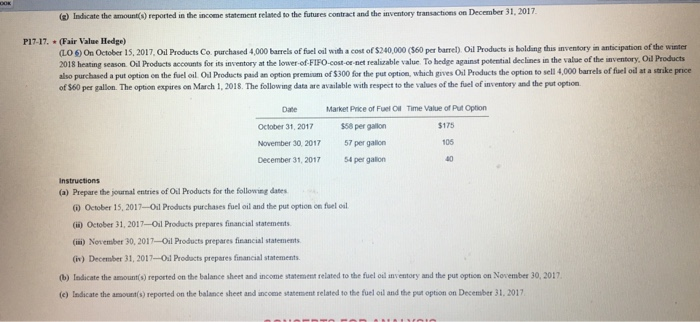

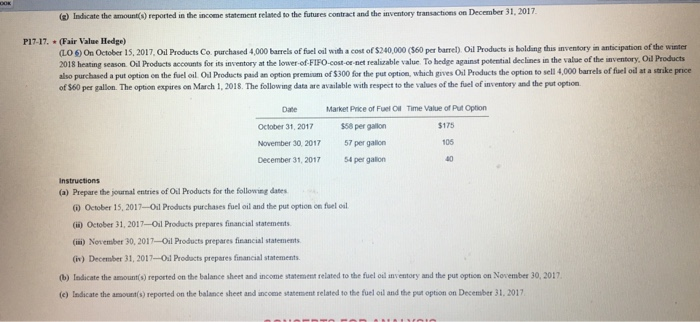

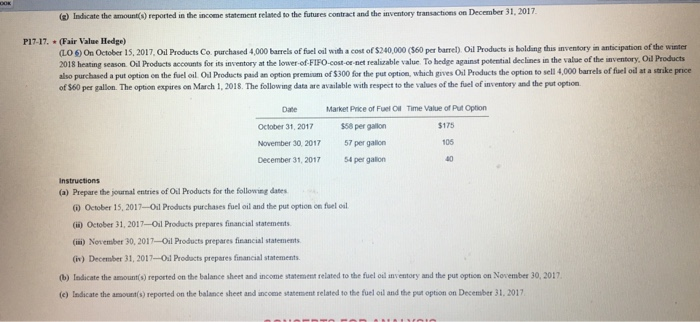

please show calculations. thank you  (g) Indicate the amount) reported in the income statement relaned to the futures contract and the inventory transactions on December 31, 2017 P17-17.(Fair Value Hedge) 5) On October 15, 2017, 01 Products Co purchased 4 000 barrels of fel el w a cost of S240 000 (S60 per barrel) 01 Prd es ir b Idag this mens ry ansapat on of the wasa 2018 heating season. Oil Products accounts for its inventory at the lower of FIFO-cost-ce-net realizable value. To hedge against potential declines in the value of the inventory, Oil Products also purchased a put option on the felo10 1Products paad an option pren am or so ofor the propto which gives Oil Pre ducts the option to sell 4,00 banen of elodanake poe of $60 per gallon. The option expires on March 1, 2018. The following data are available with respect to the values of the fuel of inventory and the put option. Market Price of Fuel Ol Time Value of Put Option Date October 31, 2017 8pr galon November 30, 2017 57 per galion December 31, 2017 54 per galion $175 105 80 instructions (a) Prepare the journal entries of Oil Products for the following dates 6 October 15, 2017-Oil Products purchases fuel oil and the put option on fuel oal (ii) October 31, 2017-Oil Products prepares financial statements (iRi) November 30, 2017-Oil Products prepares financial statements (in) December 31, 2017-Oal Prodacts prepares financial statements (b) ledicate the amount(s) reported on the balance sheet and income statemment related to the fuel oul anv entory and the put opticn on November 30, 2017 (e) Indicate the amsounts) reported on the balance sheet and incoene statement related to the fuel oil and the put option on December 31, 2017 (g) Indicate the amount) reported in the income statement relaned to the futures contract and the inventory transactions on December 31, 2017 P17-17.(Fair Value Hedge) 5) On October 15, 2017, 01 Products Co purchased 4 000 barrels of fel el w a cost of S240 000 (S60 per barrel) 01 Prd es ir b Idag this mens ry ansapat on of the wasa 2018 heating season. Oil Products accounts for its inventory at the lower of FIFO-cost-ce-net realizable value. To hedge against potential declines in the value of the inventory, Oil Products also purchased a put option on the felo10 1Products paad an option pren am or so ofor the propto which gives Oil Pre ducts the option to sell 4,00 banen of elodanake poe of $60 per gallon. The option expires on March 1, 2018. The following data are available with respect to the values of the fuel of inventory and the put option. Market Price of Fuel Ol Time Value of Put Option Date October 31, 2017 8pr galon November 30, 2017 57 per galion December 31, 2017 54 per galion $175 105 80 instructions (a) Prepare the journal entries of Oil Products for the following dates 6 October 15, 2017-Oil Products purchases fuel oil and the put option on fuel oal (ii) October 31, 2017-Oil Products prepares financial statements (iRi) November 30, 2017-Oil Products prepares financial statements (in) December 31, 2017-Oal Prodacts prepares financial statements (b) ledicate the amount(s) reported on the balance sheet and income statemment related to the fuel oul anv entory and the put opticn on November 30, 2017 (e) Indicate the amsounts) reported on the balance sheet and incoene statement related to the fuel oil and the put option on December 31, 2017

(g) Indicate the amount) reported in the income statement relaned to the futures contract and the inventory transactions on December 31, 2017 P17-17.(Fair Value Hedge) 5) On October 15, 2017, 01 Products Co purchased 4 000 barrels of fel el w a cost of S240 000 (S60 per barrel) 01 Prd es ir b Idag this mens ry ansapat on of the wasa 2018 heating season. Oil Products accounts for its inventory at the lower of FIFO-cost-ce-net realizable value. To hedge against potential declines in the value of the inventory, Oil Products also purchased a put option on the felo10 1Products paad an option pren am or so ofor the propto which gives Oil Pre ducts the option to sell 4,00 banen of elodanake poe of $60 per gallon. The option expires on March 1, 2018. The following data are available with respect to the values of the fuel of inventory and the put option. Market Price of Fuel Ol Time Value of Put Option Date October 31, 2017 8pr galon November 30, 2017 57 per galion December 31, 2017 54 per galion $175 105 80 instructions (a) Prepare the journal entries of Oil Products for the following dates 6 October 15, 2017-Oil Products purchases fuel oil and the put option on fuel oal (ii) October 31, 2017-Oil Products prepares financial statements (iRi) November 30, 2017-Oil Products prepares financial statements (in) December 31, 2017-Oal Prodacts prepares financial statements (b) ledicate the amount(s) reported on the balance sheet and income statemment related to the fuel oul anv entory and the put opticn on November 30, 2017 (e) Indicate the amsounts) reported on the balance sheet and incoene statement related to the fuel oil and the put option on December 31, 2017 (g) Indicate the amount) reported in the income statement relaned to the futures contract and the inventory transactions on December 31, 2017 P17-17.(Fair Value Hedge) 5) On October 15, 2017, 01 Products Co purchased 4 000 barrels of fel el w a cost of S240 000 (S60 per barrel) 01 Prd es ir b Idag this mens ry ansapat on of the wasa 2018 heating season. Oil Products accounts for its inventory at the lower of FIFO-cost-ce-net realizable value. To hedge against potential declines in the value of the inventory, Oil Products also purchased a put option on the felo10 1Products paad an option pren am or so ofor the propto which gives Oil Pre ducts the option to sell 4,00 banen of elodanake poe of $60 per gallon. The option expires on March 1, 2018. The following data are available with respect to the values of the fuel of inventory and the put option. Market Price of Fuel Ol Time Value of Put Option Date October 31, 2017 8pr galon November 30, 2017 57 per galion December 31, 2017 54 per galion $175 105 80 instructions (a) Prepare the journal entries of Oil Products for the following dates 6 October 15, 2017-Oil Products purchases fuel oil and the put option on fuel oal (ii) October 31, 2017-Oil Products prepares financial statements (iRi) November 30, 2017-Oil Products prepares financial statements (in) December 31, 2017-Oal Prodacts prepares financial statements (b) ledicate the amount(s) reported on the balance sheet and income statemment related to the fuel oul anv entory and the put opticn on November 30, 2017 (e) Indicate the amsounts) reported on the balance sheet and incoene statement related to the fuel oil and the put option on December 31, 2017

please show calculations. thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started