Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show calculations without excel Alias Industries is currently an all-equity firm. In the coming year the firm is forecasting annual EBIT level 580,000. The

please show calculations without excel

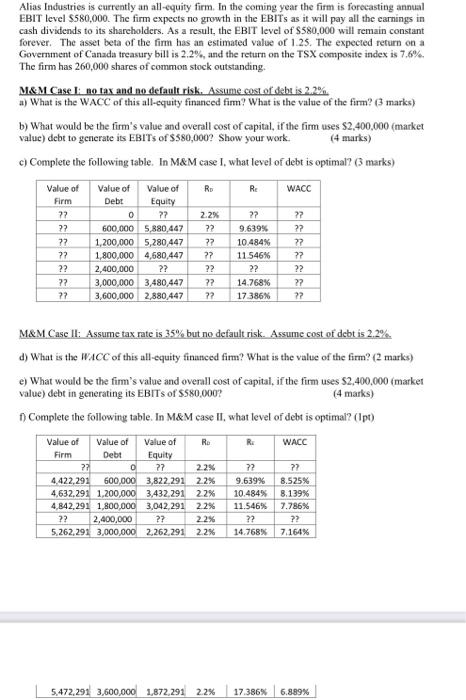

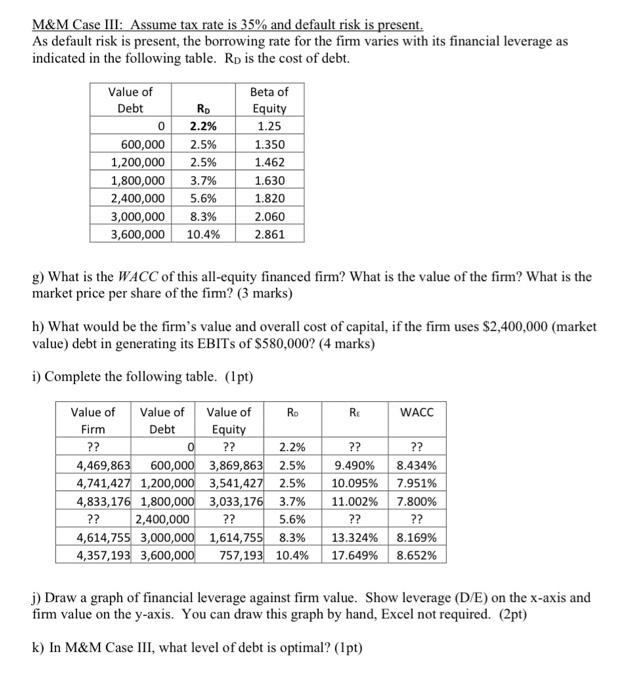

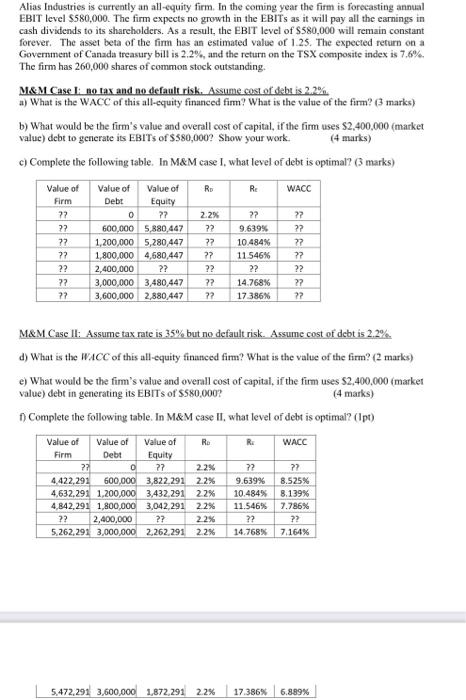

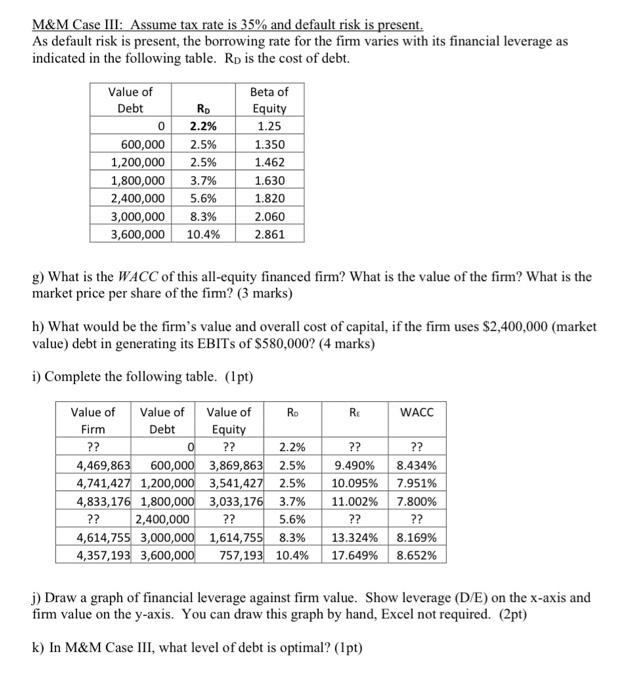

Alias Industries is currently an all-equity firm. In the coming year the firm is forecasting annual EBIT level 580,000. The firm expects no growth in the EBITs as it will pay all the earnings in cash dividends to its shareholders. As a result, the EBIT level of S580.000 will remain constant forever. The asset beta of the firm has an estimated value of 1.25. The expected return on a Government of Canada treasury bill is 2.2%, and the return on the TSX composite index is 7.6% The firm has 260,000 shares of common stock outstanding. M&M Case I no tax and no default risk. Assume cost of debt is 2.2% a) What is the WACC of this all-equity financed fin? What is the value of the firm? (3 marks) b) What would be the firm's value and overall cost of capital, if the firm uses $2,400,000 (market value) debt to generate its EBITs of S580,000? Show your work. (4 marks) c) Complete the following table. In M&M case I, what level of debt is optimal? marks) Value of Value of Value of RE WACC Equity 72 ?? 2.2% ?? 72 ?? 600,000 5,880,447 ?? 9.639% ?? 77 1,200,000 5,280,447 ?? 10.484% ?? 77 1,800,000 4,680,447 11 546% ?? 2,400,000 72 3,000,000 3,480,447 14.768% ?? 3,600,000 2,880,447 17386% Ro Firm Debt 0 ?? ?? ?? 27 ?? ?? 72 ?? 22 M&M Case II: Assume tax rate is 35% but no default risk. Assume cost of debt is 2.2% d) What is the WACC of this all-equity financed firm? What is the value of the firm? (2 marks) e) What would be the firm's value and overall cost of capital, i the firm uses $2,400,000 (market value) debt in generating its EBITs of SS80.000? (4 marks) Complete the following table. In M&M case II, what level of debt is optimal? (Ipt) RE WACC Value of Value of Value of RO Firm Debt Equity 27 o ?? 22% 4.422,291 600,000 3,822,291 22% 4,632,291 1,200,000 3,432,291 22% 4.842,291 1,800,000 3,042,291 2.2% ?? 2,400,000 ?? 2.2% 5,262,293,000,000 2,262,291 2.2% 72 9.639% 10.484% 11.546% ?? 14.768% 72 8.525% 8.139% 7.786% ?? 7.164% 5.472,291 3,600,000 1,872,291 2.2% 17.386% 6.889% M&M Case III: Assume tax rate is 35% and default risk is present. As default risk is present, the borrowing rate for the firm varies with its financial leverage as indicated in the following table. Rp is the cost of debt. Value of Debt 0 600,000 1,200,000 1,800,000 2,400,000 3,000,000 3,600,000 RD 2.2% 2.5% 2.5% 3.7% 5.6% 8.3% 10.4% Beta of Equity 1.25 1.350 1.462 1.630 1.820 2.060 2.861 g) What is the WACC of this all-equity financed firm? What is the value of the firm? What is the market price per share of the fimm? (3 marks) h) What would be the firm's value and overall cost of capital, if the firm uses $2,400,000 (market value) debt in generating its EBITs of $580,000? (4 marks) i) Complete the following table. (Ipt) Value of Value of Value of Ro RE WACC Firm Debt Equity ?? 0 ?? 2.2% ?? ?? 4,469,863 600,000 3,869,863 2.5% 9.490% 8.434% 4,741,427 1,200,000 3,541,427 2.5% 10.095% 7.951% 4,833,176 1,800,000 3,033,176 3.7% 11.002% 7.800% ?? 2,400,000 ?? 5.6% ?? ?? 4,614,755 3,000,000 1,614,755 8.3% 13.324% 8.169% 4,357,193 3,600,000 757,193 10.4% 17.649% 8.652% j) Draw a graph of financial leverage against firm value. Show leverage (DE) on the x-axis and firm value on the y-axis. You can draw this graph by hand, Excel not required. (2pt) k) In M&M Case III, what level of debt is optimal? (1 pt) Alias Industries is currently an all-equity firm. In the coming year the firm is forecasting annual EBIT level 580,000. The firm expects no growth in the EBITs as it will pay all the earnings in cash dividends to its shareholders. As a result, the EBIT level of S580.000 will remain constant forever. The asset beta of the firm has an estimated value of 1.25. The expected return on a Government of Canada treasury bill is 2.2%, and the return on the TSX composite index is 7.6% The firm has 260,000 shares of common stock outstanding. M&M Case I no tax and no default risk. Assume cost of debt is 2.2% a) What is the WACC of this all-equity financed fin? What is the value of the firm? (3 marks) b) What would be the firm's value and overall cost of capital, if the firm uses $2,400,000 (market value) debt to generate its EBITs of S580,000? Show your work. (4 marks) c) Complete the following table. In M&M case I, what level of debt is optimal? marks) Value of Value of Value of RE WACC Equity 72 ?? 2.2% ?? 72 ?? 600,000 5,880,447 ?? 9.639% ?? 77 1,200,000 5,280,447 ?? 10.484% ?? 77 1,800,000 4,680,447 11 546% ?? 2,400,000 72 3,000,000 3,480,447 14.768% ?? 3,600,000 2,880,447 17386% Ro Firm Debt 0 ?? ?? ?? 27 ?? ?? 72 ?? 22 M&M Case II: Assume tax rate is 35% but no default risk. Assume cost of debt is 2.2% d) What is the WACC of this all-equity financed firm? What is the value of the firm? (2 marks) e) What would be the firm's value and overall cost of capital, i the firm uses $2,400,000 (market value) debt in generating its EBITs of SS80.000? (4 marks) Complete the following table. In M&M case II, what level of debt is optimal? (Ipt) RE WACC Value of Value of Value of RO Firm Debt Equity 27 o ?? 22% 4.422,291 600,000 3,822,291 22% 4,632,291 1,200,000 3,432,291 22% 4.842,291 1,800,000 3,042,291 2.2% ?? 2,400,000 ?? 2.2% 5,262,293,000,000 2,262,291 2.2% 72 9.639% 10.484% 11.546% ?? 14.768% 72 8.525% 8.139% 7.786% ?? 7.164% 5.472,291 3,600,000 1,872,291 2.2% 17.386% 6.889% M&M Case III: Assume tax rate is 35% and default risk is present. As default risk is present, the borrowing rate for the firm varies with its financial leverage as indicated in the following table. Rp is the cost of debt. Value of Debt 0 600,000 1,200,000 1,800,000 2,400,000 3,000,000 3,600,000 RD 2.2% 2.5% 2.5% 3.7% 5.6% 8.3% 10.4% Beta of Equity 1.25 1.350 1.462 1.630 1.820 2.060 2.861 g) What is the WACC of this all-equity financed firm? What is the value of the firm? What is the market price per share of the fimm? (3 marks) h) What would be the firm's value and overall cost of capital, if the firm uses $2,400,000 (market value) debt in generating its EBITs of $580,000? (4 marks) i) Complete the following table. (Ipt) Value of Value of Value of Ro RE WACC Firm Debt Equity ?? 0 ?? 2.2% ?? ?? 4,469,863 600,000 3,869,863 2.5% 9.490% 8.434% 4,741,427 1,200,000 3,541,427 2.5% 10.095% 7.951% 4,833,176 1,800,000 3,033,176 3.7% 11.002% 7.800% ?? 2,400,000 ?? 5.6% ?? ?? 4,614,755 3,000,000 1,614,755 8.3% 13.324% 8.169% 4,357,193 3,600,000 757,193 10.4% 17.649% 8.652% j) Draw a graph of financial leverage against firm value. Show leverage (DE) on the x-axis and firm value on the y-axis. You can draw this graph by hand, Excel not required. (2pt) k) In M&M Case III, what level of debt is optimal? (1 pt)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started