Answered step by step

Verified Expert Solution

Question

1 Approved Answer

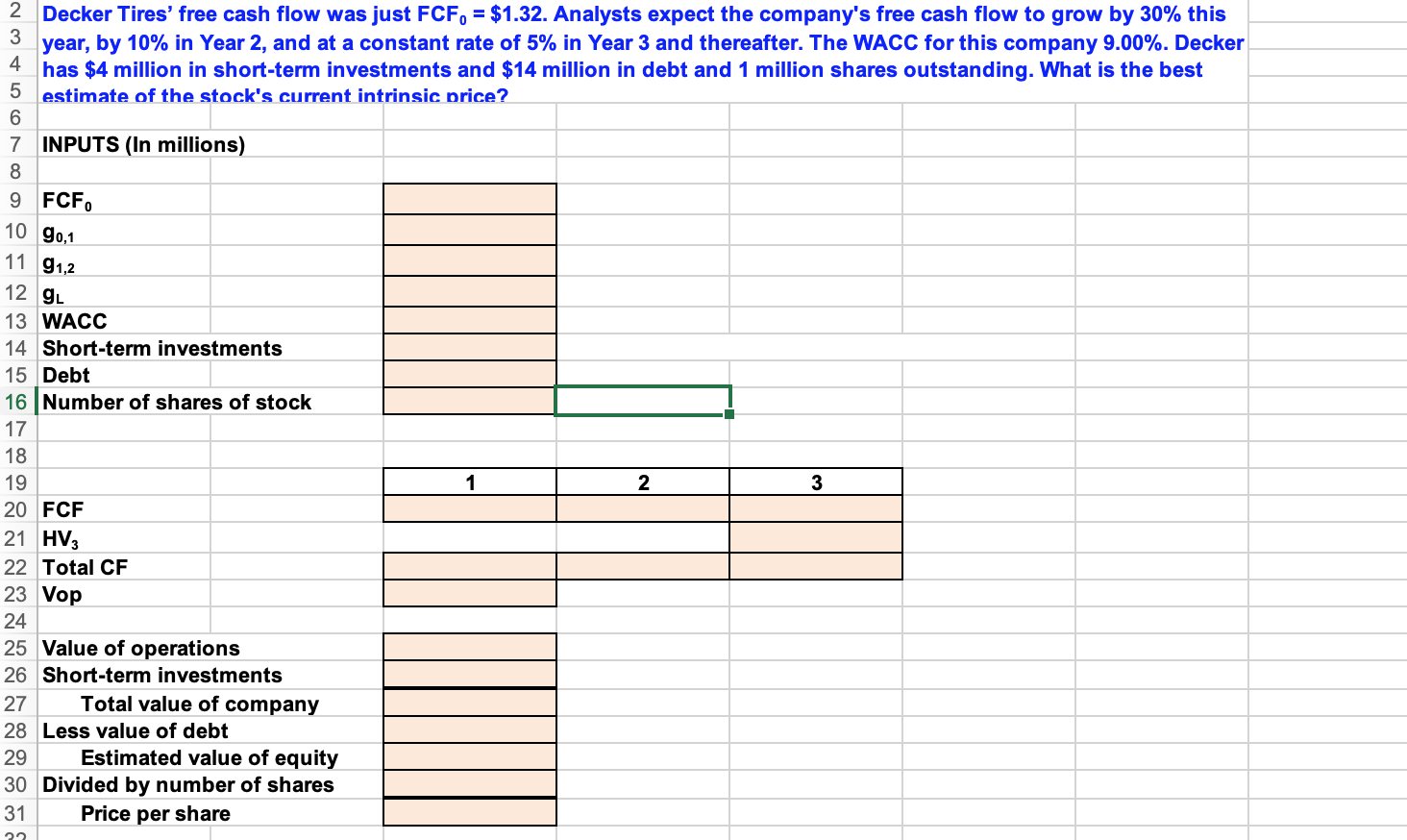

Please show cell references Thanks Decker Tires' free cash flow was just FCF, = $1.32. Analysts expect the company's free cash flow to grow by

Please show cell references Thanks

Decker Tires' free cash flow was just FCF, = $1.32. Analysts expect the company's free cash flow to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter. The WACC for this company 9.00%. Decker has $4 million in short-term investments and $14 million in debt and 1 million shares outstanding. What is the best estimate of the stock's current intrinsic price? 7 INPUTS (In millions) 9 FCF. 10 90,1 11 9 1,2 12 g. 13 WACC 14 Short-term investments 15 Debt 16 Number of shares of stock 17 18 19 1 2 3 20 FCF 21 HV 22 Total CF 23 Vop 24 25 Value of operations 26 Short-term investments 27 Total value of company 28 Less value of debt 29 Estimated value of equity 30 Divided by number of shares 31 Price per share 22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started