Please show cell referencing

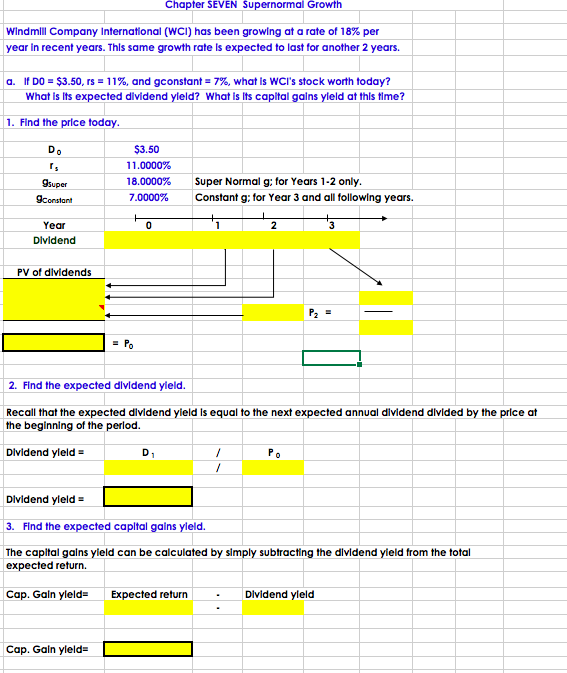

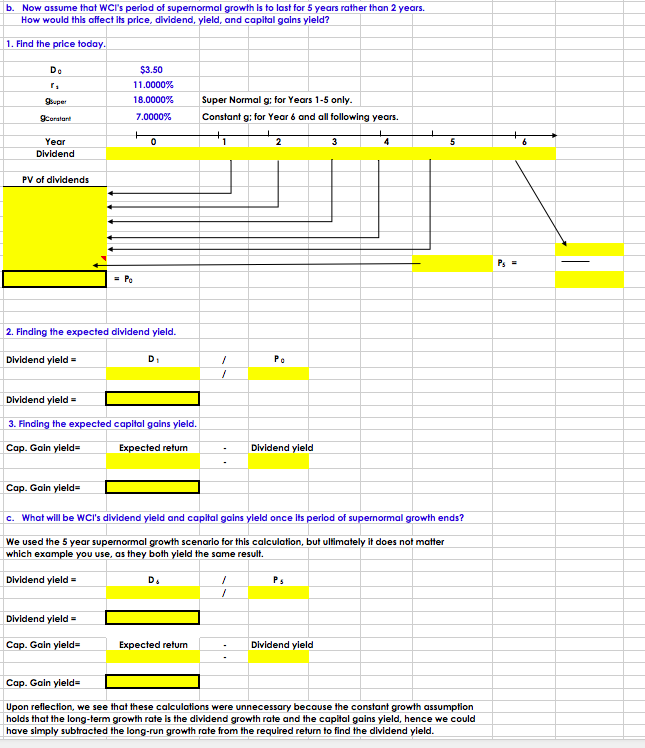

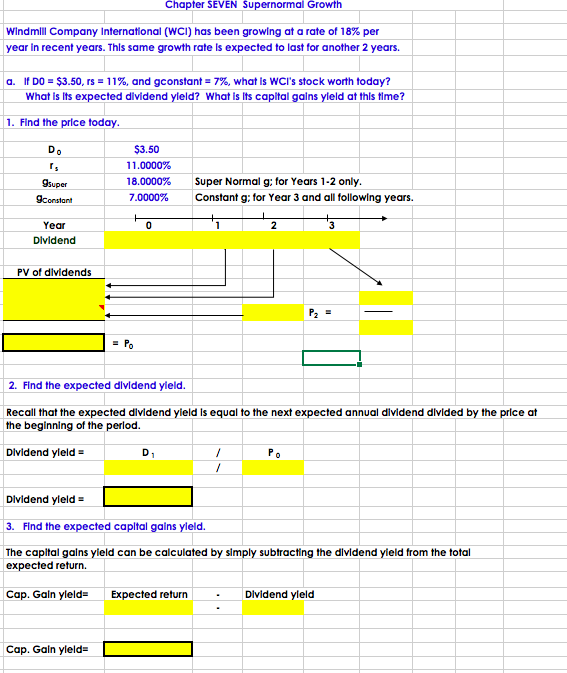

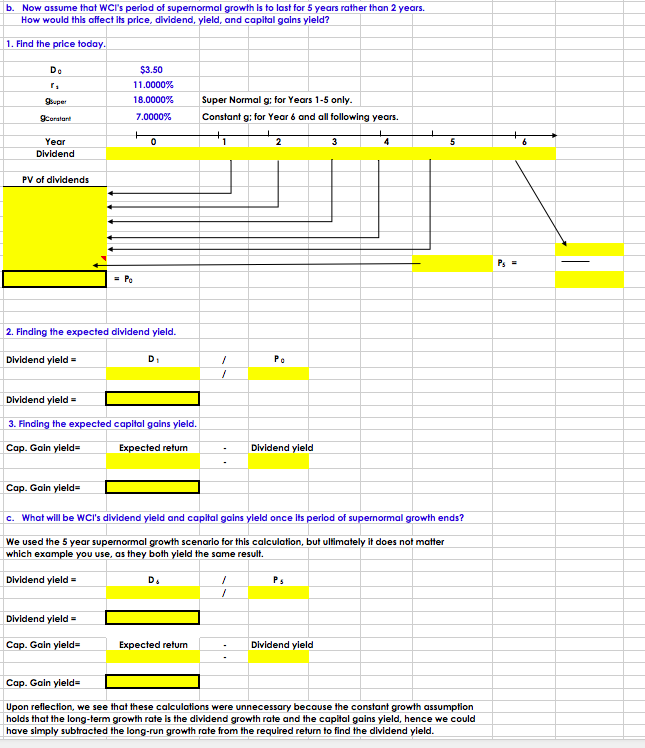

Chapter SEVEN Supernormal Growth Windmill Company International (WCI) has been growing at a rate of 18% per year in recent years. This same growth rate is expected to last for another 2 years. a. If DO = $3.50, rs = 11%, and gconstant = 7%, what is WCi's stock worth today? What is its expected dividend yield? What is its capital gains yield at this time? 1. Find the price today. DO rs $3.50 11.0000% 18.0000% 7.0000% super Super Normal g; for Years 1-2 only. Constant g; for Year 3 and all following years. constant 2 Year Dividend PV of dividends P2 = = Po 2. Find the expected dividend yield. Recall that the expected dividend yield is equal to the next expected annual dividend divided by the price at the beginning of the period. Dividend yleld - D PO / Dividend yield = 3. Find the expected capital gains yield. The capital gains yield can be calculated by simply subtracting the dividend yield from the total expected return. Cap. Gain yield- Expected return Dividend yield Cap. Gain yield= b. Now assume that WCI's period of supernormal growth is to last for 5 years rather than 2 years. How would this affect its price, dividend, yleld, and capital gains yield? 1. Find the price today. Do $3.50 11.0000% 18.0000% 7.0000% Super Super Normal g; for Years 1-5 only. Constant g: for Year 6 and all following years. Curatare 0 2 5 Year Dividend PV of dividends PS = = Po 2. Finding the expected dividend yield. Dividend yield = D Po / / Dividend yield = 3. Finding the expected capital gains yield. Cap. Gain yield Expected return Dividend yield Cap. Gain yield c. What will be WCI's dividend yield and capital gains yield once its period of supernormal growth ends? We used the 5 year supernormal growth scenario for this calculation, but ultimately it does not matter which example you use, as they both yield the same result. Dividend yield = PS / Dividend yield- Cap. Gain yield- Expected return Dividend yield Cap. Gain yield Upon reflection, we see that these calculations were unnecessary because the constant growth assumption holds that the long-term growth rate is the dividend growth rate and the capital gains yield, hence we could have simply subtracted the long-run growth rate from the required return to find the dividend yield. Chapter SEVEN Supernormal Growth Windmill Company International (WCI) has been growing at a rate of 18% per year in recent years. This same growth rate is expected to last for another 2 years. a. If DO = $3.50, rs = 11%, and gconstant = 7%, what is WCi's stock worth today? What is its expected dividend yield? What is its capital gains yield at this time? 1. Find the price today. DO rs $3.50 11.0000% 18.0000% 7.0000% super Super Normal g; for Years 1-2 only. Constant g; for Year 3 and all following years. constant 2 Year Dividend PV of dividends P2 = = Po 2. Find the expected dividend yield. Recall that the expected dividend yield is equal to the next expected annual dividend divided by the price at the beginning of the period. Dividend yleld - D PO / Dividend yield = 3. Find the expected capital gains yield. The capital gains yield can be calculated by simply subtracting the dividend yield from the total expected return. Cap. Gain yield- Expected return Dividend yield Cap. Gain yield= b. Now assume that WCI's period of supernormal growth is to last for 5 years rather than 2 years. How would this affect its price, dividend, yleld, and capital gains yield? 1. Find the price today. Do $3.50 11.0000% 18.0000% 7.0000% Super Super Normal g; for Years 1-5 only. Constant g: for Year 6 and all following years. Curatare 0 2 5 Year Dividend PV of dividends PS = = Po 2. Finding the expected dividend yield. Dividend yield = D Po / / Dividend yield = 3. Finding the expected capital gains yield. Cap. Gain yield Expected return Dividend yield Cap. Gain yield c. What will be WCI's dividend yield and capital gains yield once its period of supernormal growth ends? We used the 5 year supernormal growth scenario for this calculation, but ultimately it does not matter which example you use, as they both yield the same result. Dividend yield = PS / Dividend yield- Cap. Gain yield- Expected return Dividend yield Cap. Gain yield Upon reflection, we see that these calculations were unnecessary because the constant growth assumption holds that the long-term growth rate is the dividend growth rate and the capital gains yield, hence we could have simply subtracted the long-run growth rate from the required return to find the dividend yield