Answered step by step

Verified Expert Solution

Question

1 Approved Answer

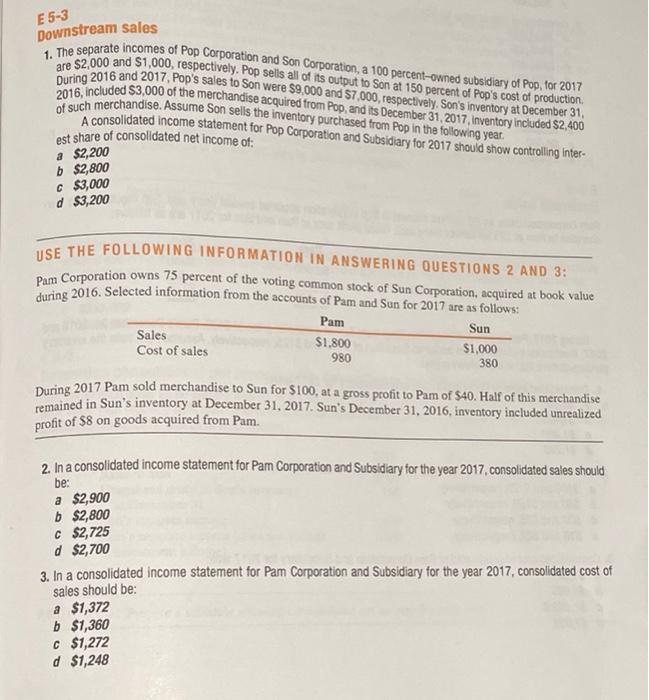

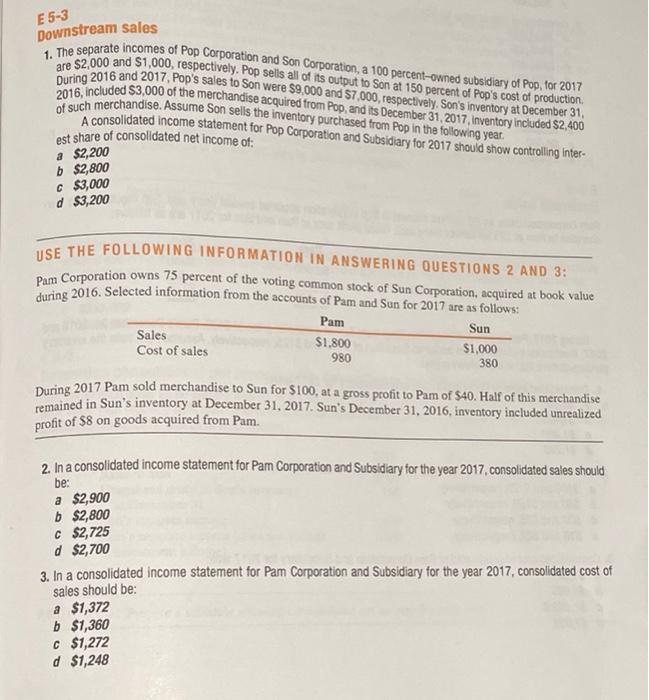

Please show clean work! E5-3 Downstream sales 1. The separate incomes of Pop Corporation and Son Corporation, a 100 percent-owned subsidiary of Pop, for 2017

Please show clean work!

E5-3 Downstream sales 1. The separate incomes of Pop Corporation and Son Corporation, a 100 percent-owned subsidiary of Pop, for 2017 are $2,000 and $1,000, respectively. Pop sells all of its output to Son at 150 percent of Pop's cost of production During 2016 and 2017, Pop's sales to Son were $9,000 and $7,000, respectively. Son's inventory at December 31, 2016, included $3,000 of the merchandise acquired from Pop, and its December 31, 2017 Inventory included $2,400 of such merchandise. Assume Son sells the inventory purchased from Pop in the following year. est share of consolidated net income ot: A consolidated income statement for Pop Corporation and Subsidiary for 2017 should show controlling inter- a $2,200 b $2,800 $3,000 d $3,200 USE THE FOLLOWING INFORMATION IN ANSWERING QUESTIONS 2 AND 3: Para Corporation owns 75 percent of the voting common stock of Sun Corporation, acquired at book value during 2016. Selected information from the accounts of Pam and Sun for 2017 are as follows: Sun Sales $1,800 Cost of sales Pam 980 $1,000 380 During 2017 Pam sold merchandise to Sun for S100, at a gross profit to Pam of S40. Half of this merchandise remained in Sun's inventory at December 31, 2017. Sun's December 31, 2016, inventory included unrealized profit of $8 on goods acquired from Pam. 2. In a consolidated income statement for Pam Corporation and Subsidiary for the year 2017, consolidated sales should be: a $2,900 b$2,800 C$2,725 d $2,700 3. In a consolidated Income statement for Pam Corporation and Subsidiary for the year 2017, consolidated cost of sales should be: a $1,372 b$1,360 C$1,272 d $1,248

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started