Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show clear solutions with explanations. A quick response will be appreciated with an up vote. Thank you in anticipation QUESTION TWO Mfungo Enterprises' projects

Please show clear solutions with explanations. A quick response will be appreciated with an up vote. Thank you in anticipation

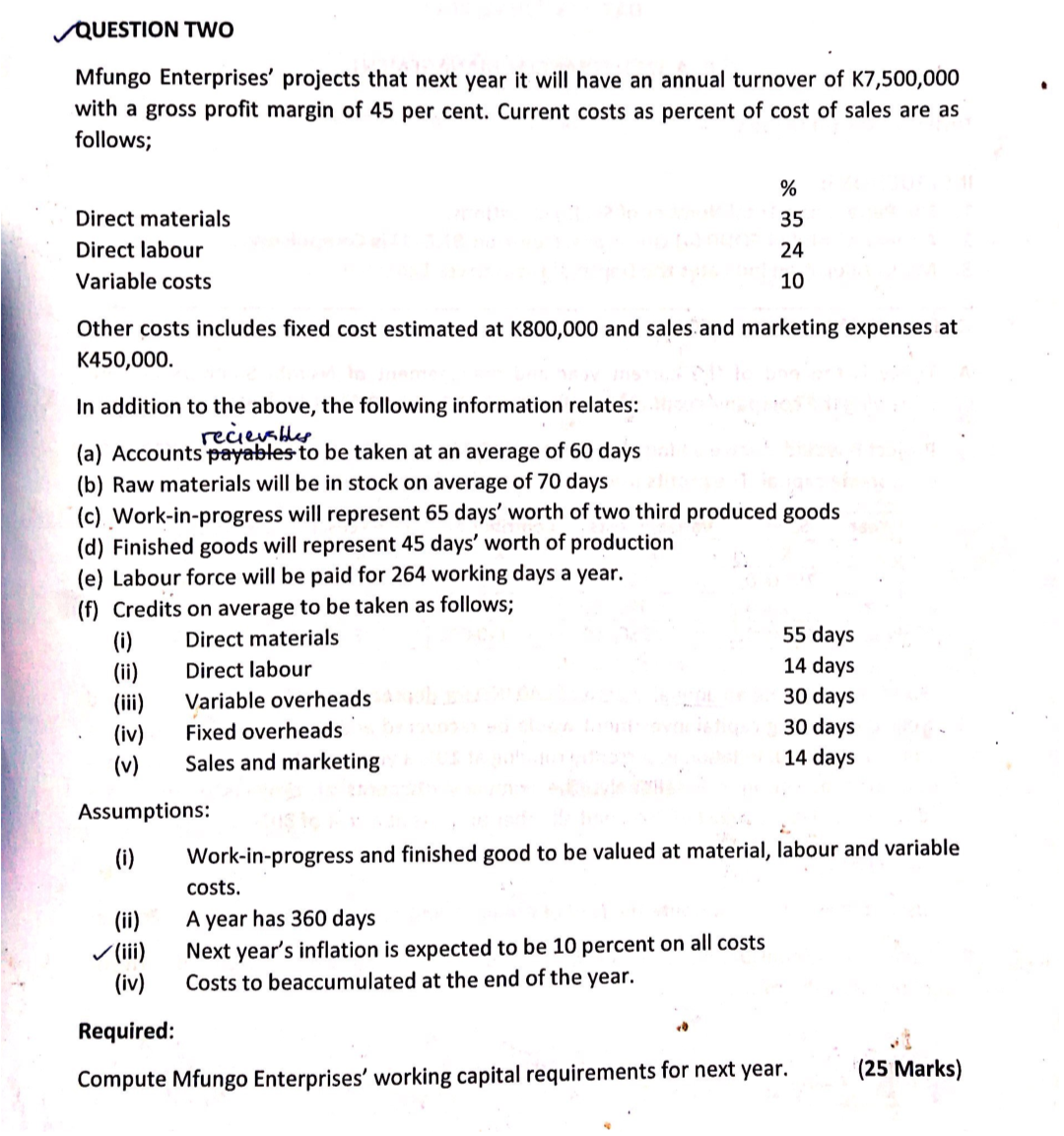

QUESTION TWO Mfungo Enterprises' projects that next year it will have an annual turnover of K7,500,000 with a gross profit margin of 45 per cent. Current costs as percent of cost of sales are as follows; % Direct materials Direct labour Variable costs 35 24 10 Other costs includes fixed cost estimated at K800,000 and sales and marketing expenses at K450,000. In addition to the above, the following information relates: recievables (a) Accounts payables to be taken at an average of 60 days (b) Raw materials will be in stock on average of 70 days (c) Work-in-progress will represent 65 days' worth of two third produced goods (d) Finished goods will represent 45 days' worth of production (e) Labour force will be paid for 264 working days a year. (f) Credits on average to be taken as follows; (i) Direct materials 55 days (ii) Direct labour 14 days (iii) Variable overheads 30 days (iv) Fixed overheads 30 days (v) Sales and marketing 14 days Assumptions: (i) (ii) (iii) (iv) Work-in-progress and finished good to be valued at material, labour and variable costs. A year has 360 days Next year's inflation is expected to be 10 percent on all costs Costs to beaccumulated at the end of the year. 0 Required: Compute Mfungo Enterprises' working capital requirements for next year. (25 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started