Please SHOW COMPLETE SOLUTIONS IN EVERY ANSWER.

RECEIVABLES FINANCING, ACCOUNTING FOR LOAN RECEIVABLE AND ACCOUNTING FOR RECEIVABLE IMPAIRMENT

?

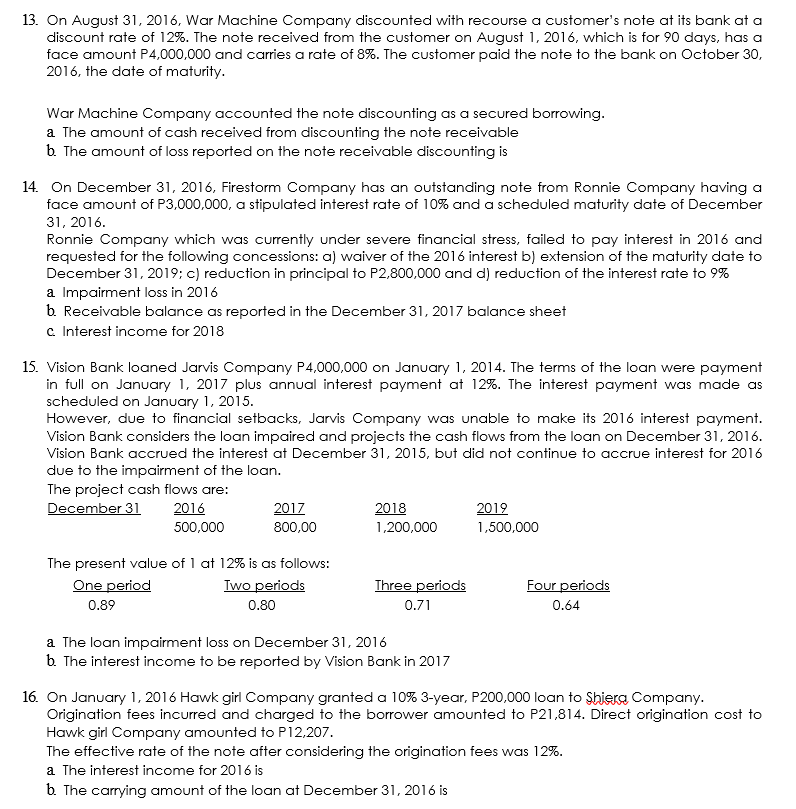

13. On August 31, 2016, War Machine Company discounted with recourse a customer's note at its bank at a discount rate of 12%. The note received from the customer on August 1, 2016, which is for 90 days, has a face amount P4,000,000 and carries a rate of 8%. The customer paid the note to the bank on October 30, 2016, the date of maturity. War Machine Company accounted the note discounting as a secured borrowing. a The amount of cash received from discounting the note receivable b. The amount of loss reported on the note receivable discounting is 14. On December 31, 2016, Firestorm Company has an outstanding note from Ronnie Company having a face amount of P3,000,000, a stipulated interest rate of 10% and a scheduled maturity date of December 31, 2016. Ronnie Company which was currently under severe financial stress, failed to pay interest in 2016 and requested for the following concessions: a) waiver of the 2016 interest b) extension of the maturity date to December 31, 2019; c) reduction in principal to P2,800,000 and d) reduction of the interest rate to 9% a Impairment loss in 2016 b. Receivable balance as reported in the December 31, 2017 balance sheet C. Interest income for 2018 15. Vision Bank loaned Jarvis Company P4,000,000 on January 1, 2014. The terms of the loan were payment in full on January 1, 2017 plus annual interest payment at 12%. The interest payment was made as scheduled on January 1, 2015. However, due to financial setbacks, Jarvis Company was unable to make its 2016 interest payment. Vision Bank considers the loan impaired and projects the cash flows from the loan on December 31, 2016. Vision Bank accrued the interest at December 31, 2015, but did not continue to accrue interest for 2016 due to the impairment of the loan. The project cash flows are: December 31 2016 2017 2018 2019 500,000 800,00 1,200,000 1,500,000 The present value of 1 at 12% is as follows: One period Two periods Three periods Four periods 0.89 0.80 0.71 0.64 a The loan impairment loss on December 31, 2016 b. The interest income to be reported by Vision Bank in 2017 16. On January 1, 2016 Hawk girl Company granted a 10% 3-year, P200,000 loan to Shiera Company. Origination fees incurred and charged to the borrower amounted to P21,814. Direct origination cost to Hawk girl Company amounted to P12,207. The effective rate of the note after considering the origination fees was 12%. a The interest income for 2016 is b. The carrying amount of the loan at December 31, 2016 is