please show computations thanks X+X=X format

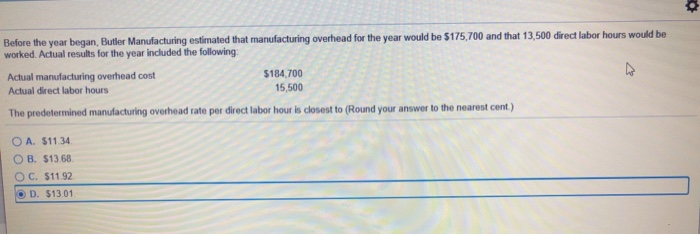

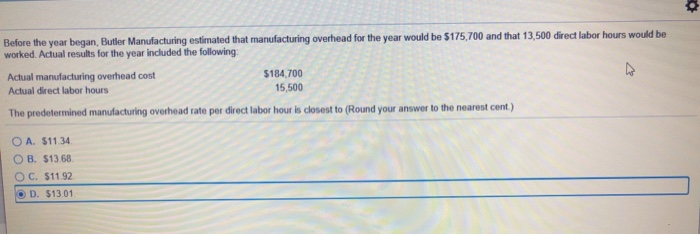

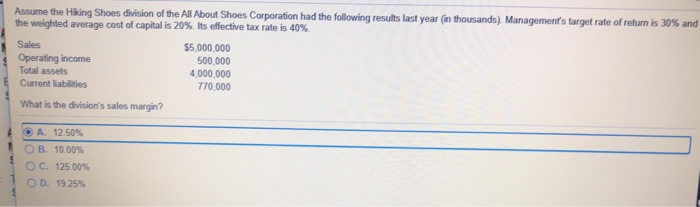

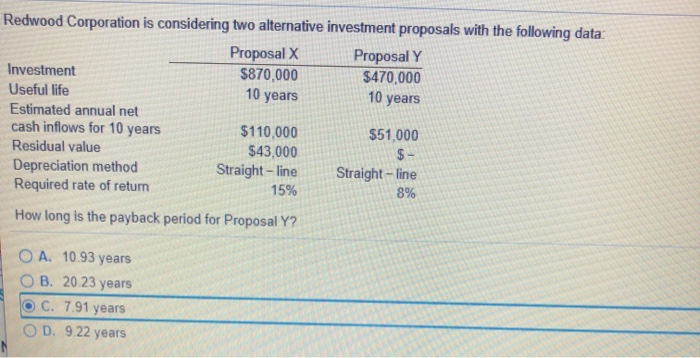

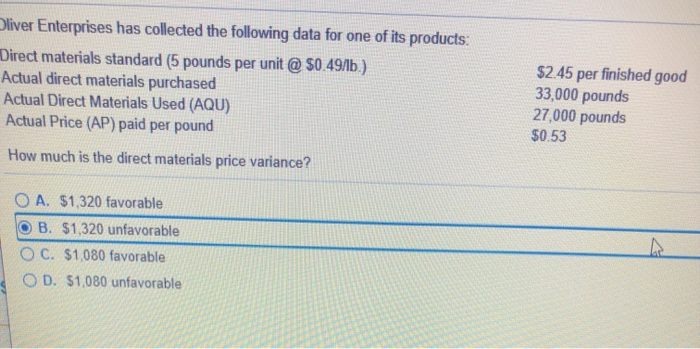

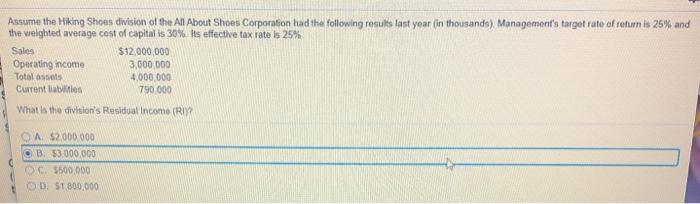

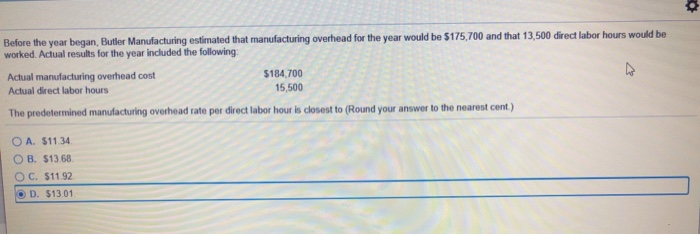

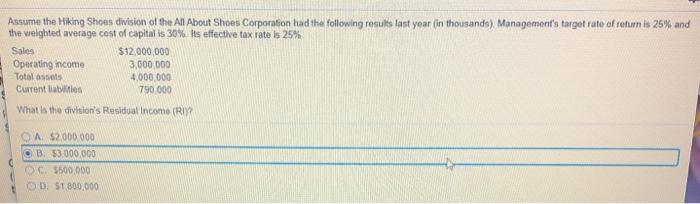

Before the year began, Butler Manufacturing estimated that manufacturing overhead for the year would be $175,700 and that 13,500 direct labor hours would be worked. Actual results for the year included the following: Actual manufacturing overhead cost $184,700 Actual direct labor hours 15,500 The predetermined manufacturing overhead rate per direct labor hour is closest to (Round your answer to the nearest cent) O A $11.34 OB. $13.68 OC. $11.92 OD. $13.01 Assume the Hiking Shoes division of the All About Shoes Corporation had the following results last year (in thousands). Management's target rate of return is 30% and the weighted average cost of capital is 20%. Its effective tax rate is 40% Sales $5,000,000 Operating income 500,000 Total assets 4,000,000 Current liabilities 770 000 What is the division's sales margin? A 12 50% OB 10.00% O C. 125.00% OD 19 25% Redwood Corporation is considering two alternative investment proposals with the following data: Proposal X Proposal Y Investment $870,000 $470,000 Useful life 10 years Estimated annual net cash inflows for 10 years $110,000 $51.000 Residual value $43,000 $- Depreciation method Straight-line Straight-line Required rate of return 15% 8% 10 years How long is the payback period for Proposal Y? O A. 10.93 years B. 20.23 years C. 7.91 years OD. 9.22 years Oliver Enterprises has collected the following data for one of its products: Direct materials standard (5 pounds per unit @ $0.49/b.) Actual direct materials purchased Actual Direct Materials Used (AQU) Actual Price (AP) paid per pound How much is the direct materials price variance? $2.45 per finished good 33,000 pounds 27,000 pounds $0.53 O A. $1,320 favorable B. $1,320 unfavorable O C. $1,080 favorable OD. 51,080 unfavorable Assume the Hiking Shoes division of the All About Shoes Corporation had the following results last year (in thousands) Management's target rate of return is 25% and the weighted average cost of capital is 30%. Its effective tax rate is 25% Sales $12,000,000 Operating income 3,000,000 Total assets 4.000.000 Current liabilities 790.000 What is the division's Residual income (RI)? O A $2,000.000 . B. $3.000.000 OC. $500,000 OD $1,800,000