Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show computations. TSLA is expected to generate free cash flows of $70 billion starting one year from now, and these free cash flows will

please show computations.

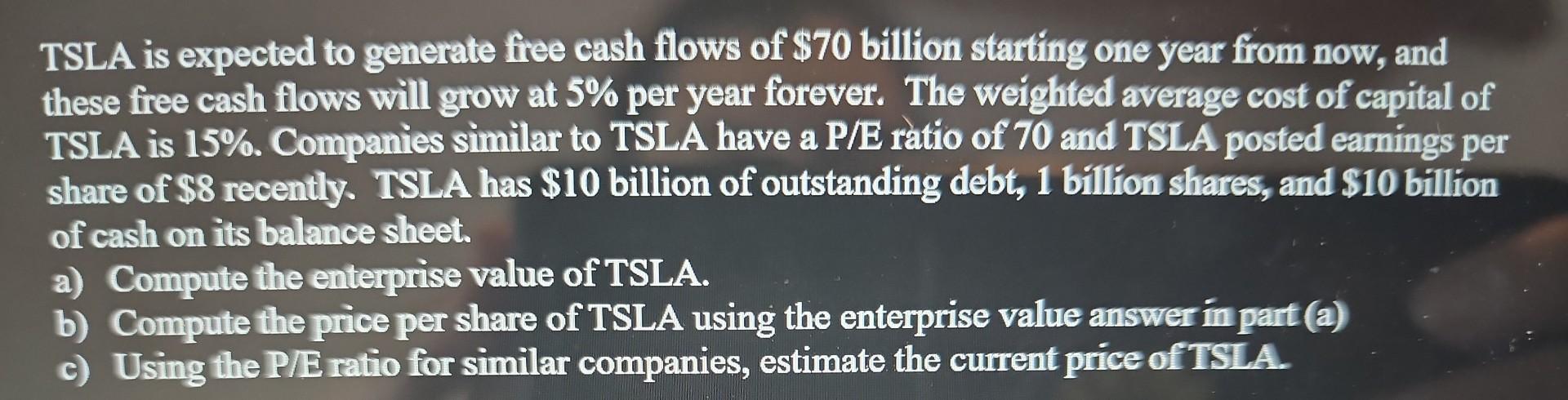

TSLA is expected to generate free cash flows of $70 billion starting one year from now, and these free cash flows will grow at 5% per year forever. The weighted average cost of capital of TSLA is 15%. Companies similar to TSLA have a P/E ratio of 70 and TSLA posted earnings per share of $8 recently. TSLA has $10 billion of outstanding debt, 1 billion shares, and $10 billion of cash on its balance sheet. a) Compute the enterprise value of TSLA. b) Compute the price per share of TSLA using the enterprise value answer in part (a) c) Using the P/E ratio for similar companies, estimate the current price of TSLAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started