Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show directions on how to input in an excel sheet ( eg how we arrive at a total ) 3 34 10. NPV versus

please show directions on how to input in an excel sheet ( eg how we arrive at a total )

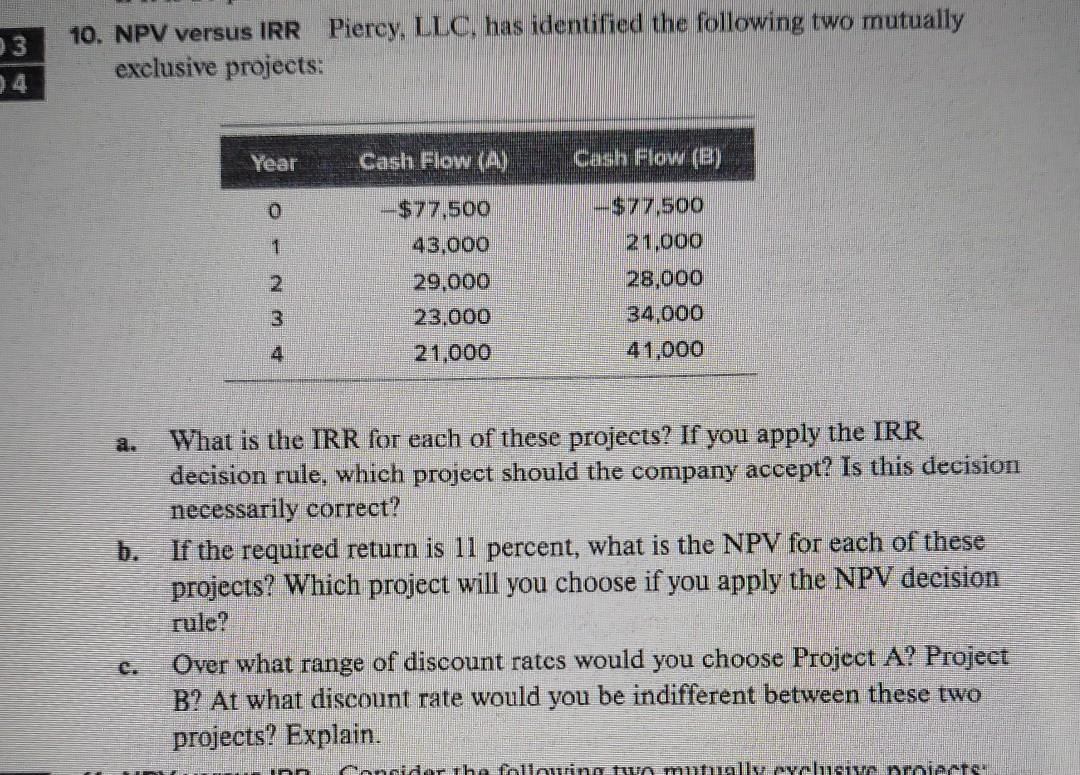

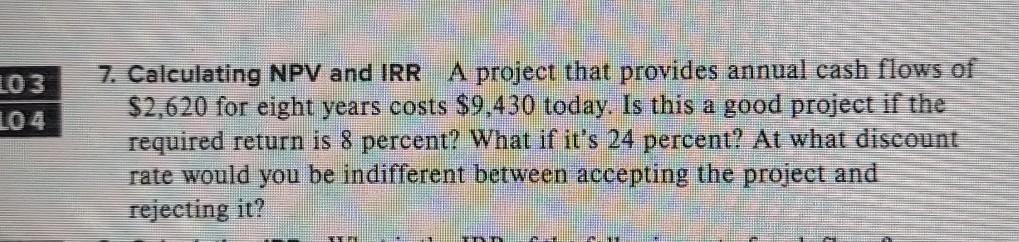

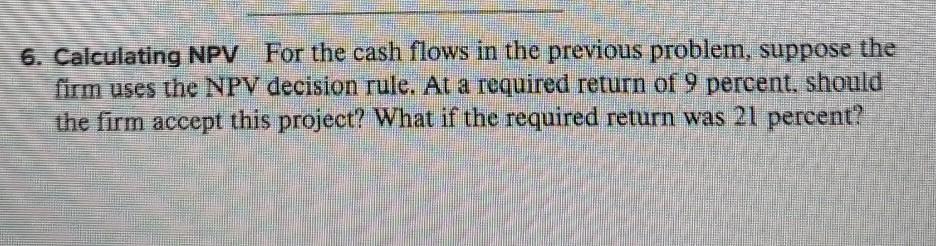

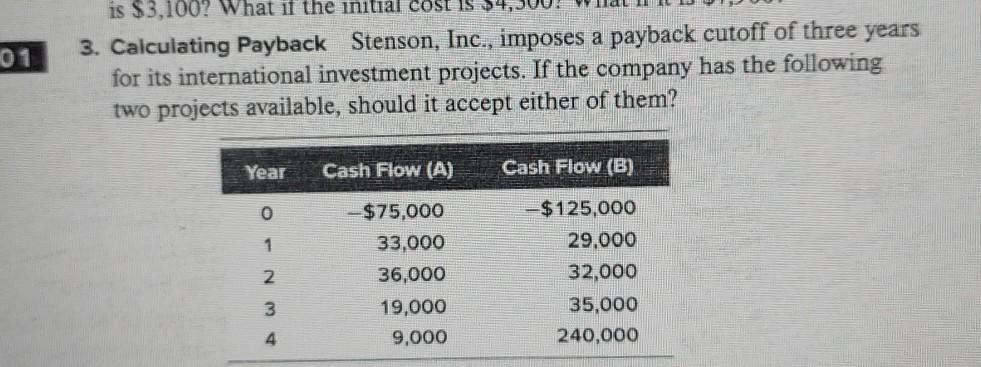

3 34 10. NPV versus IRR Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (1) 0 1 Cash Flow (A) -$77,500 43,000 29,000 23.000 21,000 --$77,500 21.000 28.000 34,000 41,000 3 4 What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accept? Is this decision necessarily correct? b. If the required return is 11 percent, what is the NPV for each of these projects? Which project will you choose if you apply the NPV decision Over what range of discount rates would you choose Project A? Project B? At what discount rate would you be indifferent between these two projects? Explain. dhe futurino tumutually value a AAA 103 LO 4 7. Calculating NPV and IRR A project that provides annual cash flows of $2,620 for eight years costs $9.430 today. Is this a good project if the required return is 8 percent? What if it's 24 percent? At what discount rate would you be indifferent between accepting the project and rejecting it? RE 6. Calculating NPV For the cash flows in the previous problem, suppose the firm uses the NPV decision rule. At a required return of 9 percent, should the firm accept this project? What if the required return was 21 percent? is $3,100? What if the initial cost IS 34 3. Calculating Payback Stenson, Inc., imposes a payback cutoff of three years for its international investment projects. If the company has the following two projects available, should it accept either of them? Year Cash Flow (A) Cash Flow (B) 0 1 2 ---$75,000 33,000 36,000 19,000 9,000 $125,000 29,000 32,000 35,000 240,000 3 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started