Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW EACH STEP, I DO NOT KNOW WHAT TO TYPE IN FOR SALES TO FIND THE MARGIN. THANK YOU Check my work 10 Mindspin

PLEASE SHOW EACH STEP, I DO NOT KNOW WHAT TO TYPE IN FOR SALES TO FIND THE MARGIN. THANK YOU

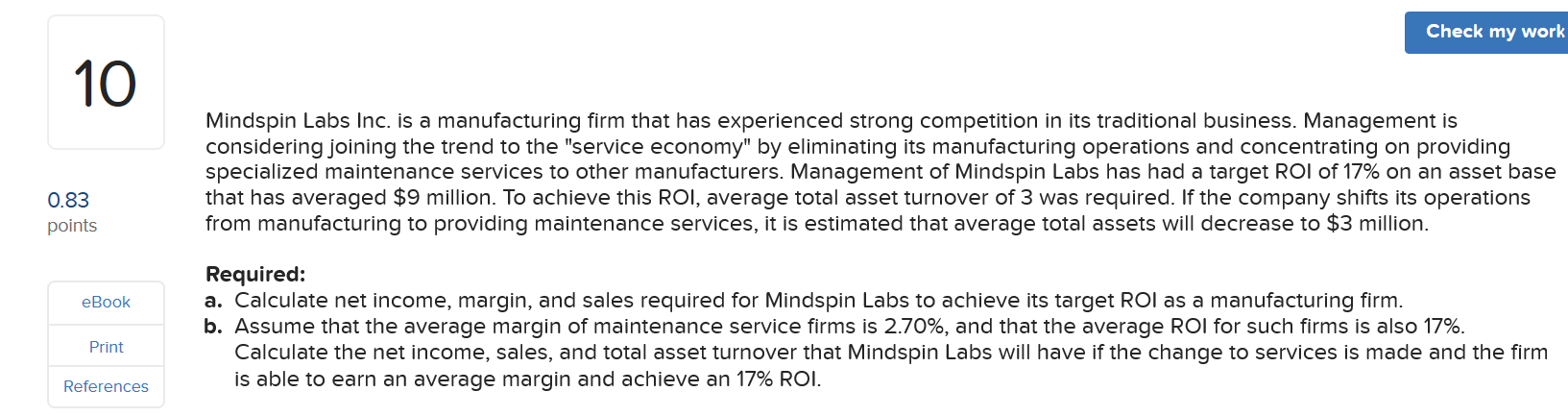

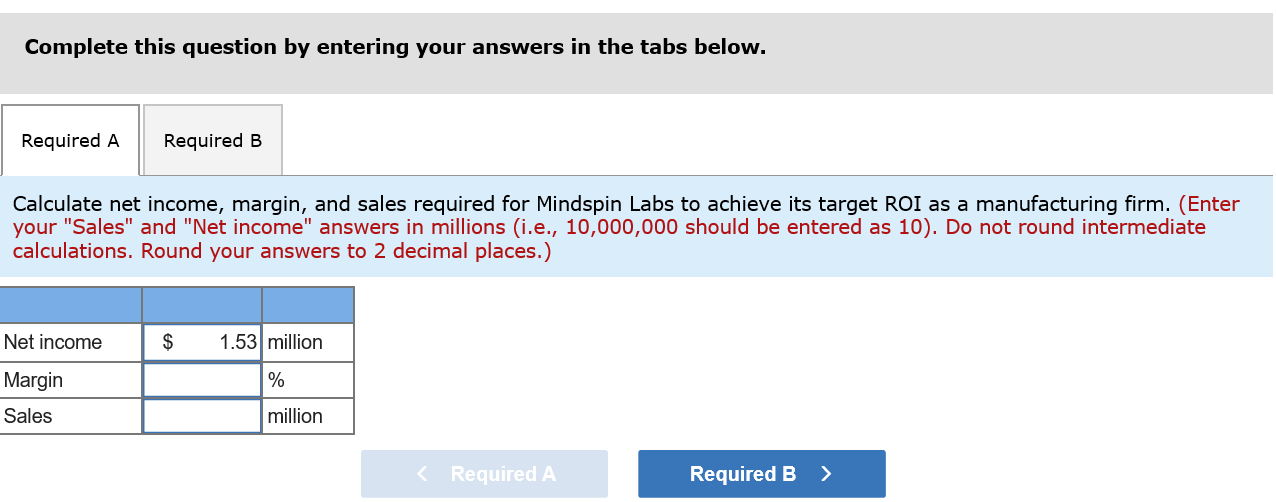

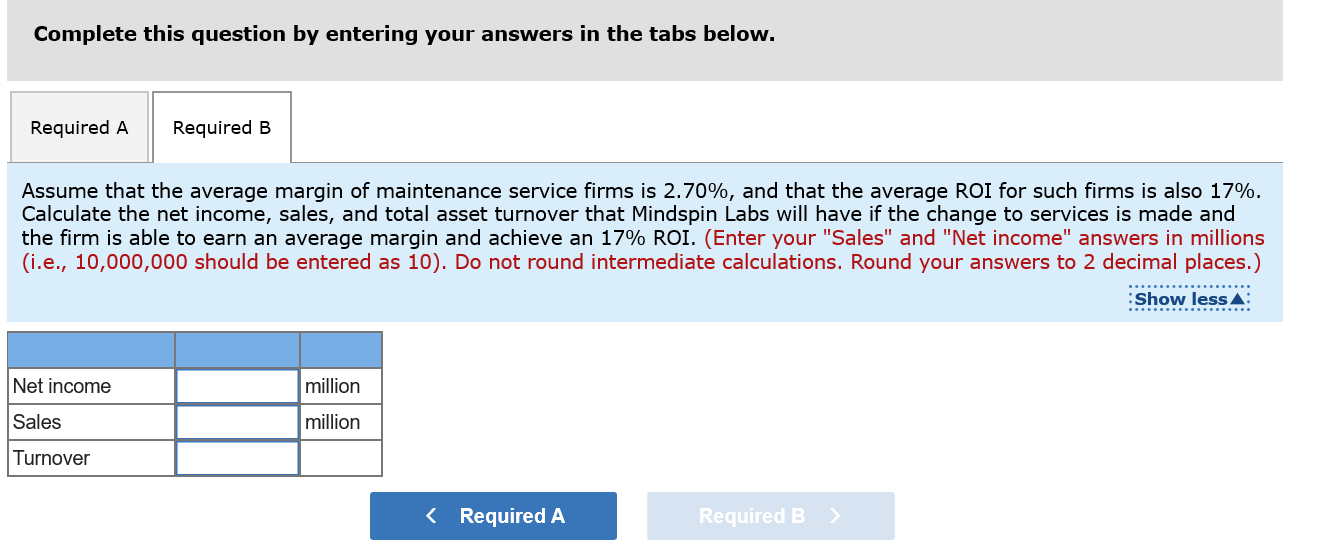

Check my work 10 Mindspin Labs Inc. is a manufacturing firm that has experienced strong competition in its traditional business. Management is considering joining the trend to the "service economy" by eliminating its manufacturing operations and concentrating on providing specialized maintenance services to other manufacturers. Management of Mindspin Labs has had a target ROI of 17% on an asset base that has averaged $9 million. To achieve this ROI, average total asset turnover of 3 was required. If the company shifts its operations from manufacturing to providing maintenance services, it is estimated that average total assets will decrease to $3 million. 0.83 points eBook Required: a. Calculate net income, margin, and sales required for Mindspin Labs to achieve its target ROI as a manufacturing firm. b. Assume that the average margin of maintenance service firms is 2.70%, and that the average ROI for such firms is also 17%. Calculate the net income, sales, and total asset turnover that Mindspin Labs will have if the change to services is made and the firm is able to earn an average margin and achieve an 17% ROI. Print References Complete this question by entering your answers in the tabs below. Required A Required B Calculate net income, margin, and sales required for Mindspin Labs to achieve its target ROI as a manufacturing firm. (Enter your "Sales" and "Net income" answers in millions (i.e., 10,000,000 should be entered as 10). Do not round intermediate calculations. Round your answers to 2 decimal places.) Net income $ 1.53 million Margin % Sales millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started