Question

Please show equations on excel if needed. Thank you!! As we saw in Chapter 2, interest rate risk is one of the key risks for

Please show equations on excel if needed. Thank you!!

Please show equations on excel if needed. Thank you!!

As we saw in Chapter 2, interest rate risk is one of the key risks for fixed-income securities. What is the graphical representation for price sensitivity (a.k.a duration) to changes in interest rate risk, y? [Hint: Pick any y level and using Excel drawing tools draw the tangency line to the curve to find the slope of the curve, dP/dy.]

Current Yield Effect: Create a new column for %Price = (1/p)(dP/dy)=(1/P1) (P2- P1)/(y2-y1) for each of two rows y1 and y2. Calculate the %Price for all the ys values and graph the %Price column vs. ys column. Explain the pattern you observe.

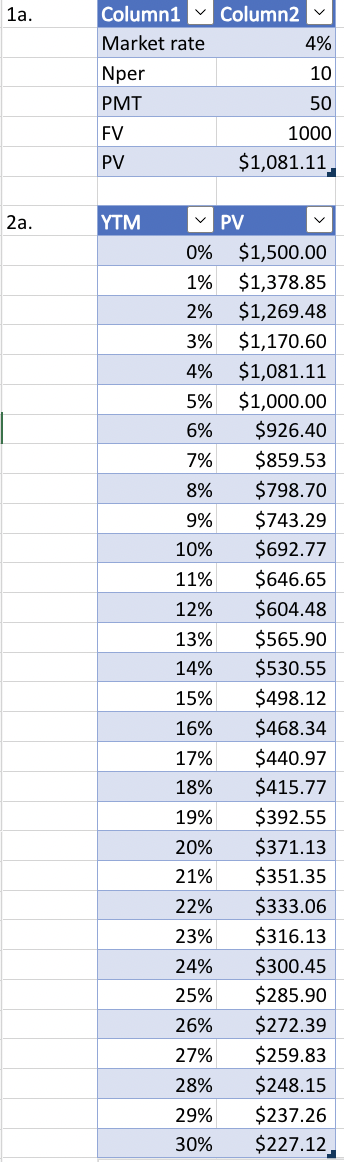

1a. \begin{tabular}{|l|r|} \hline Column1 & Column2 \\ \hline Market rate & 4% \\ \hline Nper & 10 \\ \hline PMT & 50 \\ \hline FV & 1000 \\ \hline PV & $1,081.11 \\ \hline \end{tabular} 2a. \begin{tabular}{|r|r|} \hline YTM & \multicolumn{1}{|c|}{ PV } \\ \hline 0% & $1,500.00 \\ \hline 1% & $1,378.85 \\ \hline 2% & $1,269.48 \\ \hline 3% & $1,170.60 \\ \hline 4% & $1,081.11 \\ \hline 5% & $1,000.00 \\ \hline 6% & $926.40 \\ \hline 7% & $859.53 \\ \hline 8% & $798.70 \\ \hline 9% & $743.29 \\ \hline 10% & $692.77 \\ \hline 11% & $646.65 \\ \hline 12% & $604.48 \\ \hline 13% & $565.90 \\ \hline 14% & $530.55 \\ \hline 15% & $498.12 \\ \hline 16% & $468.34 \\ \hline 17% & $440.97 \\ \hline 18% & $415.77 \\ \hline 19% & $392.55 \\ \hline 20% & $371.13 \\ \hline 21% & $351.35 \\ \hline 22% & $333.06 \\ \hline 23% & $316.13 \\ \hline 24% & $300.45 \\ \hline 25% & $285.90 \\ \hline 26% & $272.39 \\ \hline 27% & $259.83 \\ \hline 28% & $248.15 \\ \hline 29% & $237.26 \\ \hline 30% & $227.12 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started