Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show every step of calculation.thank you Question One Laura, the CEO of Magana Manufacturing Itd is preparing a proposal to present to her board

please show every step of calculation.thank you

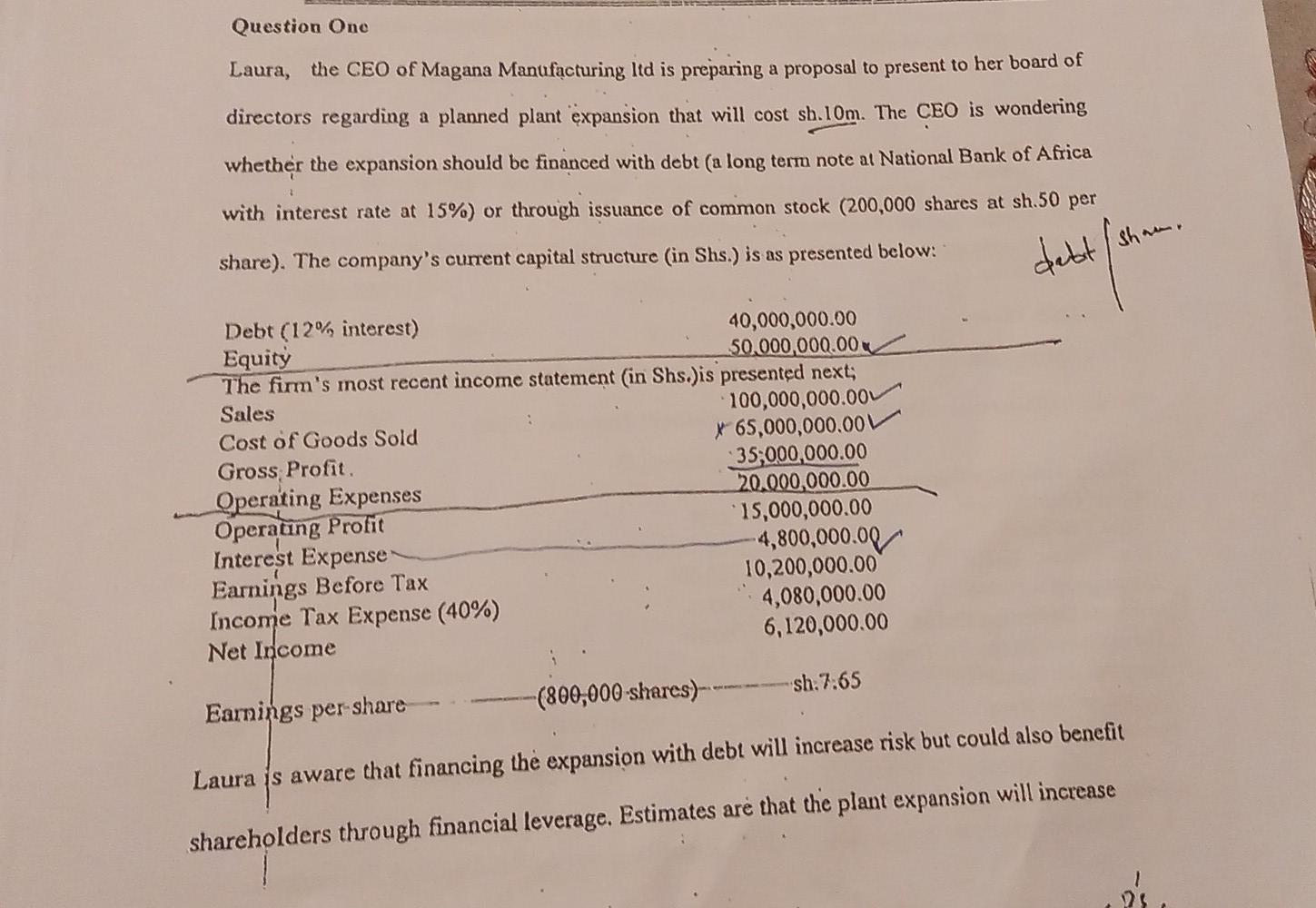

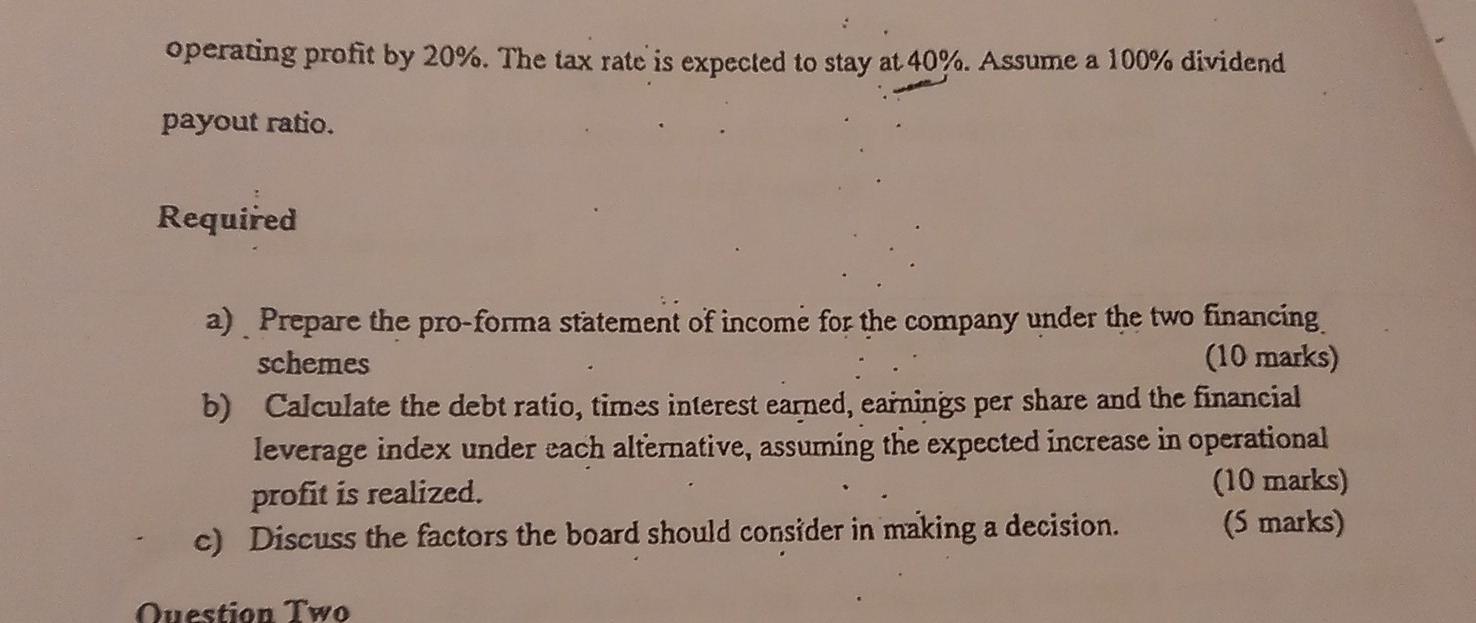

Question One Laura, the CEO of Magana Manufacturing Itd is preparing a proposal to present to her board of directors regarding a planned plant expansion that will cost sh. 10m. The CEO is wondering whether the expansion should be financed with debt (a long term note at National Bank of Africa with interest rate at 15%) or through issuance of common stock (200,000 shares at sh.50 per share). The company's current capital structure (in Shs.) is as presented below: debt / shame Debt (12%, interest) 40,000,000.00 Equity 50,000,000.00 The firm's most recent income statement in Shs.)is presented next; Sales 100,000,000.00 Cost of Goods Sold 65,000,000.00 Gross Profit 35,000,000.00 Operating Expenses 20.000,000.00 Operating Profit 15,000,000.00 Interest Expense -4,800,000.00 Earnings Before Tax 10,200,000.00 Income Tax Expense (40%) 4,080,000.00 Net Income 6,120,000.00 sh.7.65 (800,000 shares) Earnings per share Laura is aware that financing the expansion with debt will increase risk but could also benefit shareholders through financial leverage. Estimates are that the plant expansion will increase D'S operating profit by 20%. The tax rate is expected to stay at 40%. Assume a 100% dividend payout ratio. Required - a) Prepare the pro-forma statement of income for the company under the two financing schemes (10 marks) b) Calculate the debt ratio, times interest eamed, earnings per share and the financial leverage index under cach alternative, assuming the expected increase in operational profit is realized. (10 marks) c) Discuss the factors the board should consider in making a decision. (5 marks) Question TwoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started