Answered step by step

Verified Expert Solution

Question

1 Approved Answer

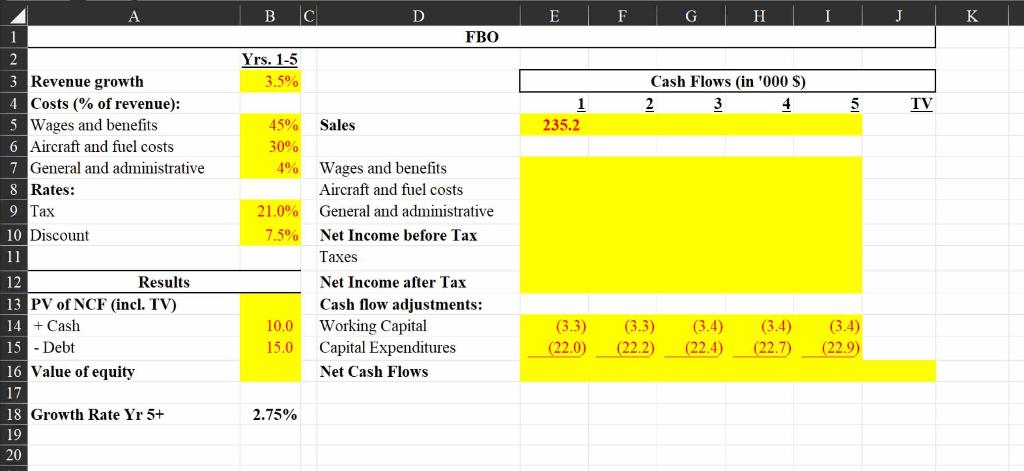

Please show excel calculations or formulas. 2. ABC FBO is looking to buy another FBO. It is being offered an established FBO whose owner wants

Please show excel calculations or formulas.

2. ABC FBO is looking to buy another FBO. It is being offered an established FBO whose owner wants to sell. ABC's CFO gave you the numbers and asked you to calculate its price. The CFO asks that you use a 7.5% discount rate and a 2.75% growth rate for year 5 and on. What should ABC consider paying? The data you need is in the template provided! B C D E F G H K FBO Yrs. 1-5 3.5% Cash Flows in '000 S) 2 3 4 5 TV 1 235.2 Sales 45% 30% 4% 21.0% 7.5% 1 2 3 Revenue growth 4 Costs (% of revenue): 5 Wages and benefits 6 Aircraft and fuel costs 7 General and administrative 8 Rates: 9 Tax 10 Discount 11 12 Results 13 PV of NCF (incl. TV) 14 + Cash 15 - Debt 16 Value of equity 17 18 Growth Rate Yr 5+ 19 20 Wages and benefits Aircraft and fuel costs General and administrative Net Income before Tax Taxes Net Income after Tax Cash flow adjustments: Working Capital Capital Expenditures Net Cash Flows 10.0 15.0 (3.3) (22.0 (3.3) (22.2) (3.4) (22.4) (3.4) (22.7) (3.4) (22.9) 2.75%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started