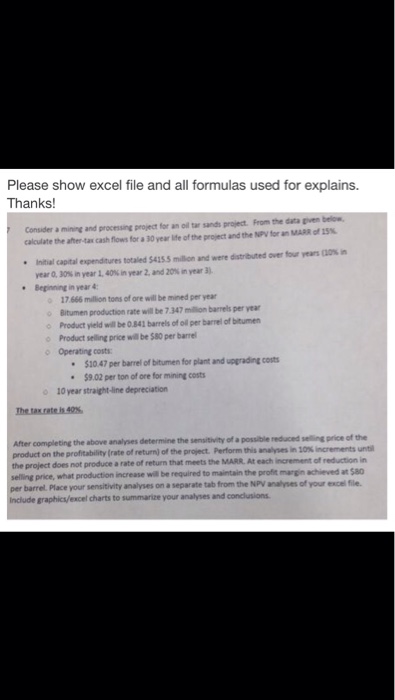

Please show excel file and all formulas used for explains. Thanks Consider a mining and processing project for an oil tar sands project. From the data given below calculate the ater-tax cash flows for a 30 year lfe of the project and the NPV for an MARR of 15% a0% Initial capital expenditures totaled S4155 maon and were dtrbted oer b year 0, 30% in year L 40% in year 2. and20% in year 3). Beginning in year 4 17.666 million tons of ore will be mined per year o Bitumen production rate wll be 7.347 million barrels per year Product yield will be 0841 barrels of oa per banel or men Product seine price wabeS80 per barrel Operating costs: $10.47 per barrel of bitumen for plant and upgrading cost $9.02 per ton of ore for mining costs o 10 year straight-line depreciation possible reduced selling price of the After completing the above analhyses determine the sensitivity of a product on the profitability (rate of return) of the project. Perform this analynes in 10% increments unti does not produce a rate of return that meets the MARR. At each increment of reduction in price, what production increase will be required to maintain the profit margin achieved at $80 barrel. Place your sensitivity analyses on a separate tab from the NPV analyses of your excel file. Include graphics/excel charts to summarize your analyses and conclusions Please show excel file and all formulas used for explains. Thanks Consider a mining and processing project for an oil tar sands project. From the data given below calculate the ater-tax cash flows for a 30 year lfe of the project and the NPV for an MARR of 15% a0% Initial capital expenditures totaled S4155 maon and were dtrbted oer b year 0, 30% in year L 40% in year 2. and20% in year 3). Beginning in year 4 17.666 million tons of ore will be mined per year o Bitumen production rate wll be 7.347 million barrels per year Product yield will be 0841 barrels of oa per banel or men Product seine price wabeS80 per barrel Operating costs: $10.47 per barrel of bitumen for plant and upgrading cost $9.02 per ton of ore for mining costs o 10 year straight-line depreciation possible reduced selling price of the After completing the above analhyses determine the sensitivity of a product on the profitability (rate of return) of the project. Perform this analynes in 10% increments unti does not produce a rate of return that meets the MARR. At each increment of reduction in price, what production increase will be required to maintain the profit margin achieved at $80 barrel. Place your sensitivity analyses on a separate tab from the NPV analyses of your excel file. Include graphics/excel charts to summarize your analyses and conclusions