Answered step by step

Verified Expert Solution

Question

1 Approved Answer

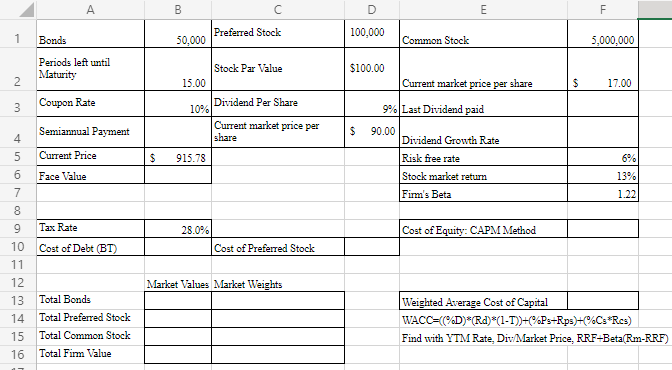

Please show Excel formula and fill in each blank A B D E F 1 Bonds Preferred Stock 50,000 100,000 Common Stock 5,000,000 Periods left

Please show Excel formula and fill in each blank

A B D E F 1 Bonds Preferred Stock 50,000 100,000 Common Stock 5,000,000 Periods left until Maturity 2 $ 17.00 3 Coupon Rate Stock Par Value 15.00 Dividend Per Share 10% Current market price per share Semiannual Payment $100.00 Current market price per share 9% Last Dividend paid $ 90.00 Dividend Growth Rate Risk free rate Stock market return Firm's Beta 4 5 6 Current Price $ 915.78 Face Value 6% 13% 1.22 7 8 Tax Rate 28.0% Cost of Equity: CAPM Method 9 10 11 Cost of Debt (BT) Cost of Preferred Stock 12 Market Values Market Weights 13 14 15 16 Total Bonds Total Preferred Stock Total Common Stock Total Firm Value Weighted Average Cost of Capital WACC=C%D)*(Rd)*(1-1))+c%Ps-Rps)+l%C"Res) Find with YTM Rate, Div/ Market Price, RRF-Beta Rm-RRF)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started