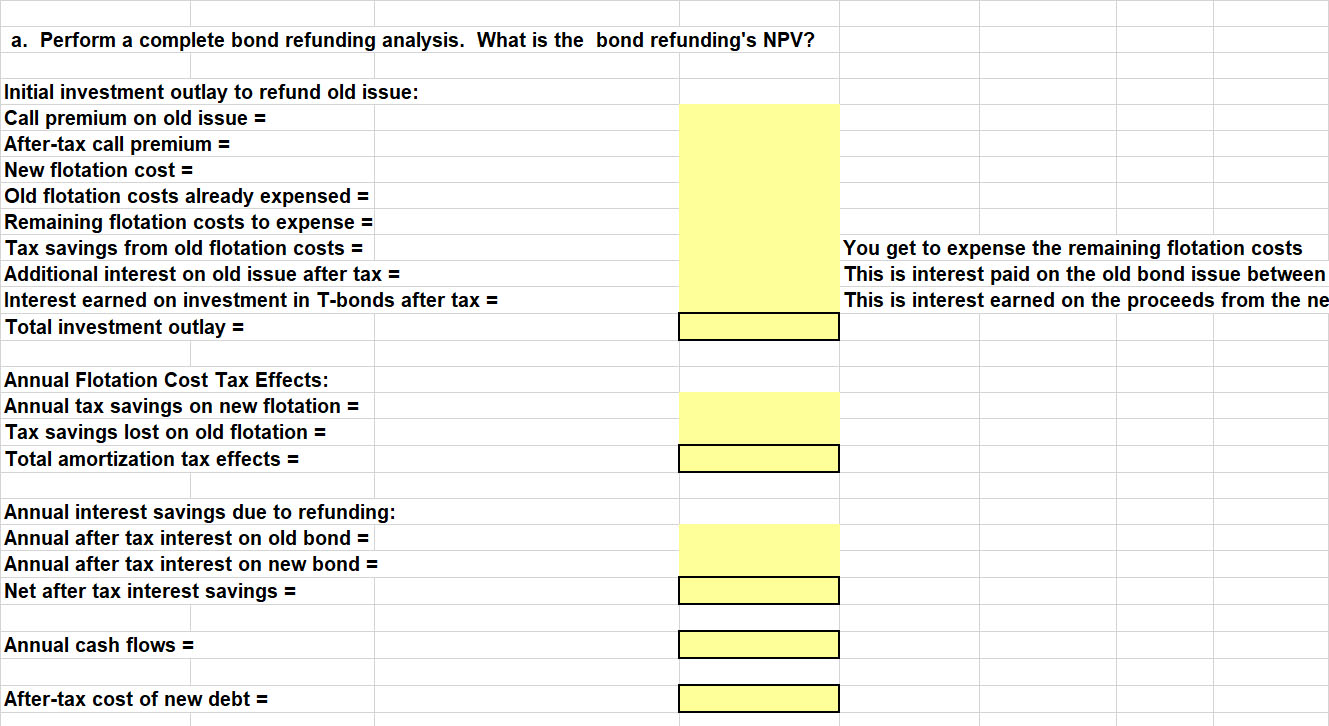

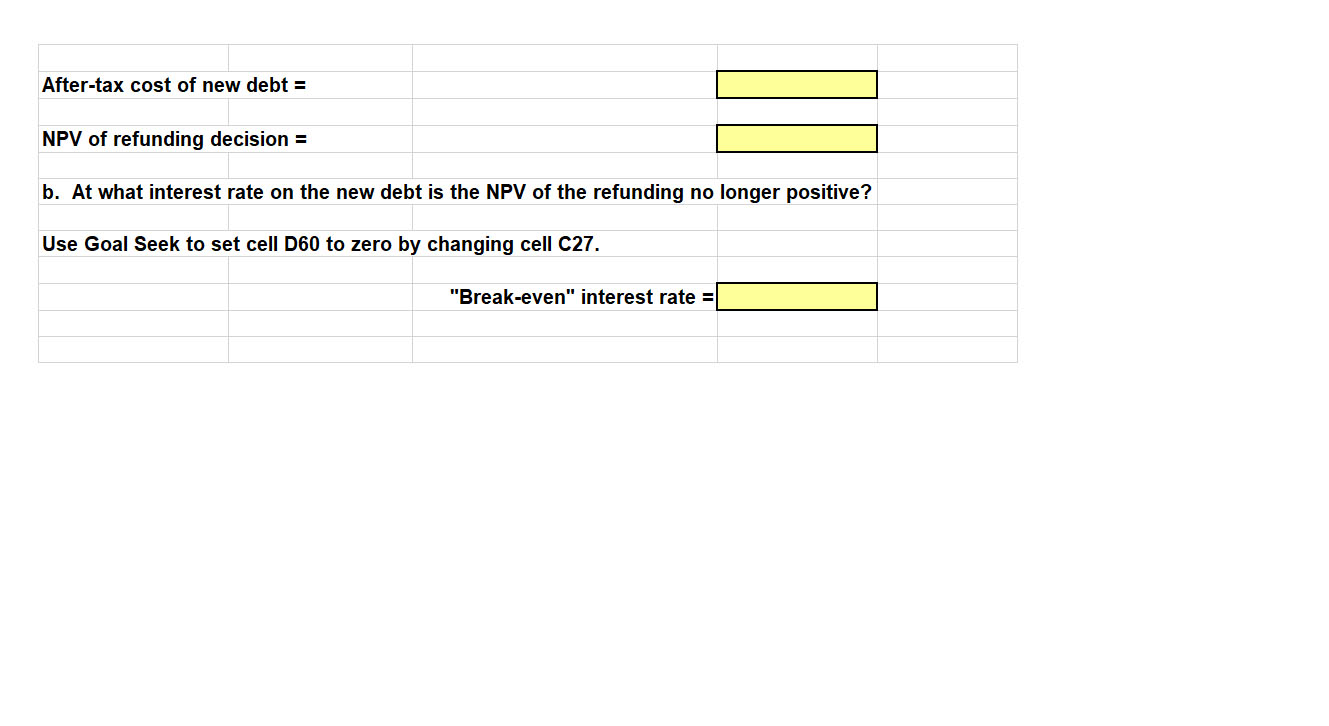

Please show excel formula to solve question a and b

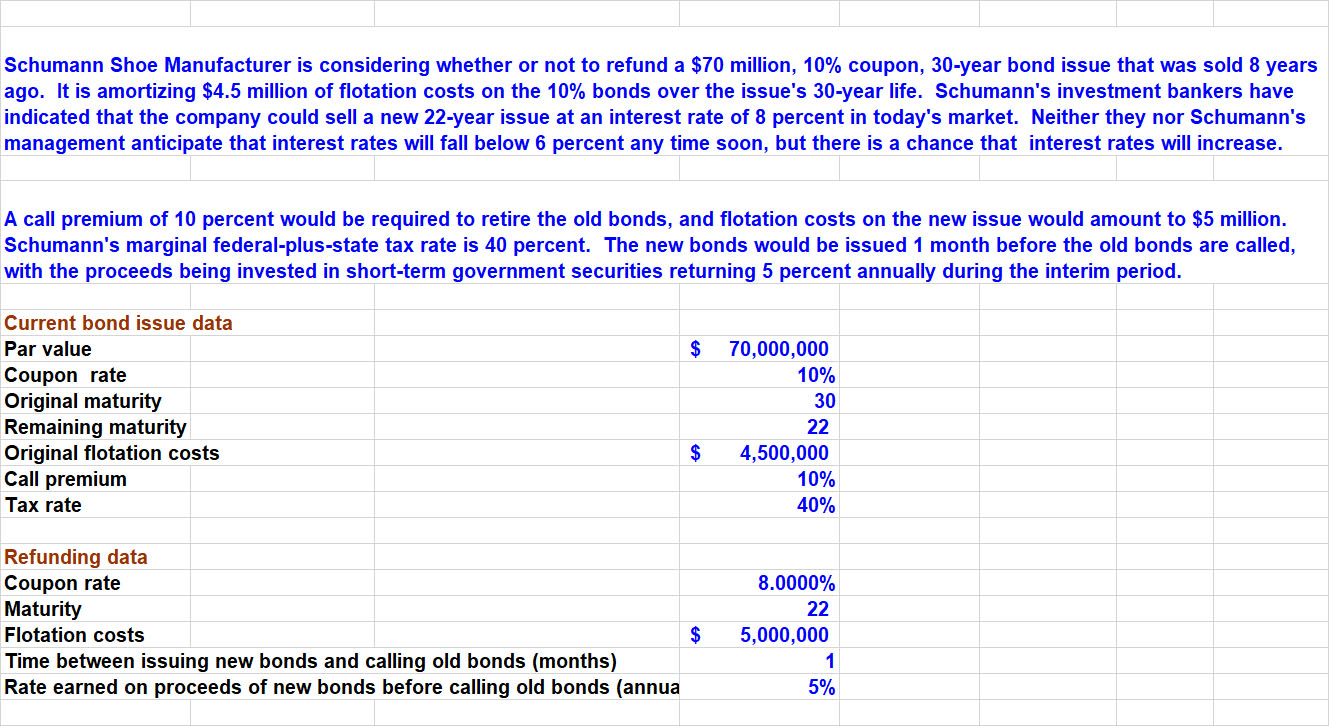

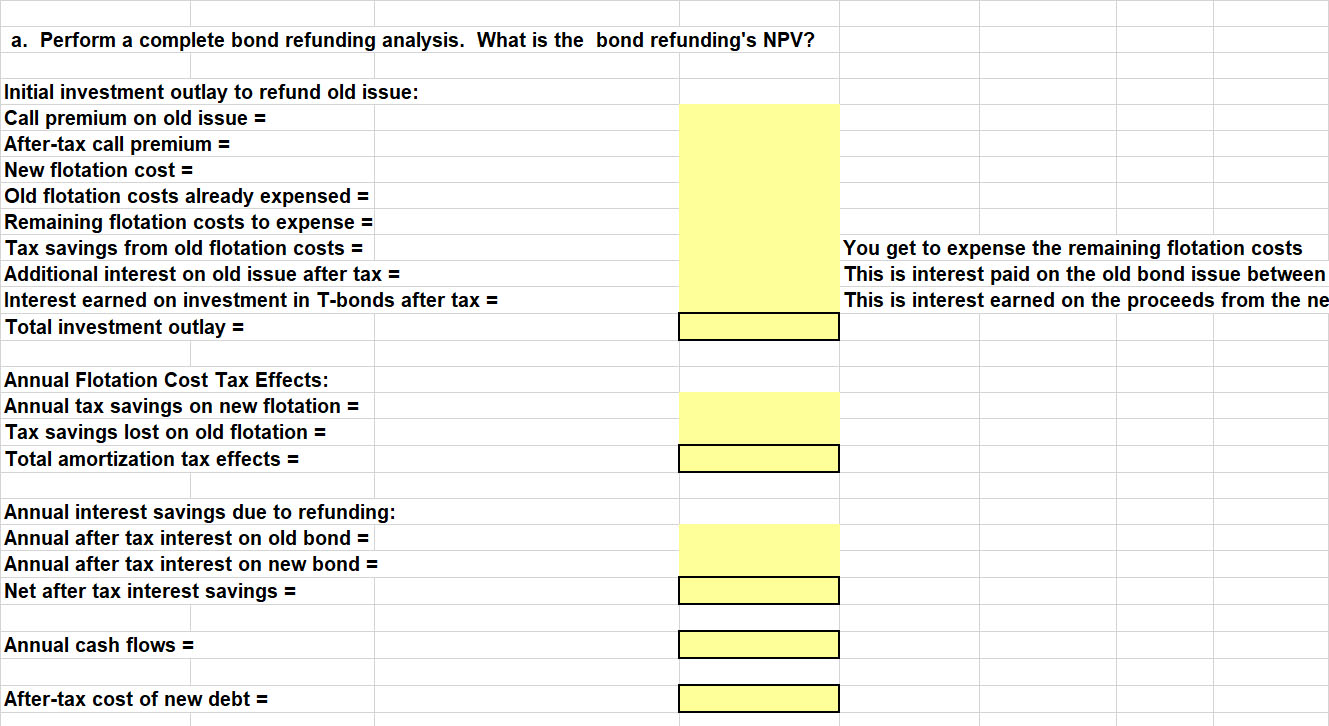

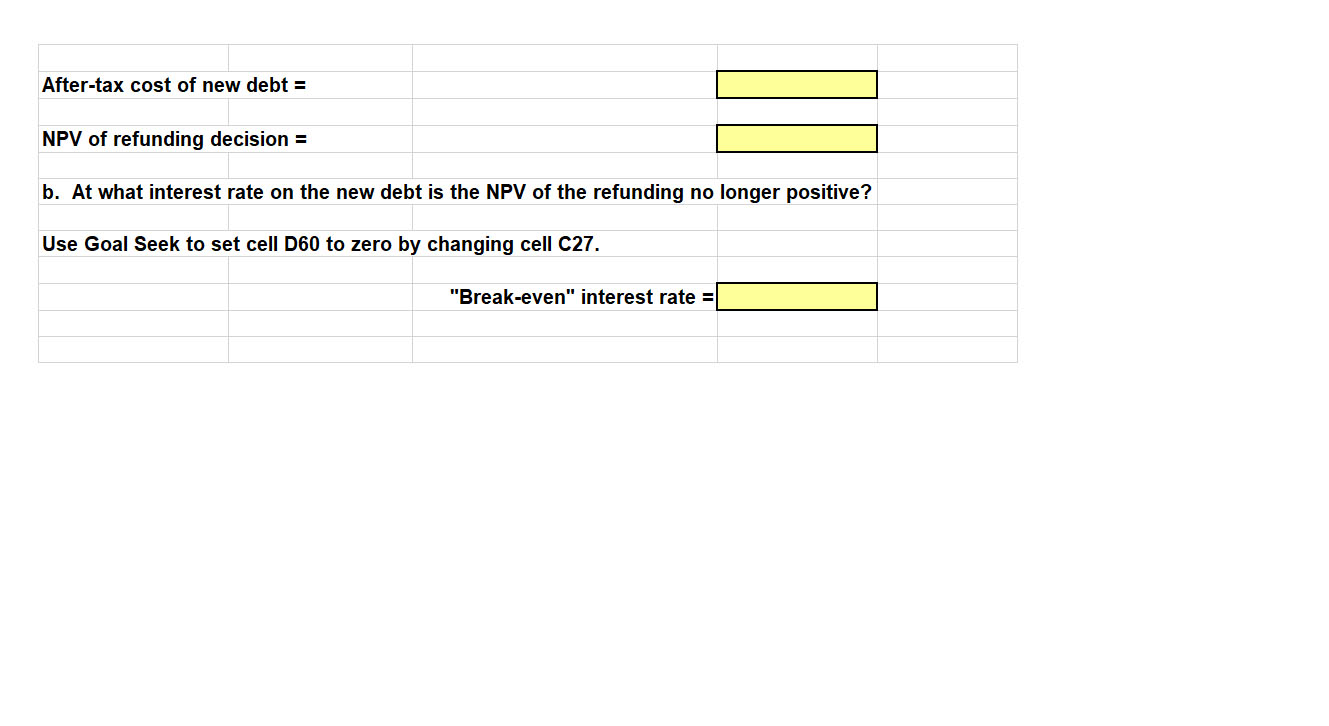

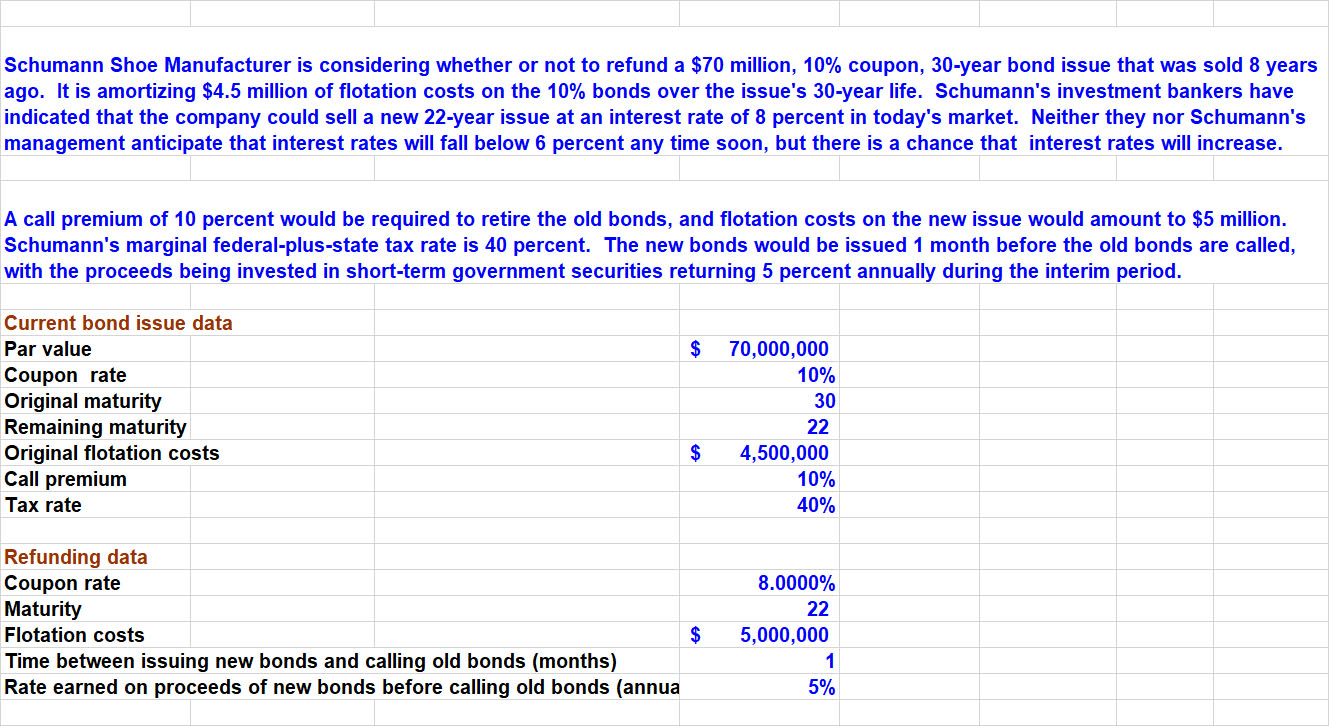

Schumann Shoe Manufacturer is considering whether or not to refund a $70 million, 10% coupon, 30-year bond issue that was sold 8 years ago. It is amortizing $4.5 million of flotation costs on the 10% bonds over the issue's 30-year life. Schumann's investment bankers have indicated that the company could sell a new 22-year issue at an interest rate of 8 percent in today's market. Neither they nor Schumann's management anticipate that interest rates will fall below 6 percent any time soon, but there a chance that interest rates will increase. A call premium of 10 percent would be required to retire the old bonds, and flotation costs on the new issue would amount to $5 million. Schumann's marginal federal-plus-state tax rate is 40 percent. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being invested in short-term government securities returning 5 percent annually during the interim period. $ Current bond issue data Par value Coupon rate Original maturity Remaining maturity Original flotation costs Call premium Tax rate 70,000,000 10% 30 22 4,500,000 10% 40% $ Refunding data Coupon rate Maturity Flotation costs $ Time between issuing new bonds and calling old bonds (months) Rate earned on proceeds of new bonds before calling old bonds (annua 8.0000% 22 5,000,000 1 5% a. Perform a complete bond refunding analysis. What is the bond refunding's NPV? Initial investment outlay to refund old issue: Call premium on old issue = After-tax call premium = New flotation cost = Old flotation costs already expensed = Remaining flotation costs to expense = Tax savings from old flotation costs = Additional interest on old issue after tax = Interest earned on investment in T-bonds after tax = Total investment outlay = You get to expense the remaining flotation costs This is interest paid on the old bond issue between This is interest earned on the proceeds from the ne Annual Flotation Cost Tax Effects: Annual tax savings on new flotation = Tax savings lost on old flotation = Total amortization tax effects = Annual interest savings due to refunding: Annual after tax interest on old bond = Annual after tax interest on new bond = Net after tax interest savings = MO Annual cash flows = After-tax cost of new debt = After-tax cost of new debt = NPV of refunding decision = b. At what interest rate on the new debt is the NPV of the refunding no longer positive? Use Goal Seek to set cell D60 to zero by changing cell C27. "Break-even" interest rate